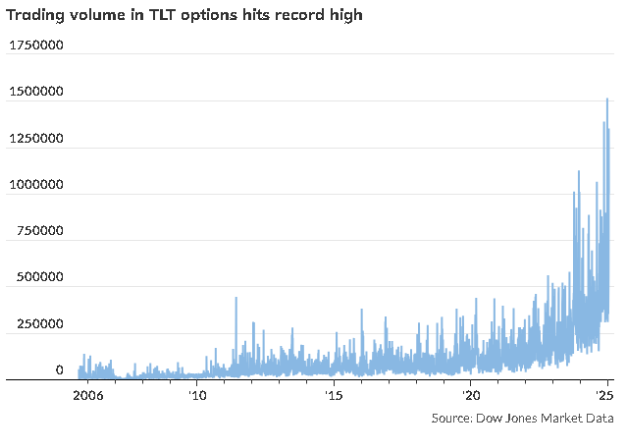

The iShares 20+ Year Treasury Bond ETF (TLT) has recently become a focal point for investors amid significant bond market volatility. As longer-dated Treasury yields rise, TLT has experienced increased options trading activity, signaling that traders are speculating on a potential rebound in bond prices.

The yield on the 10-year Treasury note has climbed to 4.801%, while the 30-year bond yield reached 5% for the first time in over a year. These developments have led to a notable uptick in bullish call options for TLT, indicating that some investors anticipate a reversal in bond prices.

This trend is particularly intriguing because, historically, bond-market selloffs have been marked by a rise in bearish options trading. The current increase in bullish bets suggests a shift in investor sentiment, with some viewing the recent price declines as a buying opportunity.

Several factors have contributed to the recent bond market movements, including the Federal Reserve’s announcement of fewer expected rate cuts in 2025, concerns over U.S. deficit spending, and potential inflationary pressures from anticipated policies of President-elect Donald Trump. These elements have combined to create a complex environment for bond investors.

Despite the long-term decline in TLT prices, the current volatility presents opportunities for traders seeking short-term gains. The surge in options trading reflects a broader strategy among investors to capitalize on potential rebounds, even amid prevailing uncertainties.

Looking ahead, upcoming economic reports on consumer prices and retail sales are expected to further influence market movements. Investors in TLT and similar instruments should closely monitor these indicators, as they will provide additional insights into the direction of the bond market and broader economic trends.

In summary, the recent surge in options trading for the iShares 20+ Year Treasury Bond ETF highlights a dynamic shift in investor strategies amid bond market volatility. As economic indicators continue to evolve, TLT remains a key instrument for those looking to navigate the complexities of the current financial landscape.