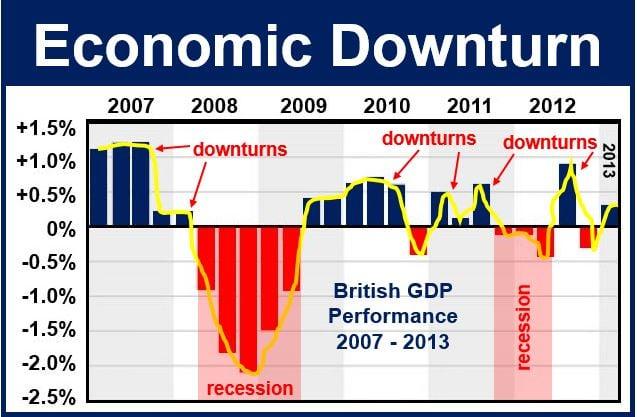

In an ever-evolving economic landscape, investors often seek stability during periods of uncertainty. Defensive stocks, known for their resilience in economic downturns, become a focal point in such times. This article explores the characteristics of defensive stocks, why they are considered safe havens during volatile market conditions, and how they can play a crucial role in portfolio diversification. By examining sectors traditionally seen as defensive, such as utilities, healthcare, and consumer staples, and analyzing specific examples, we aim to provide a comprehensive understanding of how these stocks can help mitigate risk and preserve capital when the broader market faces challenges.

Table of Contents

- Understanding Defensive Stocks: Characteristics and Benefits

- Key Sectors That Outperform During Economic Downturns

- Top Defensive Stocks to Consider for Portfolio Stability

- Evaluating Financial Health and Dividend Consistency in Defensive Plays

- Technical View

Understanding Defensive Stocks: Characteristics and Benefits

In the realm of investment, certain equities are termed as ‘defensive stocks’. These are shares of companies whose business performance and stock prices show consistent stability during various economic cycles, especially in downturns. The primary characteristics of defensive stocks include their continual demand irrespective of economic conditions. This can be attributed to the sectors they generally operate in—utilities, healthcare, and consumer staples, all essential services that people require regardless of financial climate.

Key Characteristics of Defensive Stocks:

- Low Volatility: They exhibit lesser fluctuations in their stock prices compared to the market average.

- Consistent Dividends: These stocks typically offer regular dividend payouts, providing an attractive income stream for investors.

- Non-cyclical: Their performance is not directly tied to the ebb and flow of economic cycles.

The benefits of investing in defensive stocks include a reduction in portfolio risk and a potential steady income through dividends. Their resilience during economic recessions can protect investors from severe market downturns, making them a critical component of a diversified investment strategy.

| Sector | Example Companies | Typical Dividend Yield |

|---|---|---|

| Utilities | NextEra Energy, Duke Energy | 3-4% |

| Healthcare | Johnson & Johnson, Pfizer | 2-3% |

| Consumer Staples | Procter & Gamble, Coca-Cola | 2.5-3.5% |

This blend of characteristics and benefits makes defensive stocks a viable option for conservative investors seeking to mitigate risks in turbulent times while potentially enhancing their income through consistent dividends. Their importance grows in portfolio management strategies particularly aimed at capital preservation during volatile market conditions.

Key Sectors That Outperform During Economic Downturns

In uncertain economic times, investors typically turn their attention to sectors known for their resilience. These include industries that provide essential services or products which remain in demand regardless of economic shifts. Notably, certain sectors have historically shown to not only withstand economic downturns but sometimes even outperform during these periods.

Utilities: Imperative in daily life, utilities exhibit constant demand, making them a steady choice during economic slowdowns. Electric, gas, and water companies fall into this category. As consumers prioritize essential spending, these services often see less fluctuation in demand compared to non-essential sectors.

Consumer Staples: Products such as food, beverages, and household items fall into consumer staples. During downturns, while consumers might reduce discretionary spending, they continue purchasing these necessary goods, supporting the robust nature of companies within this sector.

