– How do online banks ensure the security of online transactions?

The Best Online Banks – Digital Banking in 2021 Unleashed

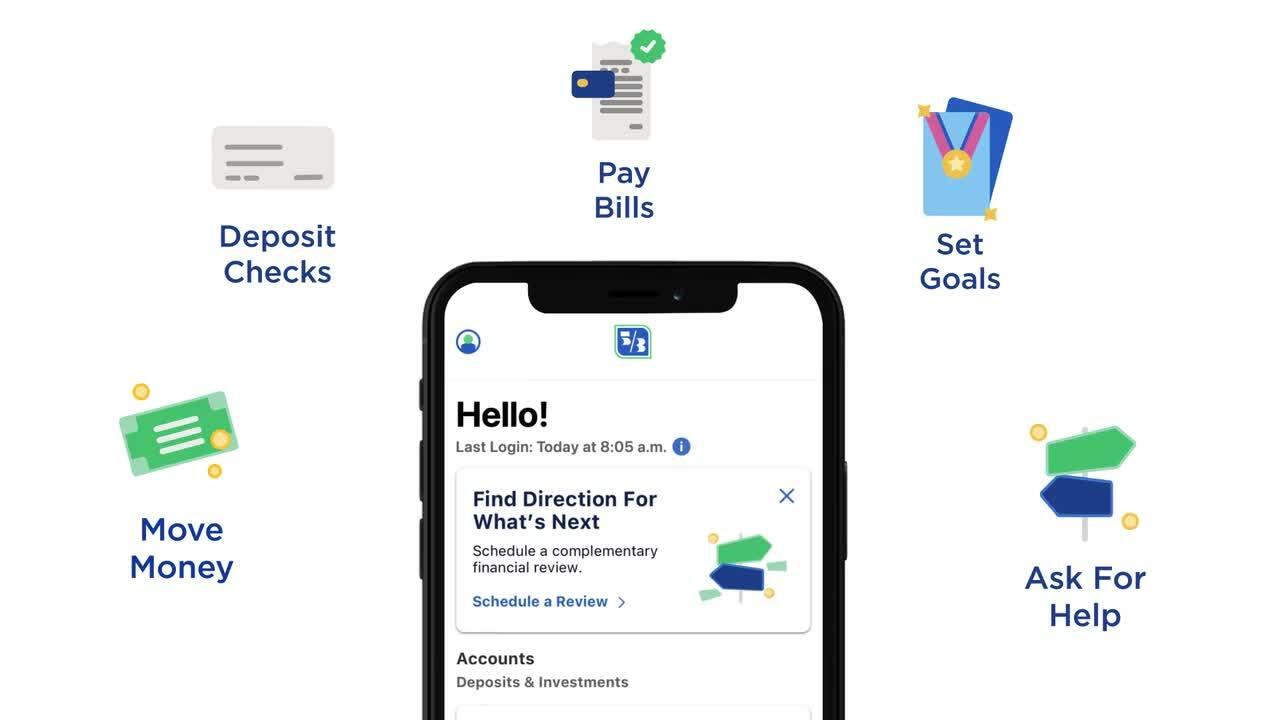

As technology continues to evolve, online banking is not only becoming more popular but also necessary. From checking balances, paying bills, to depositing checks, online banks make every process easier. Discover the best online banks that make these tasks and more a breeze, all from the comfort of your own home.

Why Choose Online Banking?

- Anywhere: No geographical limitations. Manage transactions from anywhere in the world

- Anytime: Operate 24/7. No need to worry about banking hours

- Fast: Conduct transactions in seconds

- Savings: No operational costs, leads to better savings rates

- Secure: Advanced security protocols to protect user information

Key Features to Look for in an Online Bank

- User-Friendly Interface: The bank’s website and app should be straightforward and easy to navigate

- Security: The bank you choose should use encryption and two-factor authentication to protect your information

- Customer Support: Round-the-clock service to resolve any technical or financial issues

- Services: It should offer a wide range of services from basic checking and savings accounts to financial planning tools

Top 5 Best Online Banks in 2021

Now that you have a sense of what to look for in an online bank, here are the top picks based on customer satisfaction, interest rates, security, and more.

| Bank | Best For |

|---|---|

| 1. Ally Bank | Overall Best, No-Hassle Banking |

| 2. Capital One 360 | Efficient Mobile Banking |

| 3. Discover Bank | Generous Interest Rates for Savings |

| 4. Charles Schwab Bank | Travel-Friendly Banking |

| 5. Chime | Fee-Free Banking |

These banks offer great technology, high interest rates, low fees, and superior customer service. Let’s explore each one deeply.

1. Ally Bank

Ally Bank, a pioneer in online banking, provides a full suite of services. No-fee checking accounts, high-yield savings, and competitive CD rates make it attractive for a broad spectrum of customers.

2. Capital One 360

Capital One 360 offers an excellent mobile banking experience, featuring user-friendly apps for iOS and Android with high ratings. It also offers a high-yield savings account.

3. Discover Bank

Discover Bank excels at providing high-interest rates for saving accounts and CDs. Also, it doesn’t require any minimum balance.

4. Charles Schwab Bank

If you’re a frequent traveller, Charles Schwab Bank is the one for you. It offers unlimited reimbursements for ATM fees globally and no foreign transaction fees.

5. Chime

Chime is best known for its fee-free services, user-friendly mobile app, and early direct deposit feature.

Final Thoughts

Selecting the right online bank is a choice that’s deeply personal and depends on your specific needs. Ensure that you carefully evaluate all their services, fees, and interest rates before making a decision.

Online banking is the future. It saves your time, money and efforts while giving security and convenience. Make a smart move towards the digital way of managing money with the best online bank that suits your needs.