In late 2024, whispers turned to warnings. Hospitals were seeing an earlier-than-usual surge in flu cases, alongside a spike in severe Respiratory Syncytial Virus (RSV) infections.

By November, norovirus outbreaks were shutting down schools and long-term care facilities. Then, COVID-19 re-entered the scene with a stealthy new subvariant, sending cases climbing yet again.

By January 2025, the United States found itself in the grip of what public health officials are calling the “quademic”—a rare convergence of four viral illnesses simultaneously spreading across the country.

This unprecedented collision of diseases has overwhelmed healthcare systems and sparked a national conversation about preparedness. But it’s also creating ripples that extend far beyond hospitals, into the broader economy and financial markets.

Understanding the quademic’s potential impact on industries, sectors, and markets could provide key insights into the challenges—and opportunities—this crisis presents.

The Story of The Quademic

Unlike typical viral seasons, where illnesses follow predictable patterns, the quademic has thrown the system into chaos.

Flu season arrived weeks earlier than expected, RSV surged with unusual intensity among children, norovirus spread rapidly in communal environments, and COVID-19 continued to evolve, producing a new variant capable of dodging immunity.

Together, these viruses are straining resources to the breaking point. Emergency rooms are packed, pediatric ICUs are at capacity, and schools and businesses are reporting record-high absenteeism. Rural hospitals, with fewer beds and staff, are particularly vulnerable, forcing some patients to travel hours for care.

The economic implications are already being felt. Workplace productivity is taking a hit as employees call out sick or stay home to care for sick children. Schools in several states have temporarily closed, disrupting working parents and adding to economic pressures.

The ripple effects are clear: when people are too sick to work, businesses lose revenue, supply chains face delays, and the broader economy feels the strain.

Economic Impacts: What We’ve Learned from the Past

The COVID-19 pandemic showed us just how tightly public health and economic stability are intertwined. In 2020, the global economy contracted by 3.4%, and U.S. unemployment soared as businesses shuttered and consumer spending plummeted.

While the quademic hasn’t reached pandemic proportions, its potential economic impacts follow similar patterns.

- Workforce Productivity: High absenteeism is reducing productivity across industries, particularly in healthcare, retail, and logistics. Labor-intensive sectors like manufacturing and transportation could also face slowdowns.

The National Bureau of Economic Research previously found that lost workdays due to illness during COVID-19 were a direct drag on GDP. A similar, albeit smaller-scale, effect could emerge if the quademic worsens. - Consumer Spending: During health crises, consumer behavior shifts. Spending on discretionary items like travel, entertainment, and dining out tends to decline, while spending on essentials like groceries, cleaning supplies, and over-the-counter medications increases.

Companies catering to health and hygiene—such as Procter & Gamble or Johnson & Johnson—could see increased demand, while sectors like travel and hospitality may face challenges. - Healthcare Costs: Hospitals are shouldering higher operating costs as they hire temporary staff, pay overtime, and manage a surge in patients. Delayed elective surgeries—typically a major revenue source—are putting financial pressure on healthcare providers. This could mean short-term headwinds for hospital stocks but potential opportunities in areas like medical equipment and pharmaceutical production.

Market Impacts: Where Opportunities and Risks Lie

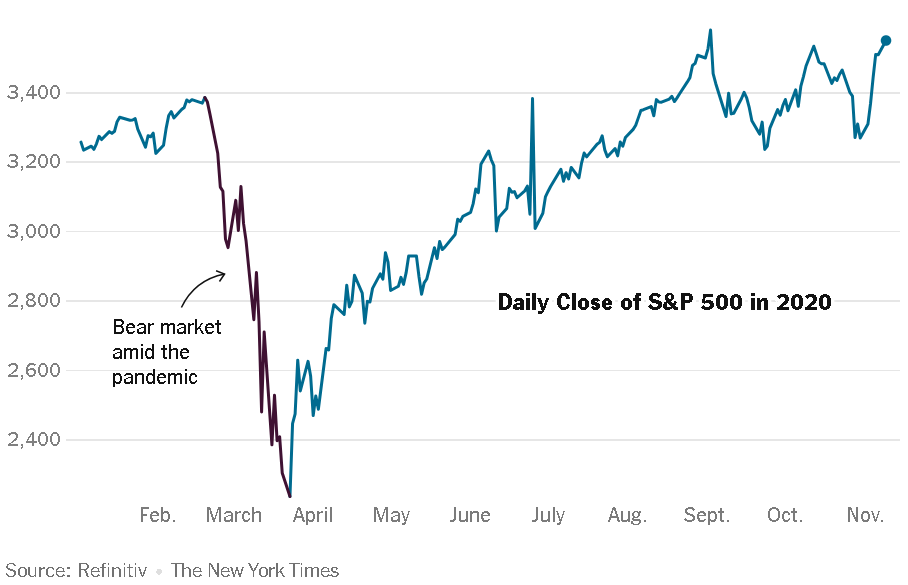

Health crises have a history of creating volatility in financial markets. During the initial COVID-19 outbreak, the S&P 500 saw one of its sharpest declines in decades, but it also rebounded as markets adjusted to new realities.

The quademic, while less dramatic, has the potential to drive sector-specific shifts.

