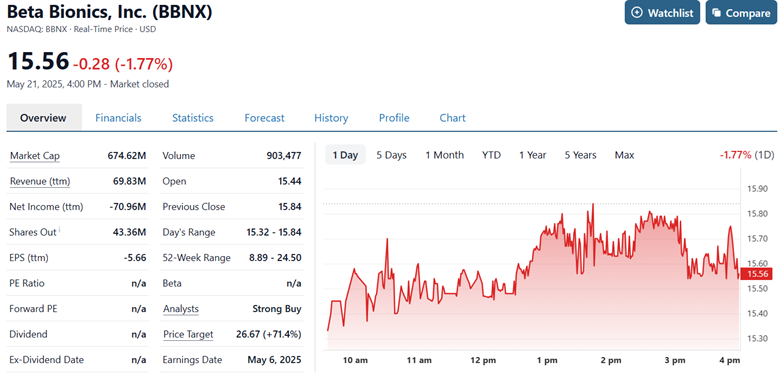

If you’re keeping tabs on innovative health tech companies, Beta Bionics should definitely be on your radar. The company made a bold debut on the NASDAQ in January 2025 with its IPO priced at $17 per share, and it didn’t disappoint.

The stock opened at $22 and closed the day at $23.81, giving early investors a juicy 40% gain on Day 1. Not bad for a company aiming to shake up how we manage diabetes.

Here’s What the Noise is All About

At the center of it is the iLet® Bionic Pancreas, a game-changing medical device that automatically manages insulin delivery.

The thing is that it only needs your weight to get started. No more carb counting, no more constant insulin calculations. It’s like handing your diabetes management over to a very smart, very attentive assistant. The FDA has already given it the green light, and patients are loving the simplicity.

The company’s growth trajectory is impressive. In 2023, it brought in $12 million in revenue. Fast forward to 2024, and that number shot up to nearly $66 million. That kind of leap isn’t common for new medtech companies, and it reflects a strong product-market fit.

It also signals that Beta Bionics isn’t just a research-heavy company sitting on patents—it’s actively generating sales and scaling fast. Partnering with Abbott, a major name in healthcare, only strengthens its credibility and potential to expand distribution.

But despite all the excitement, it’s important to stay grounded. Beta Bionics is not yet profitable. It reported a net loss of $55.3 million in 2024, which is expected for a company pouring money into growth, but it’s still a red flag for risk-averse investors. IPOs in the healthcare and biotech space can be volatile, and even though the stock popped 40% on its debut, that kind of swing can go both ways.

The company’s not slowing down. It recently partnered with Abbott, integrating the iLet with Abbott’s FreeStyle Libre 3 Plus sensor to enhance the system’s efficiency. And they’re already working on a next-gen version of the iLet that delivers both insulin and glucagon, mimicking a real pancreas even more closely.

So, should you buy this IPO? If you’re comfortable with volatility and looking for a high-risk, high-reward play in a market ripe for innovation, Beta Bionics might be a smart move. But if you prefer stable returns and predictable profits, you may want to watch how the company performs in its first few quarters before jumping in.

All signs point to a company with a bold mission, the right tech, and investor confidence to match. If they keep this pace, Beta Bionics might just redefine diabetes care for good.