People Also Ask (PAA)

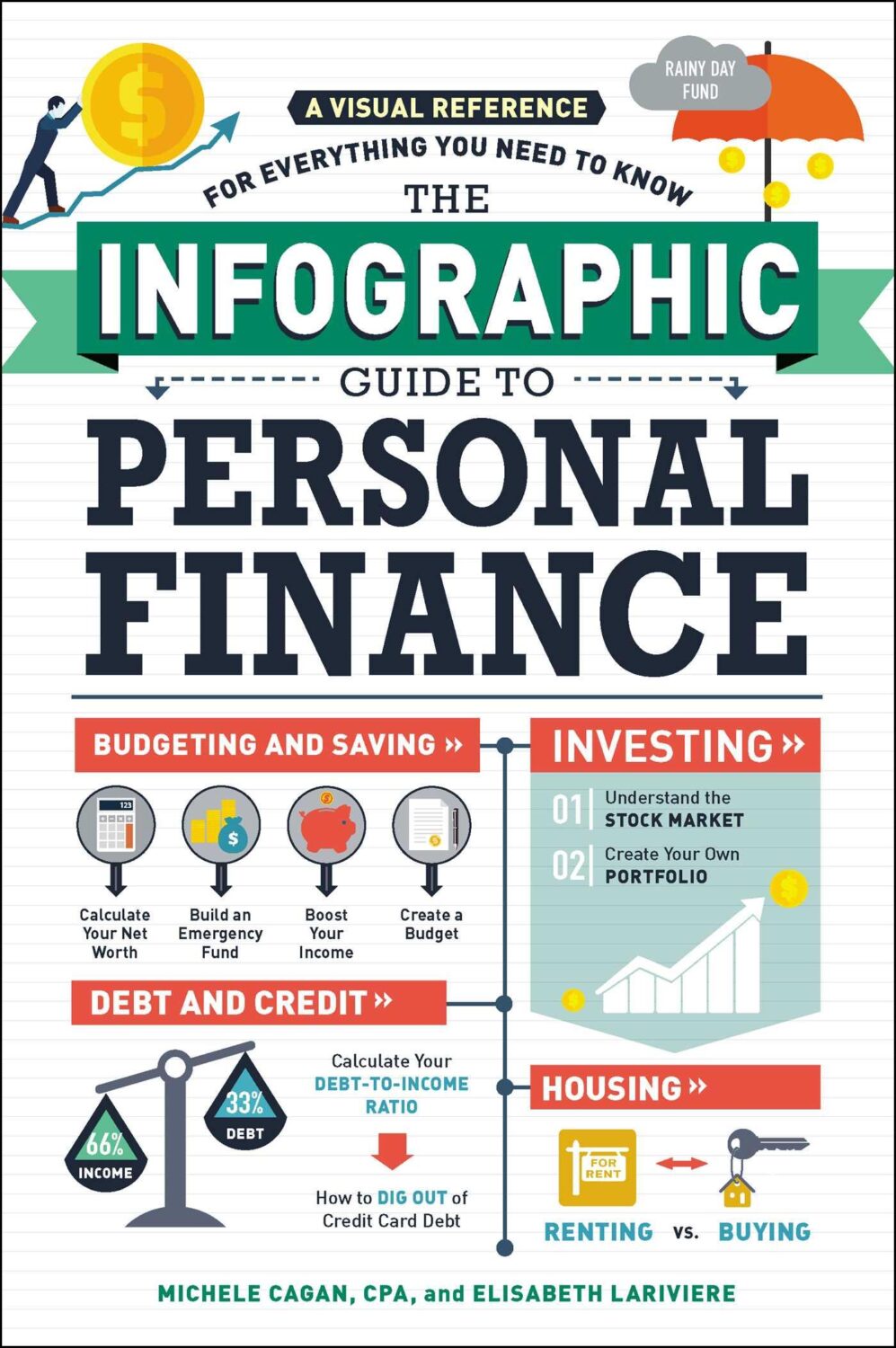

Ultimate Guide to Personal Finance for Grads

As you flip the tassel on your graduation cap, you’re also turning a vital page in your life – goodbye student, hello adult responsibilities! One of the most significant adulting tasks you’ll encounter is managing your personal finances. Right from budgeting to investing and planning for your cashless days (retirement!), personal finance covers it all. But don’t fret! Our comprehensive course on Personal Finance for Grads will equip you with all the knowledge you need for a successful financial life!

Table of Contents

- Step 1: The Art of Budgeting

- Step 2: Saving like a Pro

- Step 3: Making Your Money Work for You

- Step 4: Taming the Debt Monster

- Step 5: Planning for the Golden Years

Step 1: The Art of Budgeting

Are you feeling overwhelmed with handling your cash flow? Welcome to the practical world of budgeting, where you get to be in control of your money! Here we’ll break down this seemingly complicated process into digestible nuggets.

