Marvell Technology, Inc. (NASDAQ: MRVL) has solidified its reputation as a leader in the tech sector, thanks to strategic investments in artificial intelligence (AI) and data center solutions. As we step into 2025, the company’s growth trajectory showcases its ability to capitalize on emerging trends and deliver value to its stakeholders. Let’s take a deeper dive into the numbers, partnerships, and market sentiment driving Marvell’s success.

Stock Performance and Valuation

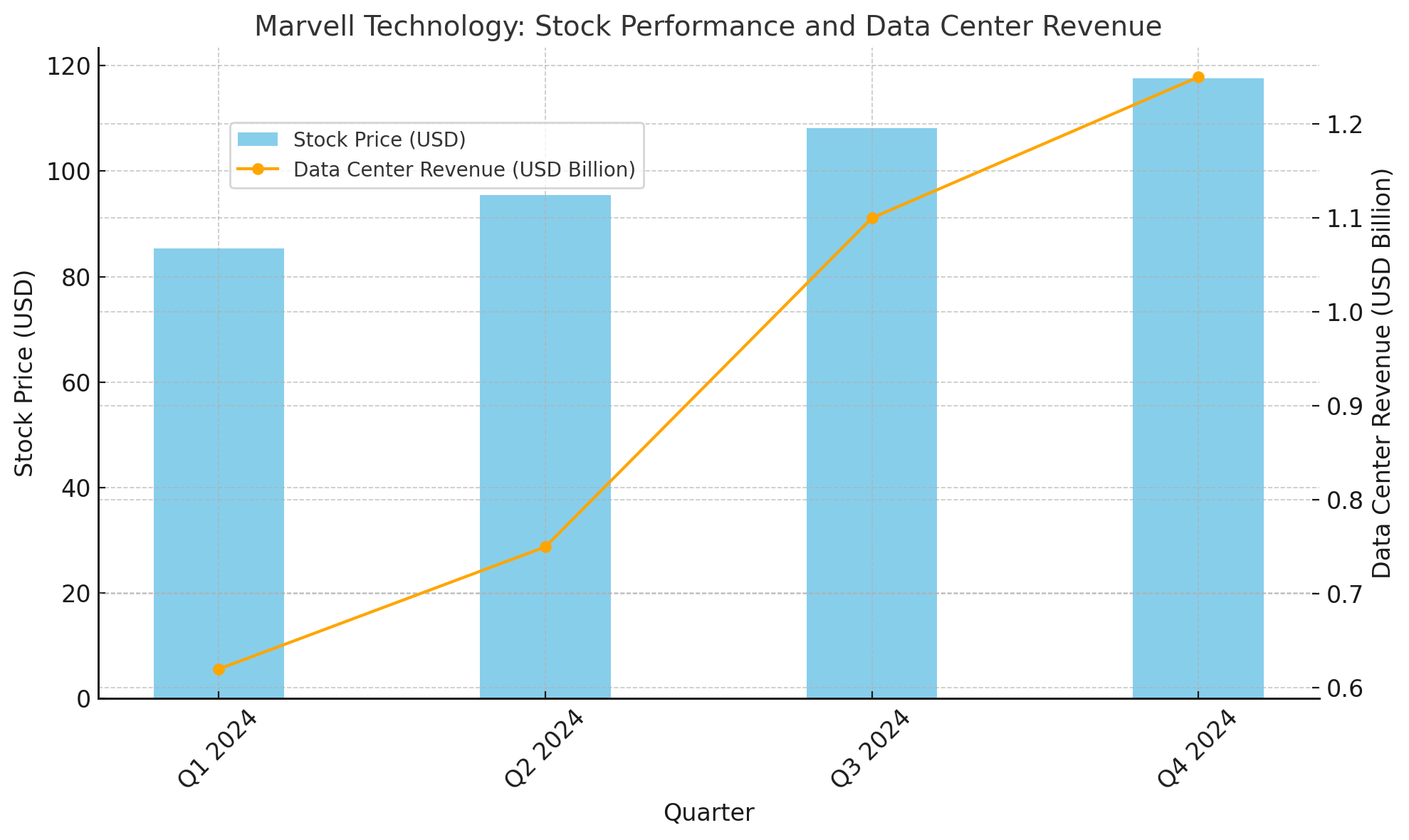

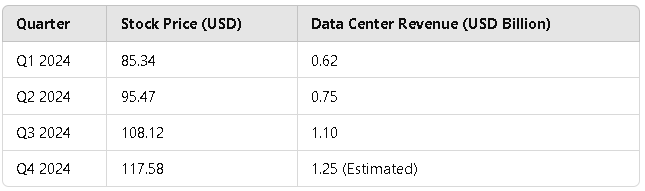

Marvell’s stock has been on a stellar run, closing at $117.58 as of January 16, 2025. This marks a significant increase over the past year, with a market capitalization of approximately $101.74 billion.

Analysts remain bullish, setting a 1-year target price estimate of $126.11, indicating further growth potential. This optimism is fueled by Marvell’s focus on high-growth markets and its ability to execute on strategic initiatives effectively.

This chart illustrates Marvell’s stock price growth alongside its data center revenue. The significant uptick in both metrics underscores the company’s strong market position and the success of its AI and data center initiatives.

Analyst Recommendations

Wall Street’s confidence in Marvell is evident from its consensus rating of 1.20, where 1.00 signifies a “Strong Buy.” Out of 30 brokerage firms covering the stock, 26 have issued “Strong Buy” ratings, and two have rated it as “Buy.” The company’s solid financial performance and strategic focus on AI and data centers have been key factors in earning this widespread support.

AI and Data Center Expansion

One of the cornerstones of Marvell’s recent success is its robust presence in the AI and data center markets. The company has secured a multigenerational agreement with Amazon Web Services (AWS) to develop custom AI chips, a testament to its technological prowess and ability to meet the needs of leading cloud providers.

Marvell’s data center segment has been a standout performer. In the fiscal third quarter, the segment’s sales nearly doubled year-over-year, reaching $1.1 billion. This accounted for an impressive 73% of the company’s total revenue. The growing demand for custom AI silicon solutions has been a driving force behind this growth. These specialized chips are crucial for enhancing the performance and efficiency of AI workloads, making Marvell an indispensable partner for cloud giants.

Financial Outlook

Looking ahead, Marvell projects fiscal fourth-quarter revenue of $1.8 billion, surpassing Wall Street’s expectations. This optimistic forecast is driven by the success of its custom AI silicon programs, positioning the company to exceed its previously stated goal of $2.5 billion in AI-related sales by fiscal 2026. Such strong financial guidance underscores the effectiveness of Marvell’s strategies and its ability to deliver consistent growth in a competitive landscape.