In the dynamic realm of financial technology, blockchain technology continues to stand out as a transformative force shaping the future of transactions and data management. As cryptocurrencies gain prominence, certain companies have positioned themselves as leaders, leveraging blockchain to drive innovation and efficiency. This article delves into the forefront of this technological revolution, highlighting cryptocurrency stocks that have emerged as significant players. We will explore how these companies are not only adapting to but also influencing the evolution of blockchain technology, offering insights into their strategic positioning, technological advancements, and potential impact on the global market. Join us as we analyze the leaders and pioneers in the blockchain arena, providing a comprehensive look at the cryptocurrency stocks leading the charge in this cutting-edge field.

Table of Contents

- 1. Overview of Leading Cryptocurrency Stocks in the Blockchain Arena

- 2. Evaluating Financial Performance and Market Trends

- 3. Spotlight on Key Innovators and Their Technological Advancements

- 4. Investment Strategies for Cryptocurrency Equities in a Volatile Market

- Fair Value

1. Overview of Leading Cryptocurrency Stocks in the Blockchain Arena

The blockchain and cryptocurrency sectors have seen unprecedented growth in recent years, giving rise to a diverse array of companies that capitalize on this digital revolution. In this rapidly expanding market, several stocks stand out as leaders in innovation and integration of blockchain technology.

Coinbase Global, Inc. (NASDAQ: COIN), a prominent platform for buying, selling, transferring, and storing digital currency, remains a heavyweight in the cryptocurrency exchange space. As a pioneer in offering a user-friendly interface combined with robust security measures, it plays a crucial role in facilitating access to the cryptocurrency market for new and experienced investors alike.

Marathon Digital Holdings, Inc. (NASDAQ: MARA) focuses on mining digital assets. It aims to leverage the latest technologies in blockchain and data center operations to enhance the efficiency and profitability of its cryptocurrency mining operations.

Riot Blockchain, Inc. (NASDAQ: RIOT) operates similarly but has invested heavily in expanding its mining capacity and optimizing its operational infrastructures, positioning itself strongly within the competitive mining sector.

| Company | Focus Area | Key Benefit |

|---|---|---|

| Coinbase Global, Inc. | Cryptocurrency Exchange | Enhanced security and user-friendly platform |

| Marathon Digital Holdings, Inc. | Cryptocurrency Mining | Advanced technological deployment |

| Riot Blockchain, Inc. | Cryptocurrency Mining | Expansion in mining capacity |

Each of these companies not only supports the underlying technologies essential for the growth of the cryptocurrency ecosystem but also indicates broader trends in innovation and strategic development within the sector. Their actions and performance are closely watched by investors keen on tapping into the lucrative blockchain market.

2. Evaluating Financial Performance and Market Trends

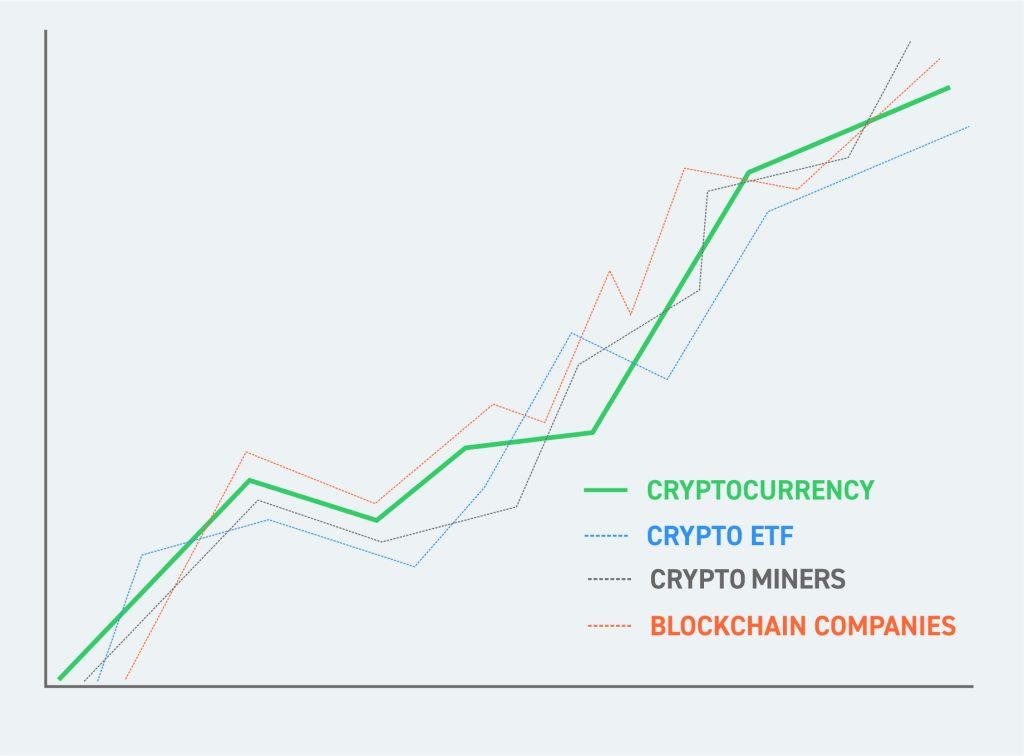

Analyzing the financial performance and market trends of stocks in the blockchain and cryptocurrency sectors involves several critical factors. First, investors should assess the revenue growth and profitability of these companies, which can be indicative of their ability to capitalize on market opportunities. Cryptocurrency companies often experience volatile earnings, which necessitates a deep dive into quarter-over-quarter earnings growth rather than just year-over-year comparisons.

