For the first time since November 2024, Bitcoin has taken a nosedive below the $90,000 mark, which has shaken up the crypto market.

As the volatility spikes, traders are equally feeling the heat.

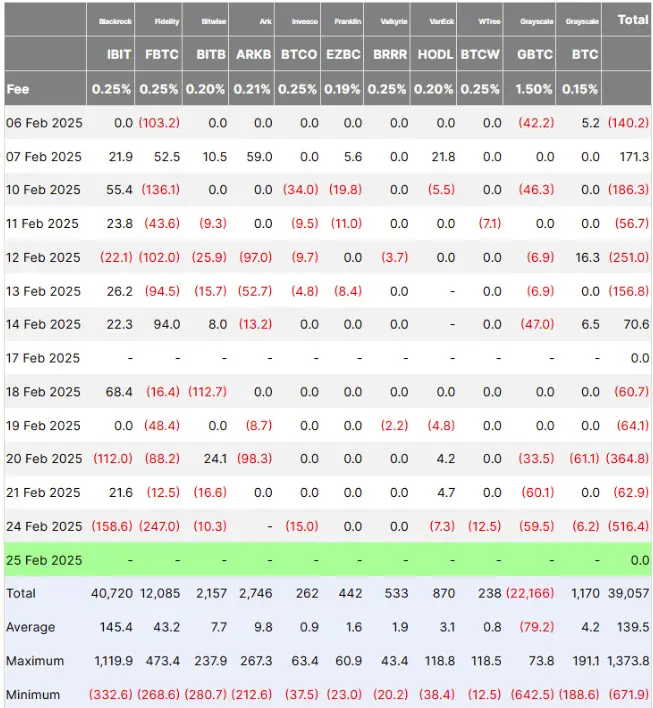

This drop happened as the U.S. spot Bitcoin ETFs records persistent outflows. This is coupled with increasing liquidations and economic uncertainty within the market.

ETF outflows send Bitcoin tumbling

On February 24, 2025, Bitcoin recorded a staggering $516 million in net outflows from U.S. spot Bitcoin ETFs, which marked the sixth consecutive day of withdrawals.

The sell-off is relentless, and the numbers speak for themselves:

Within the two weeks leading to February 21st, investors have withdrawn $1.14B.

This is the steepest two-week decline since ETFs began trading in January of 2024.

Bitcoin’s price has since dropped by over -6.2% since February 18, 2025.

This drop highlights how significantly the ETF sell-off has impacted the price of Bitcoin.

Over $1.3B in crypto liquidations add fuel to the fire

As if the ETF sell-off wasn’t enough, a wave of forced liquidations has poured gasoline on the decline in Bitcoin price.

In the past day (24 hours), over 364,000 traders have had their assets liquidated, racking up a whopping $1.3B in losses. Bitcoin alone accounts for more than $500M of these losses. Alongside were other altcoins like Solana, Ethereum, and XRP.

Macroeconomic trends and investor sentiment

The current downturn in the Crypto market is happening alongside the increasing tensions between the U.S. and China.

U.S. President, Donald Trump hinted at possibly meeting up with Chinese President, Xi Jinping.

However, he did not provide a timeline for the trade negotiations. As a result, investors remain uncertain.

Meanwhile, the Bitcoin price drop is looking eerily similar to that of its 2017 cycle, where it saw multiple downtrends before reaching an upward trend. Could history be repeating itself? Maybe.

Are analysts optimistic about the short-run potential of Bitcoin?

Despite the bearish sentiment clouding Bitcoin, some traders consider the current levels as a potential buying opportunity.

Crypto analyst, Michaël van de Poppe, believes Bitcoin could potentially dip further to $83,000–$87,000, before climbing to a recovery.