I am seeing so many interesting setups that are worth paying attention to, especially with the election around the corner.

A lot of people are still focused on the big scary headlines about the election and the usual suspects like the Magnificent Seven, but there’s so much more going on beneath the surface. Bitcoin, small caps, regional banks and breadth. They’re all telling a different story if you know where to look.

This reminds me of October 2020 right before the election.

I’ve never written this story down before (though I’ve touched on pieces of it in live chats) because it involves my friends, and I don’t want it to be misunderstood. I love my friends, but at the end of the day, I’m a trader. That’s who I am. It’s my life.

If you’ve followed me for a while, you know I see the world through a trader’s lens. I can look at a wave and think about trend following. I watch my bees and think about risk management. Even my childhood has connections to trading.

It’s endless!

At my core, I’m a deep thinker. That’s a huge part of my personality. I love getting lost in thought, being fully present, and then, out of nowhere, having an epiphany.

So, the day before the 2020 election, some friends invited me to hang out. Now, my friends are a bit like me—none of them are what you’d call “normal,” and let’s be real, neither am I.

They told me to meet at a neutral spot, not to bring my phone, to park around the corner, and be there at 9 p.m.

I showed up, had a great time catching up, eating some food, and all that—but I was still wondering why I was there. Then, the conversation shifted.

“If Biden wins, Trump won’t leave office, and it’ll cause a civil war,” someone said. Then another added, “If Trump wins, the opposition will be so furious, it’ll still lead to a civil war.”

You have to remember, it was 2020. People were divided, angry, broke, and out of work.

Now, I’m someone without a party and have never fit neatly into any label. So, I was sitting there, just as confused as anyone about how we could be screwed no matter what happened. But, honestly, that was the vibe at the time. Everyone felt it.

Before I go any further, let me just say: I don’t know the future, and yes, the world is always in a delicate state. I’m not dismissing anyone’s feelings about the situation. But, I’m always going to go with the highest probable outcome.

That, after the election the market would move higher.

Every single friend, social media post, and, most importantly, the market itself was screaming that the world was about to end after this election. Yet, if you looked at realized vol vs. implied vol at the time, the market wasn’t far off from hitting all-time highs again.

Everyone else was short and terrified, while I was standing there grinning like I was about to get cast in American Psycho.

That’s kind of my default face in situations like this. I know the world is not going to understand exactly what I am thinking at the time but they will later.

Right then, I had an epiphany: If everyone feels this way before the election, who’s left to sell?

No one

So I left the party and went long the world. I am not joking I was long everything in our reflationary playbook.

And honestly, what a lot of people forget is that by that time, things were already starting to move. I had signals that were already long commodities, currencies, short bonds and long equities.

Bitcoin was signaling a major move even before the election, and as always, where KRE goes, the reflation trade follows. I had confirmation of the trend coming from all directions, but still—no one was looking beyond tech and the S&P 500.

Sound familiar?

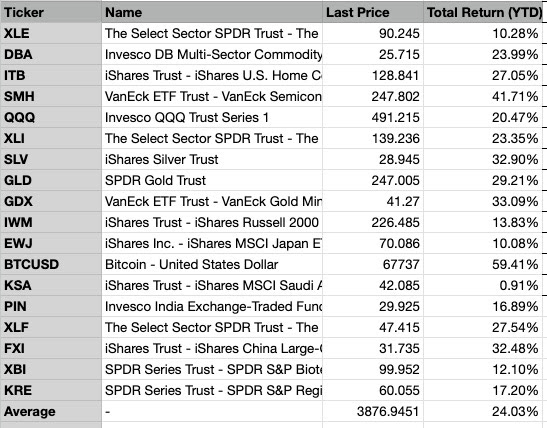

Now, fast forward to today, and here we are, only halfway through October. Let’s take a look at where things stand.

Bitcoin is leading the charge, regional banks are one of the strongest sectors, and small caps are outperforming large caps and tech so far this month—and there is still two weeks left.

Right now, we should be gearing up for the election trade. Bitcoin is hinting at a risk-on environment and liquidity flowing into the system. Our models continue to point to higher stock, precious metal, and commodity prices.

Pretty soon, we’re going to hear the usual: “If Trump wins, this will happen… if Harris wins, that will happen… and if Santa wins, something else will happen.”

Honestly, I don’t care if it’s Zeus or the Tooth Fairy—the market action is always going to be the best indicator of where prices are headed.