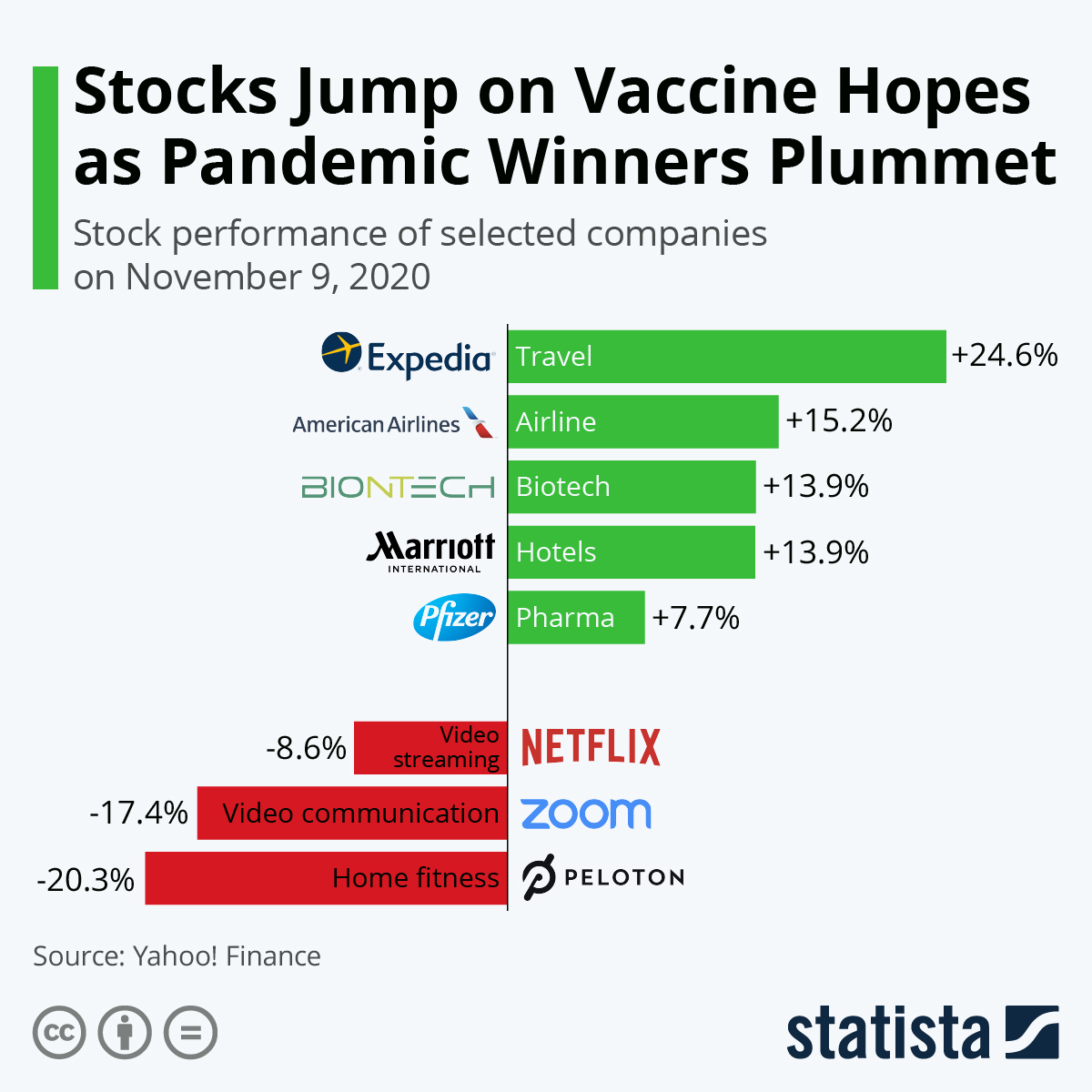

Healthcare and Biotech Stocks: Companies involved in vaccines, antivirals, and diagnostics could benefit from heightened demand. For example, Moderna and Pfizer, which played pivotal roles during the COVID-19 pandemic, may see increased interest if booster campaigns or antiviral treatments ramp up.

Diagnostic companies like Abbott Laboratories, which manufacture testing kits, could also see gains as testing increases.

Consumer Staples: Investors often flock to companies offering essentials during periods of uncertainty. Retailers like Walmart, Costco, and CVS are likely to see a boost in sales of over-the-counter medications, cleaning supplies, and household necessities.

During the pandemic, these companies outperformed as consumers shifted spending toward essentials—a trend that could repeat in the quademic.

Travel and Hospitality: Airlines, hotels, and entertainment companies are vulnerable. Even a modest drop in travel due to health concerns could lead to declines in revenue for these industries. During COVID-19, global air passenger traffic fell by 66% in 2020, illustrating how quickly consumer behavior can change in response to health fears.

Technology and Remote Work: If illness continues to disrupt workplaces, demand for remote work solutions could rise. Companies offering virtual meeting tools, cloud-based services, and digital productivity platforms may see renewed growth, mirroring trends observed during COVID-19 lockdowns.

Investor Takeaways: Balancing Risks and Opportunities

The quademic is a reminder of how quickly public health crises can reshape economic and market landscapes.

The immediate impacts are likely to be sector-specific, with healthcare, biotech, and consumer staples poised to benefit, while travel, hospitality, and discretionary retail could face headwinds.

While the quademic may not have the catastrophic impact of COVID-19, its effects are real and multifaceted.

The story is still unfolding, but one thing is clear: health, economics, and markets are inextricably linked, and understanding those connections is essential for navigating the challenges ahead.