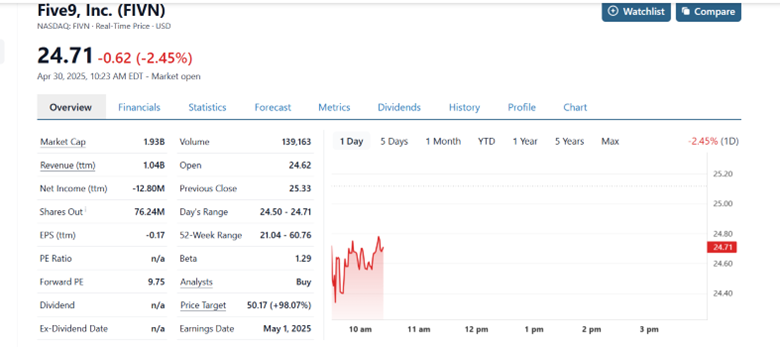

Revenue projections are down. Price target slashed. But somehow… analysts are still bullish? Welcome to the rollercoaster ride that is Five9 Inc. (NASDAQ: FIVN) ahead of its Q1 earnings on May 1, 2025.

Cloud contact center software provider, Five9, just got a reality check from Rosenblatt Securities, sort of.

Analyst Catharine Trebnick lowered her revenue forecasts for 2025 and 2026, citing growing macro uncertainty (yep, tariffs are back in the headlines).

Her price target dropped from $58 to $36, but she still holds a Buy rating on the stock. Why the mixed signals? Let’s unpack it.

The Trimmed Numbers

Trebnick now expects 2025 revenue of $1.136 billion, down from the previous $1.142 billion estimate. That’s about 9% year-over-year growth, and slightly below Street estimates of $1.139 billion.

2026 revenue trimmed to $1.249 billion from $1.261 billion, again, a miss compared to consensus at $1.255 billion.

So, not catastrophic, but definitely cautious.

On the flip side, earnings got a tiny bump. 2025 pro forma EPS nudged up to $2.60 from $2.58, and 2026 EPS is unchanged at $3.00, slightly ahead of Wall Street’s $2.98.

The earnings boost is thanks to Five9’s workforce reduction plan, which is cutting 4% of staff to streamline operations and improve operating margins.

Despite the Revenue Cuts

Trebnick still sees long-term promise. Why? Because AI is eating the contact center space, and Five9 is well-positioned to benefit.

Unlike competitors locked into more rigid systems, Five9 offers a flexible, open platform, which makes it a strong candidate for businesses re-evaluating their CCaaS (Contact Center as a Service) strategy. As AI continues to reshape customer service, this flexibility could give Five9 a serious edge.

Let’s Keep It Real

Slashing price targets by nearly 40% isn’t a bullish move on paper.

But Rosenblatt’s continued Buy rating suggests that the long-term fundamentals still look solid, especially for investors who believe in the AI revolution within enterprise software.

With Five9 trading around $25 (at the time of writing), it’s far below the revised $36 target. That could spell opportunity for those who can stomach short-term volatility.

Five9’s story isn’t a screaming buy, but it is one to watch closely. May 1 earnings could be the next big catalyst.