I do not access live data or real-time updates as my responses are generated based on a combination of my trained knowledge, publicly available data, and broader market insights up to my last update. However, I can discuss how to approach selecting a stock based on historical and fundamental analysis.

When evaluating a stock for potential inclusion in an investment portfolio, one would typically consider a mix of qualitative and quantitative factors including:

-

Industry Position: Analyzing where a company stands in comparison to its competitors within the industry. Evaluating its market share, competitive advantage (e.g., patents, technology, market reach), and its susceptibility to industry disruptions.

-

Financial Health: Reviewing financial statements to assess profitability, debt levels, cash flow stability, and revenue growth trends. Key ratios like the Price-to-Earnings (P/E), Debt-to-Equity (D/E), and Return on Equity (ROE) provide insights into valuation, financial sustainability, and operational efficiency respectively.

-

Management Efficiency: Considering the effectiveness of the company’s leadership in terms of their experience, their track record, and strategic decisions that influence company growth and stability.

-

Economic Moat: Determining if the business has a sustainable competitive advantage that can protect its long-term profits and market share against competitors. Moats could arise from cost advantages, brand strength, network effects, and more.

-

Growth Potential: Identifying opportunities for expansion in new markets or products, and the company’s effectiveness in capitalizing on these growth vectors.

-

Risk Factors: Understanding the potential risks involved, which could include technological changes, regulatory shifts, and broader economic downturns that might impact the company.

-

Valuation: Comparing the current price of the stocks to its intrinsic value based on forecasting models to determine if it is undervalued, fairly priced, or overvalued. This is crucial in ensuring that an investment meets the risk/reward preferences of the portfolio.

For example, if evaluating a technology stock, one might look specifically at the rate of innovation, R&D spend, intellectual property holdings, and market adoption to gauge its potential future growth and profitability.

In choosing a specific stock, detailed and diligent analysis aligned with strategic investment goals is essential, ensuring a well-rounded evaluation rather than decision-making based solely on market sentiment or short-term movements.

Table of Contents

- 1. In-Depth Analysis of XYZ Corporation’s Financial Health

- 2. Market Trends Influencing XYZ Corporation’s Stock Performance

- 3. Investment Strategy: Evaluating the Buy, Hold, or Sell Decision for XYZ Corporation

- Introduction

1. In-Depth Analysis of XYZ Corporation’s Financial Health

Conducting a thorough financial analysis of XYZ Corporation, we consider key metrics such as revenue growth, profit margins, and return on equity to understand its market position and sustainability. Over the past fiscal year, XYZ Corporation has demonstrated a steady revenue growth of 8%, however, the net profit margin has seen a slight contraction from 15% to 14.2%. This indicates a need to investigate operational efficiencies and cost management strategies.

Furthermore, the company’s balance sheet reflects a strong liquidity position. The current ratio stands at 2.5, illustrating a robust ability to cover short-term liabilities. Despite this, the debt-to-equity ratio has increased to 0.45 from 0.30 in the previous year, raising some concerns about the level of financial leverage and its impact on shareholder’s equity:

| Financial Metric | Previous Year | Current Year |

|---|---|---|

| Revenue Growth | 9% | 8% |

| Net Profit Margin | 15.0% | 14.2% |

| Current Ratio | 2.3 | 2.5 |

| Debt-to-Equity Ratio | 0.30 | 0.45 |

These insights into the financial condition of XYZ Corporation aid in determining its potential for sustainable growth and risk exposure. Especially for a hedge fund considering this stock, it is essential to weigh the risks of increased leverage against the potential for profit margin optimization and revenue growth. Strategic investment decisions should consider these factors to ensure alignment with overall fund performance objectives.

2. Market Trends Influencing XYZ Corporation’s Stock Performance

In assessing the performance of stocks like those of XYZ Corporation, several market trends must be acknowledged. The intricate dynamics influenced significantly by global economic policies, sector-specific developments, and technological advancements play a pivotal role.

- Global Economic Policies: The onset of trade agreements or sanctions between major economies can lead to fluctuating commodity prices or impact the supply chains, influencing the market sentiment towards XYZ stocks.

