If you’re keeping an eye on copper stocks in 2025, it’s time to zoom in on Ero Copper Corp (NYSE: ERO), a rising small-cap mining stock that’s got Wall Street talking.

With booming demand from AI data centers and a projected copper supercycle on the horizon, Ero Copper is well-positioned to ride the next big wave in commodity investing.

But what makes Ero Copper stock a smart buy right now?

Who are They?

Ero Copper is a Canadian-based mining company with high-margin copper operations centered in Brazil, specifically in the Curaçá Valley.

Aside from copper, it also produces gold and silver by-products, adding more shine to its portfolio.

But here’s where it gets exciting: Ero Copper expects to double its copper production by the end of 2025. That’s not just ambition. This is backed by solid operations and strong fundamentals

Upside? Analysts Sure Think So

Let’s talk numbers. According to analysts.

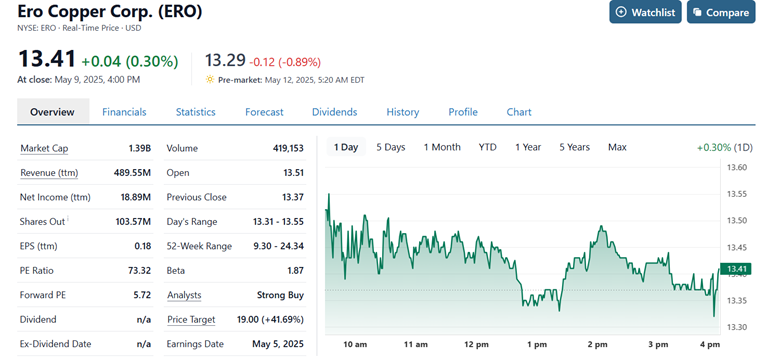

Earnings growth is expected to surge over the next 12 months. The price target for ERO stock sits at $19.00, which reflects a whopping 41% upside from current levels (as of May 9 2025). The company boasts a healthy $125 million in cash or cash equivalents (Q3 2024), giving it the financial muscle to scale operations without excessive debt.

That kind of forecast puts Ero in a league of small caps with big potential.

Copper is the New Gold (Thanks, AI)

You’ve probably heard it before: “Copper is the metal of electrification.” But in 2025, the hype is becoming reality.

The explosion in AI-driven data centers, EVs, and green energy infrastructure is fueling a global copper demand boom. While copper prices have lagged a bit this year, many analysts believe we’re on the cusp of a copper supercycle, and mining companies like Ero Copper are set to benefit big.

As governments and corporations invest heavily in energy transition and digital infrastructure, copper is going from industrial metal to strategic necessity.

A Sustainable Edge

In an era where ESG investing is no longer optional, Ero Copper stands out with its commitment to sustainable mining practices. The company is just chasing profits and managing its environmental footprint, and building long-term stakeholder value.

That’s a major plus for today’s investors who want returns without compromising on responsibility.

Sometimes the biggest opportunities come in smaller packages, and Ero Copper might just be one of the best small-cap mining stocks to watch this year.

Keep your eyes on copper, watch those earnings, and don’t be surprised if ERO stock becomes one of 2025’s quiet outperformers.