The global energy sector is undergoing a transformative shift towards sustainability, driven by heightened environmental awareness and technological advancements. As the world increasingly prioritizes carbon reduction, renewable energy sources such as solar, wind, and hydro are taking center stage in the movement towards a cleaner future. This article explores the burgeoning domain of clean energy stocks, highlighting key players and industry trends that are set to redefine the way we think about energy production and consumption. We will delve into the investment potential these changes herald, offering insights into how investors can participate in and potentially benefit from the renewable energy revolution.

Table of Contents

- Renewable Energy Markets: An Overview of Growth and Innovations

- Key Players in the Clean Energy Sector: Stocks to Watch

- Investment Strategies for Clean Energy Stocks

- Future Trends: Predicting the Trajectory of Renewable Energy Investments

- Technical View

Renewable Energy Markets: An Overview of Growth and Innovations

The growth trajectory of the renewable energy sector has been robust, driven by a confluence of technological innovations, governmental policies, and increasing investor interest. A significant aspect fueling this dynamic expansion is the continuous advancement in technologies, such as solar photovoltaic (PV) systems, wind turbines, and battery storage solutions. These have not only improved in efficiency but have also become more cost-effective relative to traditional energy sources.

Innovations at the forefront:

- Solar Photovoltaics: Continuous enhancement in solar PV cell efficiency has made solar energy one of the fastest-growing amongst renewable energy technologies.

- Wind Energy: Technological advancements in turbine design and materials have significantly increased the energy yield and reduced the cost per KWh of wind-generated electricity.

- Battery Storage: Innovations in battery technology such as solid-state batteries and lithium-silicon technologies are enhancing energy storage capacity and efficiency, facilitating the integration of renewables into the grid.

In terms of market growth, several exchanges are witnessing substantial trading volumes in clean energy stocks. Renewable energy companies are increasingly being considered not just as environmentally beneficial, but also as economically viable, long-term investments.

| Year | Wind Capacity (GW) | Solar Capacity (GW) | Battery Storage (GWh) |

|---|---|---|---|

| 2020 | 651 | 714 | 15 |

| 2025 (Projected) | 840 | 1,080 | 230 |

This data illustrates not only the substantial growth already achieved but also underscores the anticipated future expansions fueled by ongoing innovations and increased market acceptance.

Key Players in the Clean Energy Sector: Stocks to Watch

In the burgeoning field of clean energy, several companies have emerged as pivotal players, driving innovation and promoting sustainable growth. These entities not only contribute significantly to environmental conservation but are also becoming increasingly influential in financial markets. Investors looking for opportunities in the renewable energy sector may want to consider the following key stocks:

- NextEra Energy (NEE): As the world’s largest producer of wind and solar energy, NextEra Energy is a prime candidate for those looking to invest in renewable resources. With a robust portfolio of renewable infrastructure projects and consistent financial performance, NEE continues to be a leader in the clean energy transition.

- Tesla Inc (TSLA): Widely known for its electric vehicles, Tesla also plays a crucial role in the clean energy sector through its solar panel and battery storage solutions. Tesla’s commitment to innovation and its expansive market reach make it a compelling stock for clean energy investors.

- Enphase Energy (ENPH): Specializing in energy management solutions, Enphase Energy provides microinverter technology for solar photovoltaic systems. Their products improve the efficiency and reliability of solar installations, positioning ENPH as a key stock in solar technology.

The table below summarizes the stock performance and market potential of these companies, providing a snapshot for potential investors:

| Company | Stock Symbol | Recent Market Performance | Future Potential |

|---|---|---|---|

| NextEra Energy | NEE | Stable growth with upward trends | High due to ongoing expansion in renewable projects |

| Tesla Inc | TSLA | Volatile but strong overall | Very high with innovations in EV and energy storage |

| Enphase Energy | ENPH | Significant growth in recent years | High, bolstered by advancements in solar technology |

These companies are not only advancing technological innovation but are also reshaping financial landscapes in the energy sector. Monitoring their performance and market developments will be crucial for investors interested in clean energy stocks.

Investment Strategies for Clean Energy Stocks

Investing in clean energy stocks requires a strategic approach that balances growth potential against market risks. Developments in legislative support combined with technological advances in the sector highlight a few key strategies:

- Diversification within the Sector: Investors should look beyond traditional solar and wind investments to include emerging technologies such as bioenergy and battery storage. This helps mitigate risk and take advantage of growth in sub-sectors.

- Geographic Spread: Given the global push towards cleaner energy solutions, expanding investments to include companies in rapidly growing markets such as Asia and Europe can capitalize on regional growth dynamics.

