What Is a Bank Statement: Definition, Benefits, and Requirements

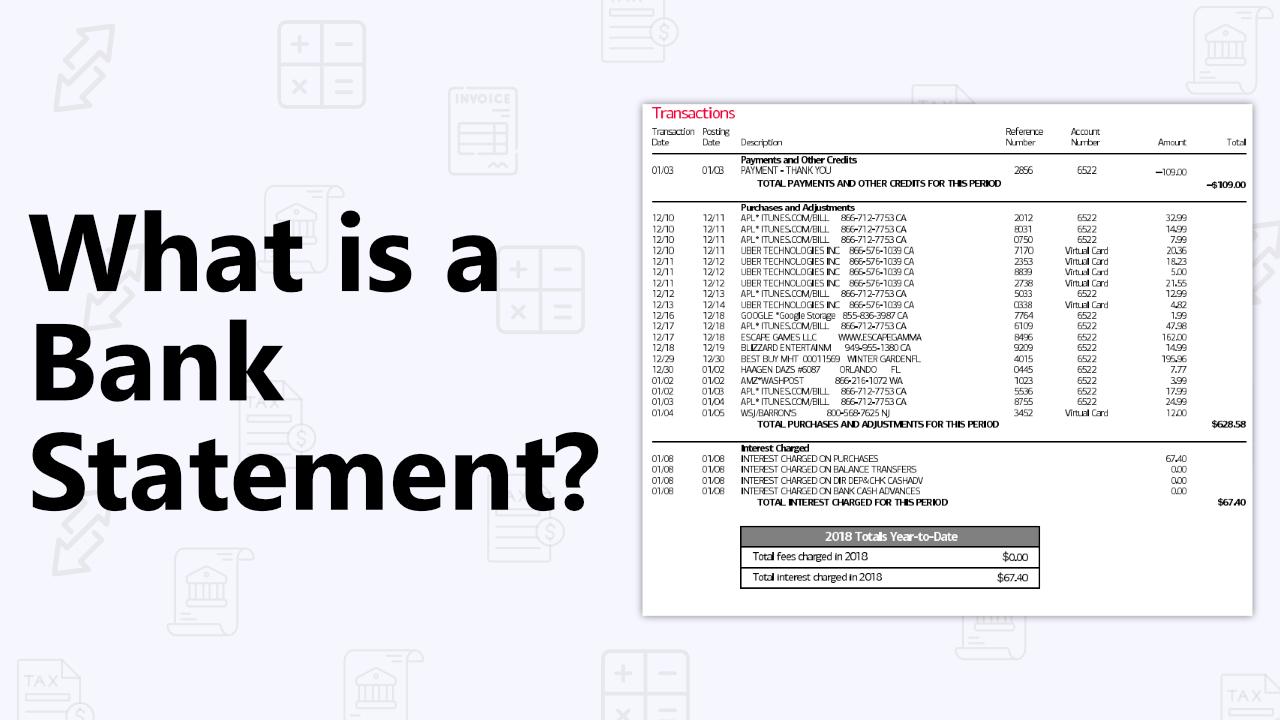

Bank statements are important financial documents that provide a summary of an individual or business’s banking activity over a certain period of time. These statements are typically issued monthly by banks and contain detailed information about deposits, withdrawals, transfers, and other transactions that have taken place in the account. Understanding bank statements is essential for managing finances effectively and ensuring the accuracy of your financial records.

Definition of a Bank Statement

A bank statement is a document issued by a financial institution, such as a bank or credit union, that shows the account holder’s balance, transactions, and other important information related to their account. Bank statements are typically provided on a monthly basis and can be accessed electronically or in paper form. They serve as a record of all the financial activity that has occurred in the account during the specified period, helping account holders track their spending, monitor their balances, and reconcile their accounts.

Benefits of Bank Statements

There are several benefits to regularly reviewing your bank statements:

- Monitoring Your Finances: Bank statements provide a comprehensive overview of your financial transactions, allowing you to track your spending and identify any unusual or unauthorized charges.

- Budgeting: By analyzing your bank statements, you can assess your spending habits, set financial goals, and create a budget to manage your money more effectively.

- Proof of Income: Bank statements can serve as proof of income when applying for loans, mortgages, or other financial products.

- Identifying Errors: Reviewing your bank statements regularly can help you identify errors, discrepancies, or fraudulent activity in your account.

Requirements for Obtaining a Bank Statement

Most financial institutions provide bank statements to account holders as part of their banking services. To obtain a bank statement, you typically need to meet the following requirements:

- An Active Bank Account: You must have an active account with the financial institution to receive bank statements.

- Consent: You may need to provide consent to receive electronic statements if you prefer to access them online rather than in paper form.

- Verification: Some financial institutions may require identity verification to ensure that the statements are being sent to the correct individual.

Practical Tips for Reviewing Bank Statements

When reviewing your bank statements, consider the following tips to ensure accuracy and security:

- Check for Errors: Verify that all transactions on the statement are accurate and authorized.

- Compare to Receipts: Match your bank statement to receipts and keep track of your spending to reconcile your account.

- Monitor for Fraud: Look for any suspicious or unknown transactions that could indicate fraudulent activity.

- Set Alerts: Utilize account alerts to notify you of low balances, large transactions, or unusual activity on your account.

Conclusion

Bank statements are essential financial documents that provide valuable information about your banking activity. By regularly reviewing your bank statements, you can monitor your finances, track your spending, and ensure the accuracy of your financial records. Understanding the benefits and requirements for obtaining a bank statement is crucial for effective financial management. By following practical tips for reviewing your statements, you can protect your account from errors and fraudulent activity. Make sure to take advantage of this valuable resource provided by your financial institution to stay informed and in control of your finances.