In the complex landscape of the global stock market, cyclical recovery stocks represent a unique category of assets that tend to move in tandem with the macroeconomic fluctuations. As economies emerge from periods of downturn, these stocks often experience significant shifts, presenting both opportunities and risks for investors. Amidst the prevailing market volatility, discerning the potential for growth in cyclical recovery stocks requires a careful evaluation of economic indicators, company fundamentals, and broader market sentiments. This article aims to delve into the intricacies of cyclical recovery stocks, elucidating the factors that make them a compelling consideration during phases of economic rebound and offering insights into navigating the associated volatility with strategic precision.

Table of Contents

- Understanding Cyclical Recovery Stocks in a Volatile Market

- Assessing Risk and Opportunity in Cyclical Sectors

- Strategic Portfolio Allocation for Cyclical Recovery

- Top Cyclical Stocks to Consider for Resilient Growth

- Fair Value

Understanding Cyclical Recovery Stocks in a Volatile Market

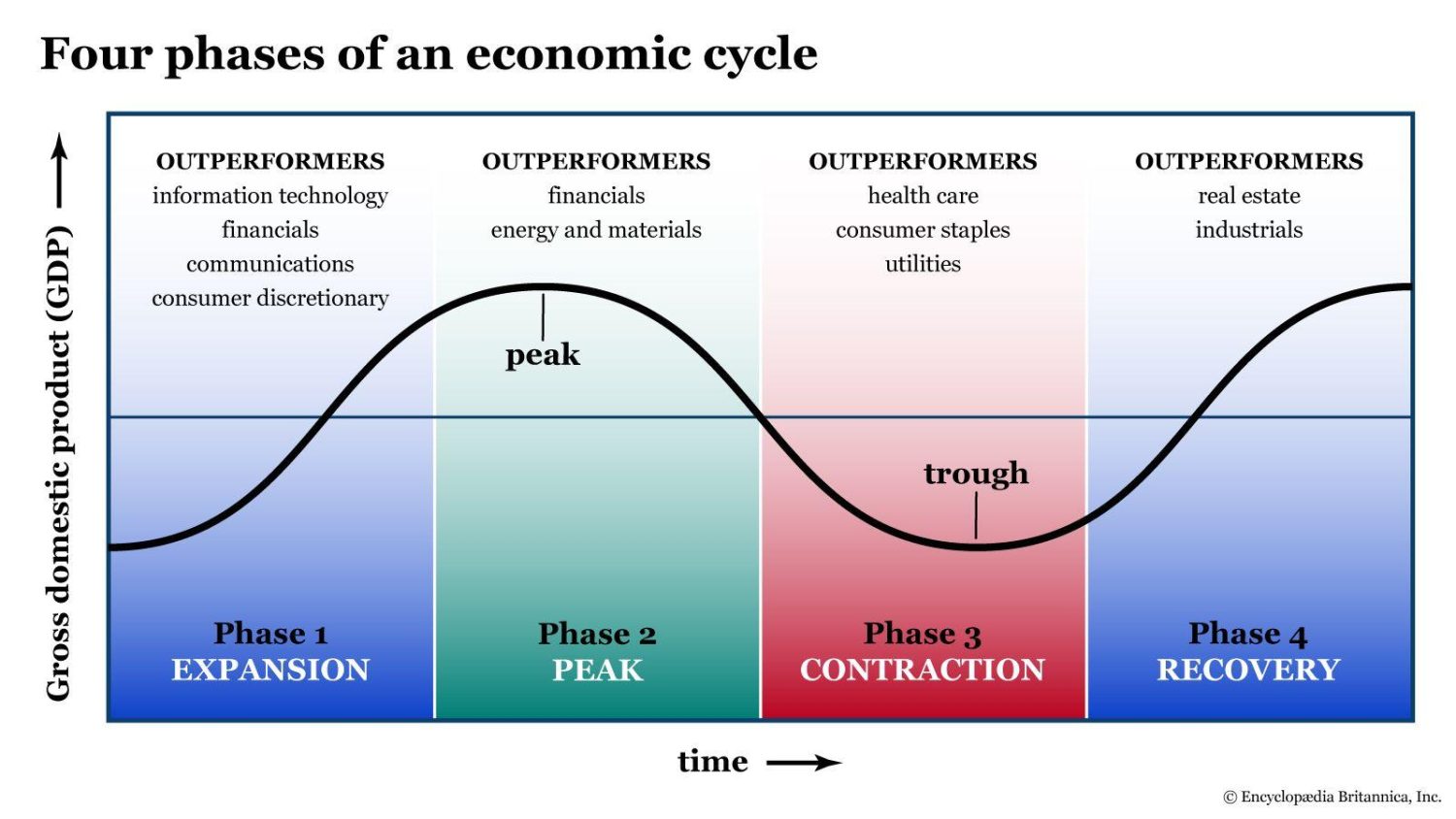

In times of economic fluctuation, certain stocks tend to mirror the broader economy’s peaks and troughs, known as cyclical stocks. These segments can present unique opportunities for savvy investors who understand their patterns and market influences. Industries such as automotive, construction, and retail fall into this category and tend to perform well when the economy is growing but retract during downturns.

Key Characteristics of Cyclical Recovery Stocks:

- High Volatility: These stocks frequently experience significant price fluctuations. This volatility can result from changes in economic forecasts, policy changes, or consumer confidence shifts.

- Sensitivity to Economic Changes: Cyclical stocks are often the first to react to economic recovery signals or to decline at the onset of economic downturns.

- Opportunity for High Returns: For investors who can time their investments wisely, buying these stocks at the lower point of the cycle and selling during the recovery phase can yield substantial profits.

Investing in cyclical recovery stocks requires a deep understanding of market conditions and timing. The table below provides a snapshot of recent performance metrics of key sectors that typically house cyclical stocks:

| Sector | Q1 Performance | Q2 Forecast |

|---|---|---|

| Automotive | +5% | Stable |

| Construction | +3% | Increasing |

| Retail | -2% | Recovery Expected |

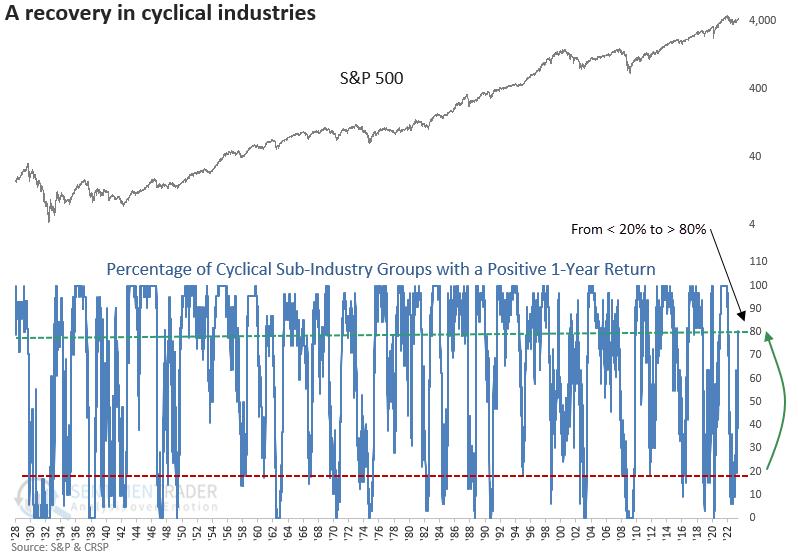

While the potential for profit is significant, it’s imperative to stay informed and react quickly to shifting economic indicators. Monitoring sector-specific trends, policy changes, and global economic indicators can greatly aid in making informed investment decisions regarding cyclical recovery stocks.

Assessing Risk and Opportunity in Cyclical Sectors

Investing in cyclical sectors requires a nuanced understanding of market dynamics and the ability to discern between short-term noise and long-term opportunity. Cyclical industries such as automotive, construction, and consumer discretionary goods tend to follow economic cycles, expanding rapidly in booming economies and contracting during slowdowns. These fluctuations present both risk and opportunity.