- Long-term Holding: Clean energy projects often have long gestation periods before becoming profitable. Patience and a long-term investment horizon can yield substantial returns as projects come online and technologies mature.

Incorporating these strategies into investment portfolios can help navigate the volatility often associated with the clean energy sector while positioning for substantial future growth. Consider the following table, which compares the 5-year performance of diverse clean energy stocks:

| Company | Technology | 5-Year Return | Geographic Focus |

|---|---|---|---|

| SunPower Corp | Solar | 190% | USA |

| Orsted A/S | Wind | 280% | Europe |

| Enphase Energy | Battery Storage | 560% | Global |

These figures demonstrate not only the potential return on investment but also emphasize the importance of diversifying across technologies and geographical areas. By applying these strategic considerations, investors can effectively engage with the lucrative market of clean energy while also contributing to a more sustainable global energy future.

Future Trends: Predicting the Trajectory of Renewable Energy Investments

As the global economy increasingly shifts towards sustainability, investments in renewable energy are expected to show robust growth. Several factors are driving this trend, including technological advancements, supportive government policies, and a growing cultural shift towards environmental responsibility. Noteworthy is the rising efficiency and decreasing cost of renewable technologies, which enhance the attractiveness of investments in this sector.

Key Predictors of Growth:

- Technological Advancements: Innovations such as enhanced battery storage and improved solar panel efficiency are making renewable energy more viable and reliable.

- Policy Support: Many governments worldwide are providing subsidies, tax incentives, and regulatory support, encouraging both businesses and consumers to choose renewable over traditional fossil fuels.

- Increased Investment: There has been a significant uptick in both private and public sector funding. Notably, major corporations are committing to green energy solutions, and investment funds are increasingly allocated to sustainable assets.

Market Impact and Investment Potential:

| Renewable Sector | Expected Growth Rate (2023-2028) | Key Factors |

|---|---|---|

| Solar Energy | 15% | Cost reduction, global reach, technology integration in residential and industrial sectors. |

| Wind Energy | 10% | Offshore development, larger turbines, government policies in the USA and Europe. |

| Bioenergy | 7% | Advancements in biofuels, legislative support for waste to energy projects. |

Given these factors, investors are keenly watching markets related to clean energy technologies, particularly those showing exponential innovation and regulatory backing.

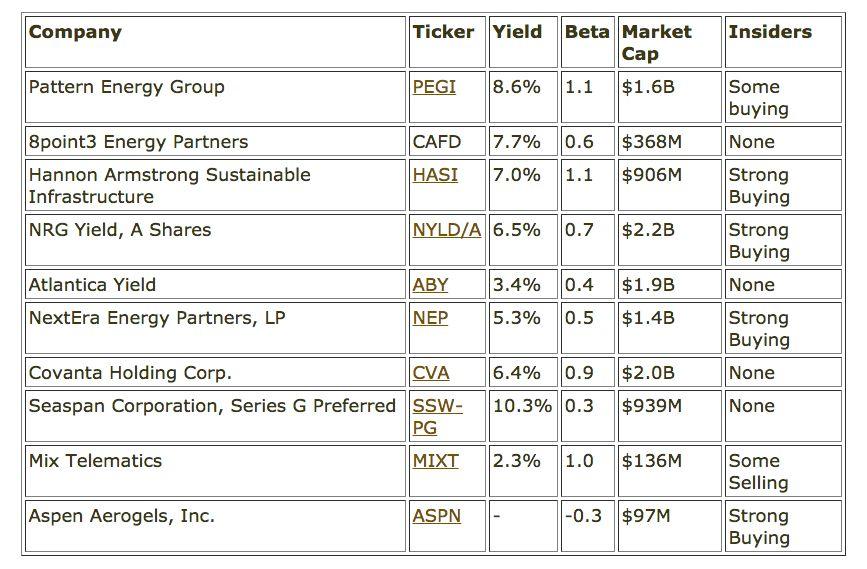

Technical View

In conclusion, the renewable energy sector represents a dynamic and rapidly evolving market, driven by a global shift towards sustainability and clean energy solutions. As we have discussed, clean energy stocks are at the forefront of this transformation, offering potential growth opportunities for investors. While the sector presents certain risks, including regulatory changes and technological developments, the overarching trend towards renewable energy seems poised to continue. Investors are encouraged to conduct thorough research and consider the long-term potentials and challenges discussed in this article when making investment decisions in clean energy stocks. As the world progresses towards a greener future, staying informed and strategic will be key in harnessing the full potential of the renewable energy revolution.