I’ll be straightforward, as always—I don’t have much new to share at the moment. We’re at that phase where, while there may not be fresh trades every day, our positions are well-aligned to capture the trends we’re in. The missing piece is energy, and we’ve got that covered. In the long-term portfolio, we’re holding XLE, and about a month ago, we got a bottoming signal in gasoline, followed by a similar signal in heating oil last week. Natural gas is a long position in the futures portfolio.

t’s time to let the winners run! This is how money is mad

“It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!” – Jesse Livermore

Please like, share and subscribe so you don’t miss any of our content and help the letter get to the people that need it the most.

Now let’s focus on what’s next!

Three key factors are currently driving commodity markets higher: the war in the Middle East, a shipping strike, and recent hurricane activity. These events are creating widespread impacts across various commodities, from grains to oil.

While energy remains the primary sector we’re closely watching, the broader market is showing signs of a shift. I’ve emphasized the importance of one particular chart that helps gauge the movement of commodities and bonds—the CRB/USB ratio. Long-term, this chart suggests commodities are emerging from a prolonged downtrend and are poised for upward momentum.

You’ve seen this before, but it’s been a while since we looked at the short-term view. The range remains tight, with levels holding steady since 2022.

While neither bonds nor commodities have significantly outperformed recently, commodities have managed to maintain their primary trend.

The bottom indicator shown is a long-term stochastic on a weekly chart. When these signals appear, they typically precede rallies in the commodity market.

This one comes right on time, coinciding with the trifecta of hurricanes, geopolitical tensions, and shipping strikes. (Though, as we explained in The Commodity Report yesterday, the shipping strike isn’t expected to impact oil prices.)

Kevin as always knocked out some knowledge quickly in the first 20 minutes. Sam dropped some amazing charts and trade levels to look out for. Kashyap went deep in to information that we need to hear as traders. This is The Commodity Report and it is what Kevin Green and I had in mind when we started these.

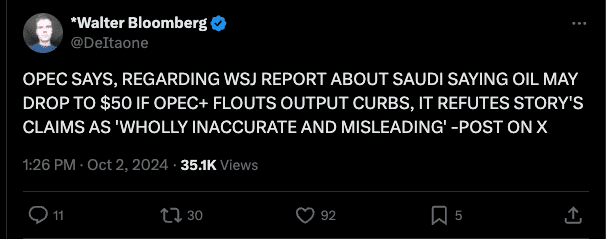

Speaking of oil another bullish development that Kevin and I said was probably a false report.

Look guys I know I am beating this trade idea to death but it is a beautiful set up.

Gold rang the bell and said inflation will come within the next 12 months after the breakout.

Then, it did not look back.

Now grains are starting to move. Wheat gave the first signal followed by corn.

This is how the cycle usually moves. Metals, softs, ags and then…

Oil. If you’re wondering, “Why does he keep talking about bonds and oil?”—this is why. The correlation between the two is strong and has been historically. Inflation, which impacts us most directly, is heavily driven by energy prices, and when inflation rises, bond yields typically follow suit. That’s why both markets are so closely linked.

Keep an eye on oil. If oil bottoms, a new commodity cycle is beginning.