In the ever-evolving landscape of global finance, identifying stocks with potential for strong performance remains crucial for investors seeking to maximize returns. This article explores analyst recommendations that are currently signaling bullish trends in the stock market. By leveraging expert insights and a detailed analysis of market data, we aim to highlight select stocks that are poised for an upward trajectory in the foreseeable future. Whether you are a seasoned investor or new to the stock market, understanding these recommendations can provide a valuable perspective in your investment strategy.

Table of Contents

- Understanding Analyst Recommendations and Their Impact on Stock Selection

- Key Factors Influencing Positive Analyst Ratings in the Current Economic Climate

- Top Upcoming Bullish Stock Picks to Consider

- Strategies for Incorporating Analyst Recommendations into Your Investment Portfolio

- Fair Value

Understanding Analyst Recommendations and Their Impact on Stock Selection

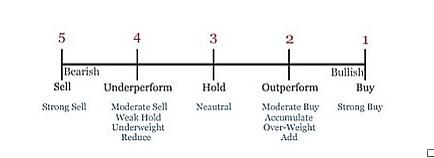

Analyst recommendations are integral to investment strategies as they provide an expert evaluation of a stock’s potential. These recommendations, such as Buy, Hold, and Sell, influence investor decisions and can lead to significant movements in stock prices. Understanding the terminology and methodology behind these suggestions is crucial for making informed investment choices.

Analysts employ a comprehensive approach, examining industry trends, financial statements, and market conditions. They also consider factors such as earnings forecasts and company management. Here are some key terms often associated with analyst reports:

- Buy: Predicts that the stock will outperform the market or sector average.

- Hold: Indicates the stock is expected to perform in line with the market or sector average.

- Sell: Suggests the stock will underperform compared to the market or sector average.

These recommendations impact stock selection by helping investors identify potential opportunities for growth, stability, or risk management. For those considering bullish stock picks, it is advisable to look for consistent Buy ratings from multiple analysts, signaling a strong consensus on the stock’s upward trajectory.

| Stock Symbol | Current Rating | Previous Rating |

|---|---|---|

| XYZ | Buy | Hold |

| ABC | Buy | Buy |

| DEF | Buy | Sell |

The above table illustrates recent upgrades in stock ratings, highlighting those with a bullish outlook. Such actionable data aids in crafting a portfolio poised to capitalize on expected market gains.

Key Factors Influencing Positive Analyst Ratings in the Current Economic Climate

In assessing the landscape of stock recommendations, several factors play pivotal roles in influencing optimistic outlooks from analysts. The current economic environment, characterized by a gradual rebound from global disruptions, has shaped unique opportunities within certain sectors.

Economic Recovery Trajectories: Various regions are experiencing uneven economic recoveries, highlighting opportunities in emerging markets and specific sectors such as technology and renewable energy. Analysts are particularly bullish on companies that show robust adaptability to new consumer behaviors and accelerated digital transformation.

- Resilience in revenue streams despite economic turbulence

- Strong corporate governance and strategic business pivots

- Capability to leverage technology for operational efficiency

Financial Health Indicators: Analysts also commend firms with solid fundamentals including liquidity ratios, debt-to-equity ratios, and consistent earnings growth. Companies that maintain healthy cash reserves are perceived as better equipped to navigate potential challenges ahead.

| Indicator | Desirable Range |

|---|---|

| Liquidity Ratio | > 1.5 |

| Debt-to-Equity Ratio | < 1.0 |

| Earnings Growth (YoY) | > 5% |

These factors not only stabilize a company’s current standing but also project profitable growth trajectories, catching the eye of anticipate investors and analysts alike. Monitoring these metrics enables timely investment decisions, pivoting from potential market downturns while capitalizing on upward trends.

Top Upcoming Bullish Stock Picks to Consider

In light of current market trends and potential growth sectors, a few stocks have been identified that are predicted to experience bullish trends in the upcoming quarter. We believe these options present viable opportunities for portfolio diversification and growth. Here are our top picks:

- XYZ Technology Corp. (XYZT) – Showing a strong upward trajectory linked to their recent innovations in cloud infrastructure and edge computing solutions. The firm’s aggressive R&D investments are bearing fruit, leading to robust client acquisitions.

- ABC Health Solutions (ABCH) – Positioned well in the biotechnology sector with promising advancements in gene therapy. ABCH has shown resilience and innovation, which are key indicators of its potential rise, driven by their successful phase 3 trials.

- 123 Green Energy (E123) – As greener alternatives gain traction, E123 stands out with its sustainable energy solutions. Recent partnerships with major industries and governments for renewable energy projects could lead to significant value increases.

| Stock Symbol | Sector | Reason for Optimism |

|---|---|---|

| XYZT | Technology | Innovative Tech & Rising Client Base |

| ABCH | Healthcare | Advancements in Gene Therapy |

| E123 | Renewable Energy | Strong Industry & Government Partnerships |

These stocks have been selected based on their recent performance, industry position, and intrinsic potential catalyzed by strategic endeavors. It is recommended for investors to further explore these options, considering their own investment strategy and risk appetite.

Strategies for Incorporating Analyst Recommendations into Your Investment Portfolio

Incorporating analyst recommendations into your investment portfolio can enhance your strategy by leveraging expert insights. One effective approach is to differentiate between short-term and long-term recommendations. Short-term picks may provide quick gains but come with higher volatility, whereas long-term picks are generally more stable and offer sustained growth potential.

It is crucial to consider your risk tolerance and investment goals when acting on these recommendations. By aligning these picks with your personal investment strategy, you can optimize your returns while maintaining a balanced risk profile. Below are some generic strategies to effectively integrate these recommendations:

- Diversification: Spread your investments across various sectors and asset classes based on bullish analyst picks to mitigate risks.

- Regular Reviews: Continuously monitor the performance of the stocks against analyst expectations and market conditions. Adjust your portfolio accordingly.

- Weighted Investments: Allocate a higher percentage of your portfolio to highly confident picks and scale down on those with weaker confidence levels.

For instance, based on recent analyst upgrades and robust earnings reports, consider the following table which outlines some bullish stock picks:

| Stock Symbol | Analyst Rating | Market Outlook | Suggested Action |

|---|---|---|---|

| XYZ | Strong Buy | Bullish | Consider Buying |

| ABC | Buy | Stable | Hold with potential to increase |

| DEF | Strong Buy | High Growth | Strong Buy |

Remember that while analyst recommendations are based on thorough research and data analysis, they should only form part of your decision-making process. Personal due diligence, aligned with these expert insights, will predictably position your portfolio for success.

Fair Value

In conclusion, while the stocks highlighted in this article have been identified as potentially bullish picks according to current analyst recommendations, it is important for investors to conduct their own thorough research and consider their investment strategy and risk tolerance before making any investment decisions. The stock market is dynamic and predictions are not guaranteed. Therefore, staying informed and agile in response to market changes is crucial for successfully navigating the investment landscape.