Risk Assessment: The primary challenge with cyclical sectors is their susceptibility to economic downturns which can lead to sharp declines in stock prices. Factors such as rising unemployment, decreased consumer spending, and tightening credit conditions can severely impact these sectors. It is vital to keep a close eye on economic indicators and sector performance to gauge potential risks:

- Sensitivity to economic cycles

- Impact of global economic volatility

- Changes in consumer behavior

Identifying Opportunities: On the flip side, the inherent volatility of cyclical sectors also creates opportunities for significant gains during economic recoveries. Stocks in these sectors often trade at a discount during downturns, poised for a rebound as conditions improve. Strategic entry and exit points must be carefully planned:

- Evaluating company fundamentals and resilience

- Timing investments with economic recovery phases

- Diversifying within the sector to mitigate risks

In summary, while cyclical sectors can be more volatile, they also offer unique opportunities for informed investors. Consideration of both macroeconomic factors and individual company performance can provide a balanced approach to investing in these sectors.

Strategic Portfolio Allocation for Cyclical Recovery

As markets enter a phase of cyclical recovery, astute investors may find robust opportunities by strategically allocating a portion of their portfolios to stocks that typically benefit from economic upturns. These sectors include consumer discretionary, financial services, real estate, and industrials. Investment in these sectors should be guided by careful analysis of company fundamentals and macroeconomic indicators to maximize returns while mitigating risks associated with market volatility.

Key Considerations for Cyclical Stock Selection:

- Earnings Momentum: Look for companies with a consistent track record of earnings growth, which is likely to accelerate as economic conditions improve.

- Balance Sheet Strength: Companies with solid balance sheets are better positioned to withstand economic fluctuations, making them a safer bet during uncertain times.

- Market Position: Prefer entities that hold a competitive advantage in their respective industries, as they are more likely to outperform during recovery phases.

Moreover, diversification across different cyclical sectors is crucial to balance the risk-return profile of your investment portfolio. Below is a simplified representation of an ideal portfolio distribution that balances exposure across various cyclical sectors known to benefit from economic recovery:

| Sector | Percentage Allocation |

|---|---|

| Consumer Discretionary | 30% |

| Financial Services | 25% |

| Real Estate | 20% |

| Industrials | 25% |

This strategic allocation allows for an optimized balance between risk and potential returns, leveraging the growth of sectors that historically perform well during recovery stages, thus positioning the portfolio favorably for the expected economic conditions.

Top Cyclical Stocks to Consider for Resilient Growth

Amidst market volatility, cyclical stocks offer potential for resilient growth as they are sensitive to the macroeconomic dynamics. Often tied to economic activities, they regain value swiftly with economic recovery. Here are several sectors and respective stocks to consider:

- Automotive: Companies like Ford Motor Company (F) and General Motors (GM) typically rebound with consumer spending and manufacturing upticks.

- Consumer Discretionary: Giants such as Amazon (AMZN) and Nike (NKE) flourish as consumer confidence restores.

- Construction: Caterpillar (CAT) and Vulcan Materials (VMC) stand out as infrastructure projects accelerate.

Assessing these stocks involves keen observation of economic indicators and timing market entry to maximize returns. Below is a comparison of key financial metrics that investors should consider:

| Stock | EPS (TTM) | P/E Ratio | Return on Equity |

|---|---|---|---|

| Ford Motor Co (F) | 1.15 | 12.3 | 14.8% |

| General Motors (GM) | 6.52 | 7.1 | 17.5% |

| Amazon (AMZN) | 41.83 | 93.7 | 27.2% |

| Nike (NKE) | 3.75 | 35.2 | 44.3% |

| Caterpillar (CAT) | 11.83 | 15.8 | 37.4% |

| Vulcan Materials (VMC) | 4.44 | 34.9 | 11.1% |

Attention to financial health and market timing are crucial, making cyclical stocks worthwhile for informed investors seeking growth amid uncertainty.

Fair Value

In conclusion, cyclical recovery stocks embody potential opportunities amidst market volatility, contingent upon careful assessment and strategic alignment with one’s investment goals. As investors navigate the landscape, focusing on thorough analysis and agile responses to market signals will be crucial. Moving forward, tuning into macroeconomic indicators and industry-specific trends will continue to guide investment decisions in this dynamic segment of the market. It is advisable to maintain a balanced approach and diversify exposure to mitigate potential risks associated with cyclical fluctuations. By doing so, investors can capably position themselves to capitalize on the possibilities that cyclical recovery stocks may offer during various economic phases.