Healthcare: The demand for healthcare services and products is generally non-cyclical. Regardless of economic conditions, people need access to healthcare, making this sector particularly resilient during downturns. This includes providers of medical services, pharmaceutical companies, and manufacturers of medical supplies and equipment.

| Sector | Example Companies |

| Utilities | Duke Energy, Southern Company |

| Consumer Staples | Procter & Gamble, Coca-Cola |

| Healthcare | Pfizer, Johnson & Johnson |

Tracking stocks from these sectors during less favorable economic cycles could provide a buffer against more volatile market movements. Investors typically find refuge in these stocks, seeking stability and potential continued returns amidst broader market challenges.

Top Defensive Stocks to Consider for Portfolio Stability

In the landscape of global stock markets, certain equities known as defensive stocks have historically maintained consistent performance, even during economic downturns. These stocks typically belong to sectors that produce essential goods and services such as utilities, healthcare, and consumer staples. Here, we highlight a few of the robust candidates that could provide your portfolio with the desired stability:

- Johnson & Johnson (JNJ): With a diverse product line spanning pharmaceuticals, medical devices, and consumer health products, JNJ remains a top pick for resilience and steady dividend growth.

- The Procter & Gamble Company (PG): As a leading consumer goods company, PG’s wide range of essential products means steady demand, making it a reliable stock during market volatility.

- Duke Energy Corp (DUK): Positioned in the utility sector, DUK provides electricity and gas to millions, securing a steady revenue flow and displaying less sensitivity to economic shocks.

To further illustrate the point, consider the below table showcasing key statistics of the mentioned stocks:

| Stock Symbol | Dividend Yield | Year-to-Date Performance |

|---|---|---|

| JNJ | 2.6% | +8% |

| PG | 2.4% | +10% |

| DUK | 3.9% | +4% |

Investors should consider these stocks not just for their ability to endure economic hardships but also for their potential to deliver steady returns in fluctuating markets. By incorporating such resilience into a portfolio, investors can effectively mitigate risks associated with economic downturns.

Evaluating Financial Health and Dividend Consistency in Defensive Plays

In times of economic uncertainty, investors often seek refuge in stocks that historically show less volatility and maintain steady dividends. These defensive stocks typically belong to sectors that provide essential services, which remain in demand regardless of economic conditions. Therefore, evaluating the financial health and consistency of dividends plays a crucial role in selecting the right defensive plays for your investment portfolio.

Financial Health: A primary indicator to consider is the company’s debt-to-equity ratio, alongside its interest coverage ratio. Companies with manageable levels of debt and high interest coverage are better equipped to withstand economic downturns. It’s equally important to assess the operating margin trends, as they provide insights into the operational efficiency and pricing power of the company. Companies demonstrating consistently high or improving margins are often more resilient.

Dividend Consistency: Reviewing the dividend history is imperative. A consistent or increasing dividend payout ratio over the years serves as a testament to the company’s stable earnings and prudent cash management. Here is a simplified representation of attributes to consider when analyzing dividends:

| Attribute | Description |

|---|---|

| Dividend Yield | The ratio of the annual dividend per share to the stock’s price per share. Higher yields can be attractive but require evaluation against industry benchmarks. |

| Payout Ratio | Percentage of earnings paid to shareholders in the form of dividends. A lower ratio could indicate sustainability. |

| Growth Rate | Annualized average rate of dividend increase over a specified period. Consistent growth can be a sign of a healthy, expandable business model. |

Evaluating both the financial health and dividend consistency of potential defensive stock investments allows for a balanced approach to portfolio management, aimed at safeguarding capital during economic uncertainty while still providing potential returns through dividends.

Technical View

In conclusion, focusing on defensive stocks can offer investors a degree of protection during economic downturns. These stocks, typically in sectors such as utilities, consumer staples, and healthcare, have historically shown resilience in facing economic challenges, providing stable dividends and earnings. Nevertheless, investors should conduct thorough research and consider their individual financial situations and risk tolerance when incorporating defensive plays into their investment portfolios. Diversification and strategic asset allocation remain key to navigating fluctuating markets effectively. In essence, while defensive stocks can be a safer harbor in stormy economic weather, they should be integrated thoughtfully within a broader, well-rounded investment strategy.