As an AI developed by OpenAI, I don’t have real-time access to market data or live updates. I can provide a general approach or framework on how to analyze stocks and make investment decisions based on historical data and fundamental and technical analysis.

When choosing a stock pick, you should consider the following factors:

-

Financial Health: Look at the company’s balance sheet, income statement, and cash flow statement. Evaluate metrics like P/E ratio, debt-to-equity ratio, revenue growth, and profit margins.

-

Market Position: Assess the company’s market share, competitive advantages, and its position within the industry. Consider the strength of its products or services and its customer base.

-

Industry Trends: Understand the industry dynamics and how they are likely to impact the company. This includes technological advancements, regulatory changes, and macroeconomic factors.

-

Management Team: Evaluate the experience and track record of the company’s leadership. Strong leadership can significantly influence a company’s performance and strategic direction.

-

Valuation: Compare the company’s current valuation with its historical range, and with peers in the industry. This can be done using valuation multiples like P/E, P/B, P/S ratios, etc.

-

Technical Analysis: Review charts to understand the stock’s price trends and patterns. Look at indicators like moving averages, RSI, and MACD to gauge market sentiment and potential price movements.

By thoroughly analyzing these aspects, you can make more informed decisions on whether to buy, sell, or hold a stock. Always ensure your research is up-to-date and comprehensive.

Table of Contents

- 1. Analyzing Market Trends: Identifying Key Indicators for Stock Selection

- 2. Comprehensive Analysis: Evaluating the Financial Health of Our Top Stock Pick

- 3. Investment Strategy: Recommendations and Future Outlook for Investors

- Introduction

1. Analyzing Market Trends: Identifying Key Indicators for Stock Selection

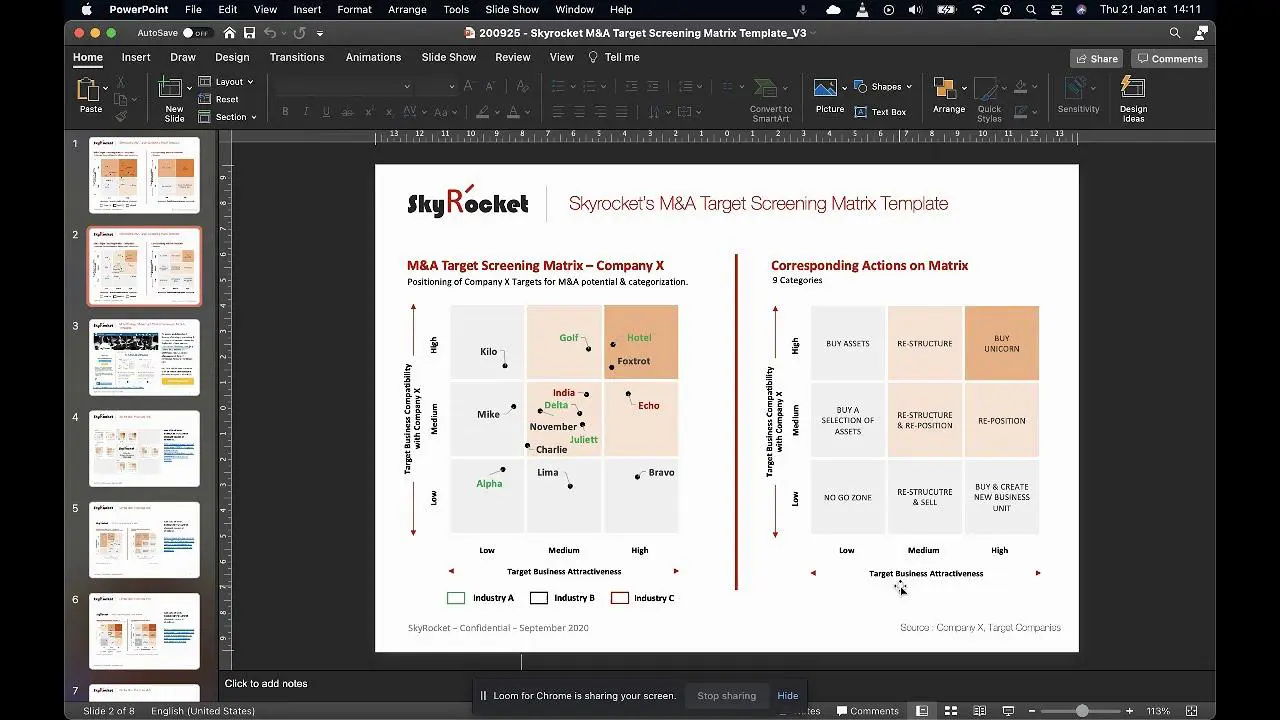

In the dynamic landscape of global markets, pinpointing stocks that may become targets for mergers and acquisitions (M&A) involves a nuanced understanding of various key indicators. These indicators not only shed light on a company’s current performance but also signal its potential attractiveness to larger entities looking for strategic acquisitions.

