trading“>

trading“>

Will this course teach me how to assess the feasibility and profitability of an algorithmic strategy?

## Introduction

- Welcome to the course on “Algorithmic Trading for Beginners”. This easy-to-understand, comprehensive guide aims to help beginners get a grasp of the inner workings of algorithmic trading. Before we delve into this seemingly complex subject, let’s break it down step by step.

What is Algorithmic Trading?

- Algorithmic trading, also known as algotrading or black box trading, involves the use of automated and pre-programmed trading instructions to carry out financial transactions. This strategy is beneficial in making high-frequency trades with speed and precision.

Example of an algorithm: Buy 50 shares of a Facebook stock when its 50-day moving average goes above the 200-day moving average.

Importance of Algorithmic Trading

Fast and Efficient

- Algorithmic trading eliminates the necessity of constant human supervision. Algorithms work at lightning speed, ensuring multiple trades are executed in the fraction of a second.

Reduces the Risk of Human Errors

- By using predefined rules, algotrading removes the emotional and psychological aspects of trading, increasing the accuracy.

Diversification

- Algorithmic trading allows trading in multiple markets and multiple accounts at the same time, providing a diverse investment portfolio.

Understanding the Concept

Trading Algorithms

- Trading Algoritms are an essential component of Algorithmic Trading. They are created with the help of quantitative analysis and the application of a methodical approach to trading.

High-Frequency Trading (HFT)

- HFT is a form of Algorithmic Trading with a focus on high-speed and high-turnover trades.

Type of Algorithmic Trading Description Trading Algorithms Trading strategies are created using mathematics and complex programming. High-Frequency Trading (HFT) High speed and high turnover trades, driven by computer algorithms ## How to Start Algorithmic Trading

- The good news is, you don’t have to be a Wall Street financial wizard or a computer science PhD to get started with Algorithmic Trading.

Choose the Right Trading Platform

- Choose a trading platform that offers a wide range of tools for Algorithmic Trading.

Learn Coding

- Acquiring basic coding skills can make the journey smoother. Languages like Python and C++ are commonly used for developing trading algorithms.

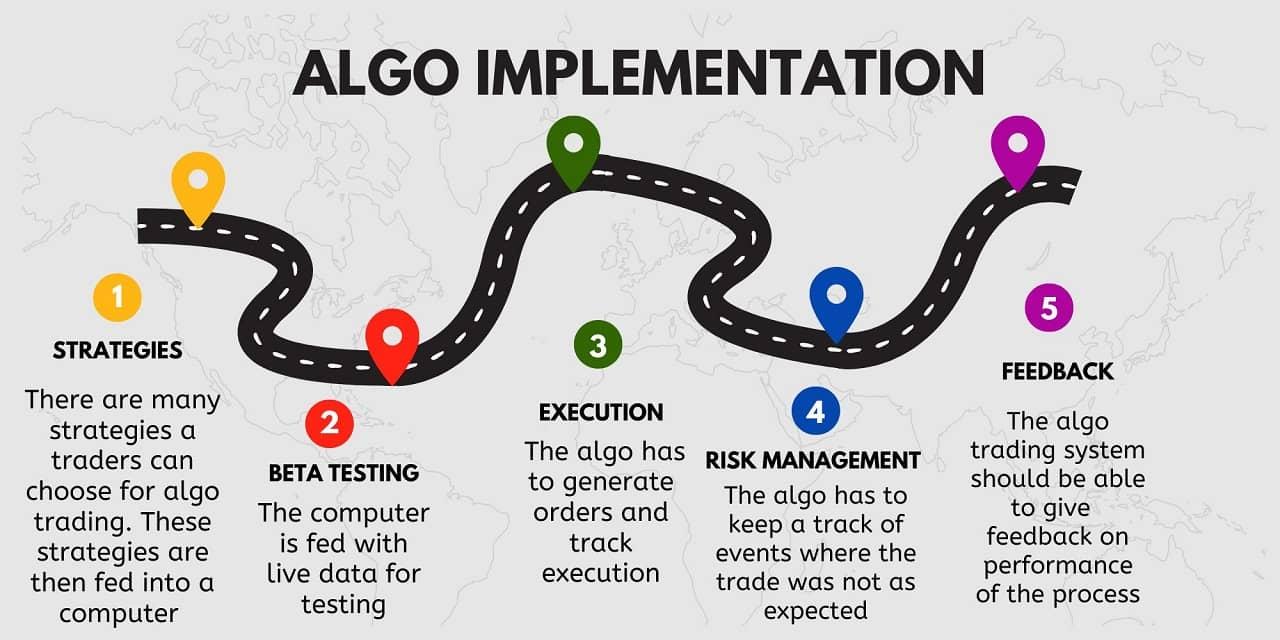

Build a Trading Algorithm

- Ultimately, you need to build and test your trading algorithm. This task involves a significant amount of testing, refining, and iterating before the algorithm is ready for deployment.

Algorithmic Trading Risks

- Algorithmic Trading, while lucrative, is not devoid of risks. System failure or a tiny error in the trading algorithm can result in significant losses. It’s crucial to monitor these algorithms and have backup systems in place.

Conclusion

- Algorithmic Trading may seem daunting at first, but with a little bit of practice, you could be making trades while you sleep! The importance of algorithmic trading in today’s high-speed and high-tech world is undeniable, and its benefits notably outweigh its complications. Understanding its workings and getting it right can open up a world of possibilities for you in the financial markets.

Remember, every master was once a beginner, and with determination, patience, and the right knowledge, you too can master the art of Algorithmic Trading!

Meta title: Complete Course on Algorithmic Trading for Beginners

Meta Description: Learn the basics of Algorithmic Trading, its benefits, how to get started and understand the risks involved. Your comprehensive guide on Algotrading for beginners is here!

H1: Algorithmic Trading for Beginners – A Comprehensive Guide

H2: What is Algorithmic Trading?

H3: Importance of Algorithmic Trading

H2: Understanding the Concept

H2: How to Start Algorithmic Trading

H2: Algorithmic Trading Risks

H1: Conclusion