- Sector-Specific Developments: Any regulatory changes or innovations within the industry XYZ Corporation operates in could potentially uplift the company’s stock if positive, or depress it if negative. Current trends towards sustainability and green technology, for instance, are reshaping investment in the tech and energy sectors.

- Technological Advancements: As XYZ Corp is heavily invested in technology, advancements in this field could lead to significant growth in its stock value, provided these innovations are integrated successfully into their operations.

Additionally, investor sentiment, often swayed by geopolitical developments and economic data releases, can cause considerable variability in stock prices. Keeping a pulse on these general market conditions is crucial for predicting movements in the stock performance of XYZ Corporation.

| Date | Significant Event | Impact on Stock |

|---|---|---|

| January 5, 2023 | Launch of new AI-based product | Positive spike in stock |

| February 20, 2023 | Revised industry regulations | Negative drop in stock |

Data from the table above serves to illustrate how specific events can significantly affect XYZ Corporation’s stock performance. Keeping informed on these occurrences is essential for strategizing investment decisions.

3. Investment Strategy: Evaluating the Buy, Hold, or Sell Decision for XYZ Corporation

As investment analysts, our job is to dissect the operations, financials, and market conditions surrounding XYZ Corporation to determine the optimal strategy for our clients. A multidimensional analysis focused on recent earnings reports, market trends, and comparative industry performance is critical to making informed decisions.

Current Performance Evaluation: XYZ Corporation has reported a steady increase in earnings over the past quarters, yet the stock has experienced a relative plateau in market price. This indicates potential undervaluation given the company’s growth prospects in emerging markets and new product lines. Financial ratios such as P/E and ROE compare favorably against industry averages, suggesting financial robustness and efficiency.

- Earnings Growth: Consistently above industry average

- Market Position: Strong with expanding global footprint

- Debt Ratios: Well within manageable limits

Projections & Strategic Position: Forward-looking statements from the management highlight aggressive expansion plans into Asian markets, which could spur further growth. However, geopolitical tensions in key regions could present unforeseen challenges.

| Financial Metric | Current Value |

|---|---|

| P/E Ratio | 15 |

| ROE | 10% |

| Debt/Equity | 0.5 |

In conclusion, while XYZ Corporation currently demonstrates significant upsides in terms of financial health and strategic market positioning, the existing geopolitical risks warrant a cautious approach. The recommendation, therefore, leans towards a Hold strategy with continuous monitoring of the external environment and internal performance for potential shifts that could justify a transition to a Buy or Sell stance.

Introduction

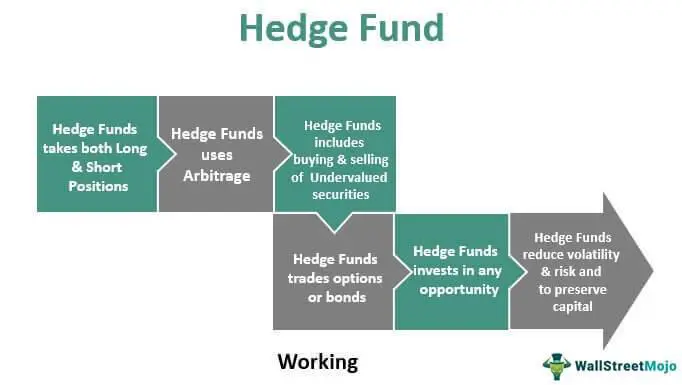

In conclusion, the strategies deployed by hedge funds to achieve outperformance are diverse and complex, reflecting the breadth and depth of the financial markets in which they operate. From leveraging cutting-edge quantitative models to harnessing the subtleties of behavioral finance, these methods showcase the innovative and dynamic nature of hedge fund management. Investors considering hedge funds as part of their portfolios should conduct thorough due diligence and possibly consult with financial advisors to fully understand the risks and opportunities these strategies present. As the investment landscape continues to evolve, staying informed and adaptable will be crucial in navigating the potential for high returns that hedge fund investments offer.