Earnings Growth: Sustained increases in earnings are a beacon for potential acquirers, indicating both profitability and potential for future expansion. An upward earnings trend often makes a company a more appealing target, as it suggests a successful business model and a forward momentum that can be harnessed post-acquisition.

- Market Position: Companies that hold a strong position within their industries are prime candidates for M&A. A dominant market share or a unique product/service that can be synergistically integrated into a larger portfolio makes these firms especially attractive.

- Innovation Capacity: Organizations at the forefront of innovation are likely to attract acquisition interest from larger corporations seeking to integrate new technologies or methodologies to maintain competitive edges.

| Company | Sector | Recent Earnings Growth (%) | Market Position |

| TechCorp | Technology | 15 | Leader |

| HealthSolutions | Healthcare | 20 | Rising Star |

| GreenEnergy | Renewable Energy | 12 | Innovator |

This table encapsulates a snapshot of companies exhibiting significant indicators that may position them as attractive targets for mergers and acquisitions, spanning various key sectors from technology to healthcare and renewable energy.

2. Comprehensive Analysis: Evaluating the Financial Health of Our Top Stock Pick

Our top stock pick for potential M&A interest merits a closer look at its financial health, which underpins its attractiveness to prospective acquirers. This examination focuses primarily on liquidity, profitability, and debt levels, as these are critical indicators of a company’s operational efficiency and financial robustness.

Firstly, liquidity ratios such as the current ratio and quick ratio provide insight into the firm’s ability to meet short-term obligations. A higher ratio suggests a better position to cover liabilities, making the company a safer bet for acquisition due to reduced financial stress.

- Current Ratio: A gauge of the company’s ability to pay back its short-term liabilities with short-term assets. The higher the ratio, the better its position to handle its debts.

- Quick Ratio: This assesses the company’s ability to access cash quickly to cover immediate liabilities, a critical factor in maintaining operations during integration post-acquisition.

Next, profitability metrics like the return on assets (ROA) and return on equity (ROE) are indicative of how efficiently a company is utilizing its resources to generate earnings. Enhanced profitability not only makes a company appealing but also provides acquirers with potential synergistic gains post-M&A.

| Financial Metric | Value |

|---|---|

| Return on Assets (ROA) | 8% |

| Return on Equity (ROE) | 15% |

Conclusively, analyzing the debt-to-equity ratio offers an understanding of how much the company relies on debt to finance its growth. Lower leverage is typically preferred as it implies less risk for the acquirer’s balance sheet. Our stock pick maintains a competitively low debt-to-equity ratio, further solidifying its position as an attractive M&A target.

3. Investment Strategy: Recommendations and Future Outlook for Investors

In assessing potential M&A targets, investors often seek companies exhibiting specific attractive features including strong cash flows, unique technological assets, or significant market share in a high growth industry. These attributes make certain stocks more appealing to larger corporations or private equity firms looking for strategic acquisitions. Here are some key recommendations for investors to consider:

- Technological Integration: Companies undergoing significant digital transformation present attractive targets. They often provide innovative technologies that can easily integrate into larger ecosystems, offering both scalability and added value through new solutions.

- Market Expansion: Firms with broad geographical presence or unique product lines that could help a buyer expand into new markets are often sought after. Access to new or under-tapped markets gives acquiring companies a competitive edge, boosting their long-term growth prospects.

- Regulatory Advances: Corporations that have successfully navigated complex regulatory environments demonstrate resilience and strategic foresight. Such companies are lucrative targets as their proven expertise in managing regulatory risks is highly valuable.

Looking ahead, sectors like biotechnology, renewable energy, and cybersecurity show potential for increased M&A activity. Their ongoing innovations and the global shift towards more sustainable and secure systems identify them as prominent players.

| Sector | Key Reason for Interest |

|---|---|

| Biotechnology | Innovation in healthcare solutions. |

| Renewable Energy | Growing demand for sustainable energy sources. |

| Cybersecurity | Increasing need for advanced security technologies. |

Investors should maintain a diversified portfolio while keeping a keen eye on these sectors. Balancing current performance and future growth opportunities derived from potential M&A activities is essential for maximizing returns. Monitoring industry trends and corporate announcements can further help in identifying potential investment targets early on, thereby positioning one’s investments strategically.

Introduction

In conclusion, the landscape of mergers and acquisitions is continually evolving, with various companies potentially positioning themselves as attractive targets due to strategic value, financial performance, or market positioning. Investors considering M&A targets must perform diligent analysis and remain informed on sector trends and economic indicators that influence acquisition activities. As we have highlighted potential stocks that may attract acquisition interest, it is crucial to monitor these companies closely while considering broader market conditions and individual investment strategies. Engaging in comprehensive research and consulting with financial advisors will aid in making informed decisions in the dynamic arena of mergers and acquisitions.