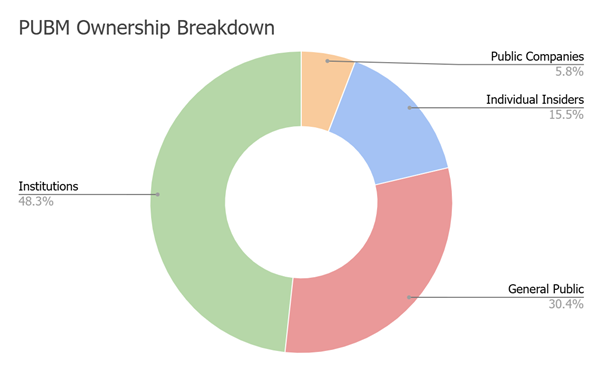

PubMatic (NASDAQ: PUBM) just had an 11% dip, and institutional investors aren’t thrilled. With 48% of shares in the hands of the big dogs (aka hedge funds and investment firms), that’s a whole lot of pain on one red day. Add in the fact that shareholders are sitting on a 50% loss over the past year, and yeah, things are heating up.

The company lost a whopping $66 million in market cap in just one week, and if that free fall continues, we could see major players start dumping their shares, fast. That’s not great news for everyday investors holding on for a turnaround.

Ownership Drama You Missed

Insiders like Amar Goel, one of the founders, still hold nearly 9% of the company’s shares. CEO Rajeev Goel isn’t far behind with almost 5%. Normally, that’s a good sign. Insiders having skin in the game can signal long-term belief. But recently, there have been some insider selling activities.

Also, one thing worth noting is that the top 14 shareholders own half of the company. That’s serious sway. If even a couple of them panic, PubMatic’s already sliding stock could hit the ground fast.

PUBM Ownership Breakdown

A Bad Week or a Bigger Warning

This isn’t just a one-off dip. The tech space, especially smaller companies like PubMatic, is under serious pressure. Ad tech has been shaky, and while PubMatic isn’t alone, investors are wondering if it can hold ground or get outpaced by bigger competitors or emerging AI-driven platforms.

If you’re holding, watching, or even remotely interested in small-cap tech? This might be the stock to keep on your radar, for better or worse.