4 Steps to Effective Budgeting

- Identify your income

- List all your expenses

- Create your budget plan

- Monitor, adjust, and repeat!

| Action | Output |

|---|---|

| Identify your income | Knowing your total income from all sources |

| List all your expenses | Understanding where your money goes |

| Create your budget plan | A blueprint for spending and saving |

| Monitor, adjust, and repeat! | A flexible budget that adjusts to your changing life |

Step 2: Saving like a Pro

An emergency fund is crucial in your financial arsenal. Besides, saving also prepares you for any anticipated future expenses like a house or car. In this section, we’ll teach you how to grow your savings effectively.

The 50/30/20 Rule

The 50/30/20 Rule is a simple, practical way of categorizing your income into needs (50%), wants (30%), and savings (20%).

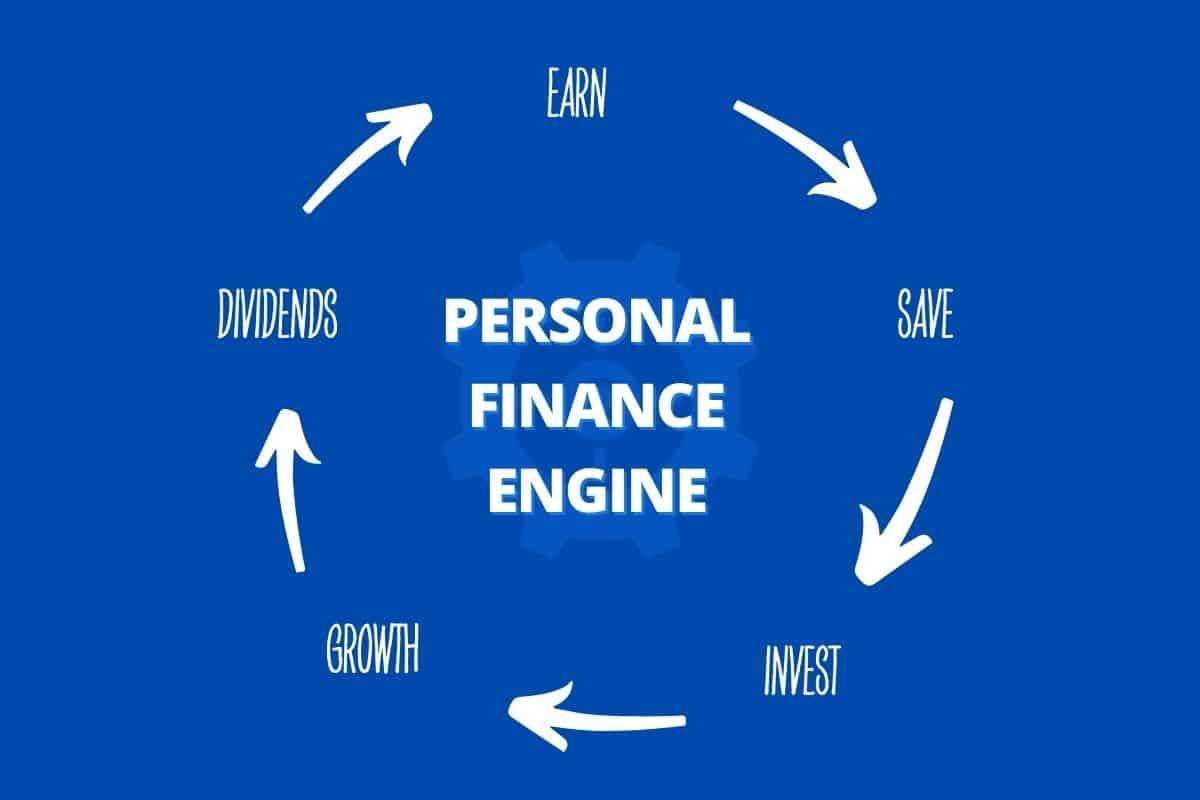

Step 3: Making Your Money Work for You

Investing helps you grow your wealth over time. Although it comes with risks, when done right, it can significantly increase your income. Whether you pick stocks, bonds or decide to plow your funds in a retirement account, understanding investment fundamentals is crucial.

Understanding Risk and Reward

Remember, higher potential returns typically mean higher risk! Understand your risk tolerance before deciding on any investment.

Step 4: Taming the Debt Monster

Debt is a significant obstacle in realizing your financial goals. Learning about loan repayment strategies and ways to avoid unnecessary debt are essential parts of your journey towards financial independence.

Choosing the Right Repayment Strategy

Whether it’s the Avalanche or Snowball method, the right strategy can help you pay off your debt easily and swiftly!

Step 5: Planning for the Golden Years

With longer life expectancies, retirement planning is more critical than ever. Here, we’ll guide you on how to start saving and investing for your retirement as early as now!

Understanding the Power of Compound Interest

The earlier you start saving for retirement, the more you can benefit from the power of compound interest. It’s like a snowball – starts small but keeps growing with time!

As Benjamin Franklin said, “Beware of little expenses. A small leak will sink a great ship.” Personal finance might seem challenging, but by equipping yourself with the right knowledge and skills, you can navigate your way to financial independence with ease.