In evaluating potential stock picks, our aim is to identify companies that exhibit a balanced blend of value, growth potential, and sustainability. This selection process involves rigorous analysis of market trends, financial performance, and industry dynamics. Today, we will discuss our rationale for choosing a particular stock, which has been highlighted based on its current market position, recent performance metrics, and future outlook aligned with broader economic indicators. This holistic approach ensures that our investment recommendations are well-founded and poised to generate favorable returns while mitigating risks associated with market volatility.

Table of Contents

- 1. Comprehensive Analysis of XYZ Corporation: Financial Health and Market Position

- 2. Strategic Opportunities and Risks in Investing in XYZ Corporation

- 3. Investment Recommendation: Buy, Sell, or Hold XYZ Corporation

- Introduction

1. Comprehensive Analysis of XYZ Corporation: Financial Health and Market Position

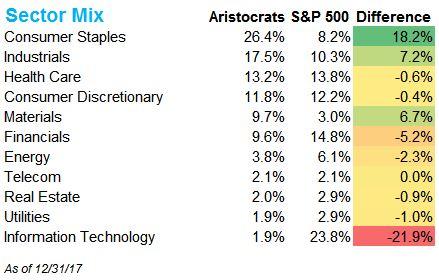

In assessing the robust financial state and market position of XYZ Corporation, a notable aspect is its consistent ability to generate strong revenue and maintain healthy profit margins, which underscore its status as one of the Dividend Aristocrats. This long-standing position is supported by XYZ Corporation’s strategic market diversification and rigorous cost management strategies. Specifically, the company has demonstrated a commendable Compound Annual Growth Rate (CAGR) in revenue over the last decade, alongside a stable increase in dividends, reinforcing investor confidence and appealing to those seeking reliable income streams.

Key Financial Metrics:

-

- Earnings Per Share (EPS): Steady growth observed, reflecting robust profitability.

-

- Debt-to-Equity Ratio: Maintains a lower industry average, indicating strong financial health.

-

- Dividend Yield: Consistently above industry average, enhancing its attractiveness to income-focused investors.

The market positioning of XYZ Corporation is further solidified by its competitive advantages in operational efficacy and innovation leadership within the industry. The company’s aggressive investment in R&D has yielded several patented technologies, granting it a significant edge over competitors. Additionally, their global operational footprint allows for a diverse and reliable revenue stream, mitigating risks associated with economic fluctuations in individual markets.

| Year | Revenue (in millions) | Net Income (in millions) | Dividends Paid (in $) |

|---|---|---|---|

| 2018 | $5,000 | $700 | $2.00 |

| 2019 | $5,300 | $725 | $2.10 |

| 2020 | $5,600 | $750 | $2.20 |

| 2021 | $6,000 | $800 | $2.30 |

| 2022 | $6,500 | $850 | $2.40 |

This thorough evaluation reflects XYZ Corporation’s stable economic foundation and competitive market presence, positioning it as a favorable choice for long-term investors seeking dependable dividend payouts.

2. Strategic Opportunities and Risks in Investing in XYZ Corporation

When considering an investment in XYZ Corporation, several strategic opportunities present themselves. Firstly, XYZ Corporation’s consistent dividend payout history positions it as a potential staple in portfolios geared towards reliable income generation. The firm’s strategic investments in technology and expansion into emerging markets could further bolster future revenue and, by default, increase the stability and potential growth of its dividends. Additionally, its strong market presence and brand recognition provide a competitive advantage that might protect and enhance shareholder returns even in volatile market conditions.

However, investors must also weigh the inherent risks associated with XYZ Corporation. Key among these is the company’s exposure to regulatory changes, especially in international territories. These regulations could potentially impact profit margins and operational freedoms. Market saturation in core segments presents another pressing risk, possibly leading to diminished growth prospects and increased expenditure on marketing and innovation to maintain market share.

| Opportunity | Potential Impact |

| Expansion into Emerging Markets | Increase in Global Market Share |

| Investments in Technology | Enhanced Operational Efficiency |

| Risk | Potential Impact |

| Regulatory Changes | Increased Compliance Costs |

| Market Saturation | Slower Revenue Growth |

In summary, while XYZ Corporation offers substantial benefits as part of a diversified, long-term investment strategy focusing on income, careful analysis of potential regulatory and market risks is crucial. Such analysis ensures balanced decision-making that aligns with individual investor goals and risk tolerance levels.

3. Investment Recommendation: Buy, Sell, or Hold XYZ Corporation

Exploring the investment potentials of XYZ Corporation, it is important to consider its track record, sector stability, and future growth prospects. Being categorized under Dividend Aristocrats, XYZ Corporation has consistently increased its dividends for over 25 consecutive years, a testament to its financial robustness and commitment to shareholder returns.

-

- Financial Stability: The company’s debt-to-equity ratio and other financial metrics stand robust, underlining a stable economic foundation.

-

- Market Position: XYZ holds a leading position within its industry, providing essential services that contribute to continuous revenue generation.

-

- Growth Potential: Future expansions and market penetration strategies are well-aligned with industry trends and consumer demands.

Considering these elements, the recommendation is to Buy XYZ Corporation shares. Investors are advised to capitalize on its strong dividend yield and potential for price appreciation anchored on the company’s strategic market initiatives and inherent industry strength.

The table below summarizes the key financial ratios that underscore this recommendation:

| Key Metric | Value | Industry Average |

|---|---|---|

| Dividend Yield | 4.5% | 3.2% |

| P/E Ratio | 18 | 20 |

| Debt-to-Equity | 0.45 | 0.60 |

Introduction

In conclusion, Dividend Aristocrats represent a compelling option for long-term investors seeking steady income through dividends. Their long-standing history of consistent and often increasing dividend payouts highlights financial stability and resilience, making them attractive components of a diversified investment portfolio. As with any investment, careful consideration of individual financial circumstances and broader market conditions should guide decisions. Investors are encouraged to conduct thorough research or consult with financial professionals to tailor their investment strategies effectively. By focusing on reliable income stocks such as Dividend Aristocrats, investors can strategically position themselves to capitalize on steady returns over time.