Another crucial angle is the examination of market adoption rates. As blockchain technology permeates various industries, from financial services to supply chain management, tracking how quickly and extensively these innovations are being adopted can provide key insights into future growth potentials. It’s also beneficial to look at the competitive landscape within this high-growth sector:

- Partnerships and collaborations: Strategic alliances can provide leverage in expanding market reach and enhancing technological capabilities.

- Technological advancements: Breakthroughs in blockchain technology and its applications, such as scalability improvements and enhanced security features, are critical for long-term sustainability.

- Regulatory environment: Changes in regulations can greatly impact the operational capacity of cryptocurrency firms, thereby affecting their stock values.

In addition to qualitative assessments, investors should closely monitor key financial ratios and performance metrics through detailed tables illustrating these elements. For instance:

| Company | Revenue Growth (%) | EBITDA Margin (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| Blockchain Global Ltd. | 50 | 25 | 0.5 |

| Coinbase Inc. | 40 | 20 | 0.3 |

| Ripple Labs Inc. | 75 | 30 | 0.2 |

Such financial metrics serve not only as a snapshot of a company’s current financial health but also provide insights into its operational efficiency and market position relative to competitors.

3. Spotlight on Key Innovators and Their Technological Advancements

In the rapidly evolving world of blockchain and cryptocurrencies, several companies have distinguished themselves by pioneering innovative solutions that redefine how digital transactions are conducted. These key players have leveraged technology to facilitate faster, more secure, and efficient processes, garnering significant attention in the investment sphere.

Coinbase Global, Inc. stands out with its user-friendly platform that significantly lowers the barrier to cryptocurrency investment. Its recent advancements in security measures and added functionalities for trading various digital assets position it as a continued leader in cryptocurrency exchanges.

Riot Blockchain, Inc. focuses on cryptocurrency mining with a commitment to sustainability. By increasing its use of renewable energy sources and enhancing mining efficiencies, Riot Blockchain not only addresses environmental concerns but also improves profitability margins.

MicroStrategy Incorporated, while primarily a business analytics leader, has adopted Bitcoin as a primary treasury reserve asset. This strategic use of cryptocurrency showcases innovative corporate finance management, possibly inspiring other corporations to follow suit. MicroStrategy’s approach signals a broader acceptance of cryptocurrencies within conventional financial frameworks.

These companies have made significant strides in blockchain technology, contributing to their own financial performance and influencing broader market dynamics. For investors, understanding the innovations at play can guide strategic investment decisions in the digital assets space.

| Company | Innovation | Impact |

|---|---|---|

| Coinbase | Enhanced Security Measures | Increased user trust and transaction volume |

| Riot Blockchain | Renewable Energy Mining Rigs | Lowered carbon footprint, enhanced ROI |

| MicroStrategy | Bitcoin as Reserve Asset | Pioneered new corporate financial strategies |

4. Investment Strategies for Cryptocurrency Equities in a Volatile Market

In navigating the turbulent waters of cryptocurrency equities, adopting robust investment strategies is essential. Volatility in this sector can yield substantial returns but also presents unique challenges. Here are some effective approaches:

- Diversification: To mitigate risks, diversify your investments not only across multiple cryptocurrency stocks but also different sectors within the blockchain technology landscape, such as mining companies, hardware manufacturers, and blockchain service providers.

- Long-term Holding: Despite the volatility, embracing a long-term perspective can be beneficial. Consider the intrinsic value and growth potential of blockchain technologies beyond immediate price fluctuations.

- Technical Analysis: Utilize technical indicators like moving averages, RSI, and MACD to make informed decisions. These tools can provide insights into market trends and help time your transactions more effectively.

Moreover, staying informed with real-time data and market analysis can prove invaluable. The following table highlights some tools and platforms that offer actionable insights for crypto equity investors:

| Tool/Platform | Features | Use Case |

|---|---|---|

| TradingView | Comprehensive charting tools, market data | Technical Analysis |

| CoinMarketCap | Crypto market cap rankings, price information | Market Monitoring |

| CryptoQuant | On-chain data, exchange flow statistics | Risk Management |

Keep in mind that the key to successfully investing in cryptocurrency equities lies in the balance of maintaining rigorous risk management strategies while being adaptable to swift market changes. A blend of these strategies, along with continuous education and research, will equip investors to navigate the complexities of the blockchain investment landscape effectively.

Fair Value

In conclusion, as we explore the array of companies leading the charge in blockchain technology, it is clear that the landscape of cryptocurrency stocks is as dynamic as it is innovative. These entities, distinguished by their pioneering approaches and technological advancements, are setting the pace for the future of financial and digital transactions. As investors consider the opportunities within this burgeoning sector, it is crucial to maintain a balanced perspective, recognizing both the potential rewards and inherent risks. The evolution of blockchain technology continues to unfold, and those positioned at the forefront are likely to play significant roles in shaping its trajectory. As always, diligent research and a cautious strategy remain paramount for those looking to invest in the cutting edge of cryptocurrency stocks.