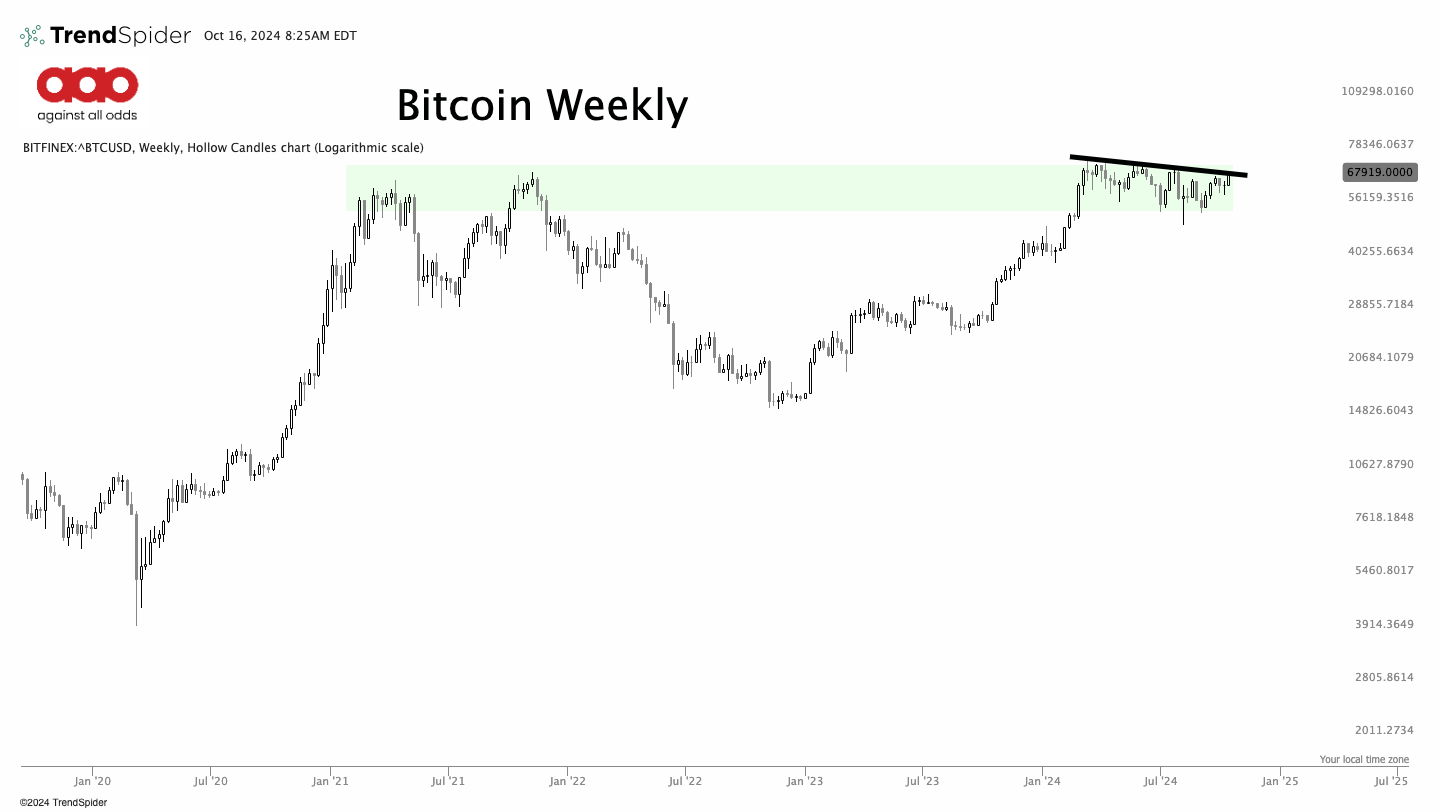

Now, this is what Bitcoin is saying about the current market. Bitcoin is not the all knowing market god that tells us every direction the market is going. However, it is a great risk on indicator.

Now, if this Bitcoin can hit a new all time high I could say with almost 99% certainty that the market is headed higher after the election. I already think that, but the break out in Bitcoin would confirm what I am thinking.

I am not a fan of trend lines but this is where we are at. A close over 70k would give us a buy signal for the flag pattern. The safest idea is to wait for a close above 72k if you don’t have a position.

We have one…

For now, we need to take the signals as they come and at the moment our portfolios are doing great long term and swing trading portfolios.

Futures Swing Portfolio

Thematic Macro Portfolio

At the end of the day, it doesn’t matter who’s in the headlines. Whether it’s Trump, Harris, or even Santa, what truly matters is what the market is telling us. The signals are out there, Bitcoin leading the way, small caps outperforming, and regional banks showing strength. All of these are signs of a reflationary environment. Instead of getting caught up in the noise, focus on what’s unfolding in front of us. The market is our best indicator, and right now, it’s pointing toward opportunity.