As every media outlet turns bearish, the market defies expectations, continuing its steady climb higher. With the election on the horizon, it’s crucial to focus on how traders can capitalize on the inevitable volatility ahead. Despite the financial media’s attempts to stir fear with predictions of an impending crash tied to the election, the trend remains strong—moving upward. Today, let’s cut through the noise, simplify the approach, and focus on the charts with a calm, clear mindset to seize the opportunities that lie ahead.

Here is the trend of the SPY ETF. As you can see, we continue to move up and to the right showing that we are in an uptrend on all time frames.

However, October has a reputation for being a month of market tops, often fueling what traders call the “October effect.” The Bank Panic of 1907, the Stock Market Crash of 1929, and Black Monday in 1987 all took place in October, reinforcing the perception that this month is particularly volatile.

The psychological association of October with major financial crashes stirs fear among traders, leading many to shy away from the market during this time, worried about the next big downturn.

For contrarian investors, this widespread fear presents a golden opportunity. When sentiment is overwhelmingly bearish, it can create conditions where stocks are undervalued, especially in a month like October. Right now, the market is in an uptrend, during an election year, and despite the growing bearish sentiment, the market keeps hitting new highs.

What’s bearish about that? Nothing.

Being on the right side isn’t about being bullish or bearish—it’s about recognizing when the probabilities are in your favor, and right now, they clearly are.

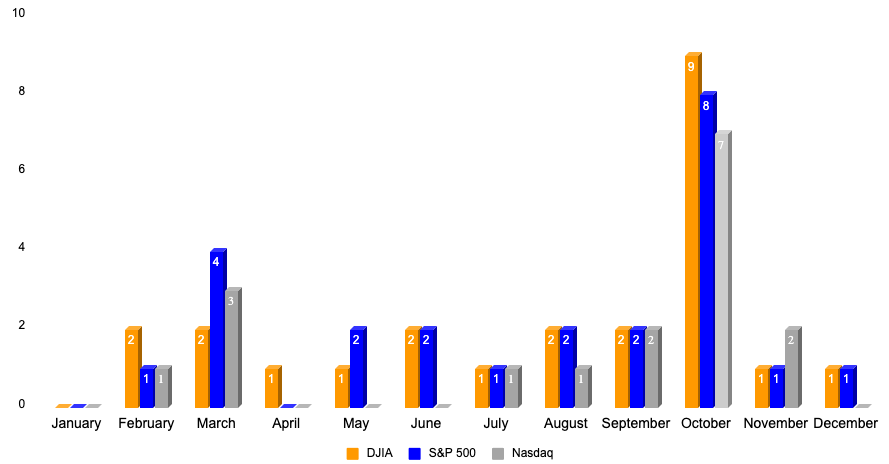

Do you remember my video from 2022 on market bottoms? In that video, I shared a chart highlighting key market bottoms throughout history. Well, here’s the updated version, now including the market bottom that occurred in 2022. In total, we’ve seen nine significant bottoms take place in October.

Want more bullish information? The most bullish cluster of weeks starts this week through November.

So where does the media get these ideas?

It comes from the collective mind of humanity. Human nature is wired to seek belonging, and countless studies show that if you’re surrounded by people who believe something—even if it’s wrong—you’ll eventually start believing it too. Add to that our love for having our biases confirmed, and you have a perfect storm.

If, somewhere deep in your subconscious, you believe the world will end through rapture, war, or some brutal dictator, you’ll naturally seek out information to support that theory. I’m not mocking these feelings—most of us experience them in some form. But the key to breaking free from this manipulation is understanding how you’re being manipulated in the first place.

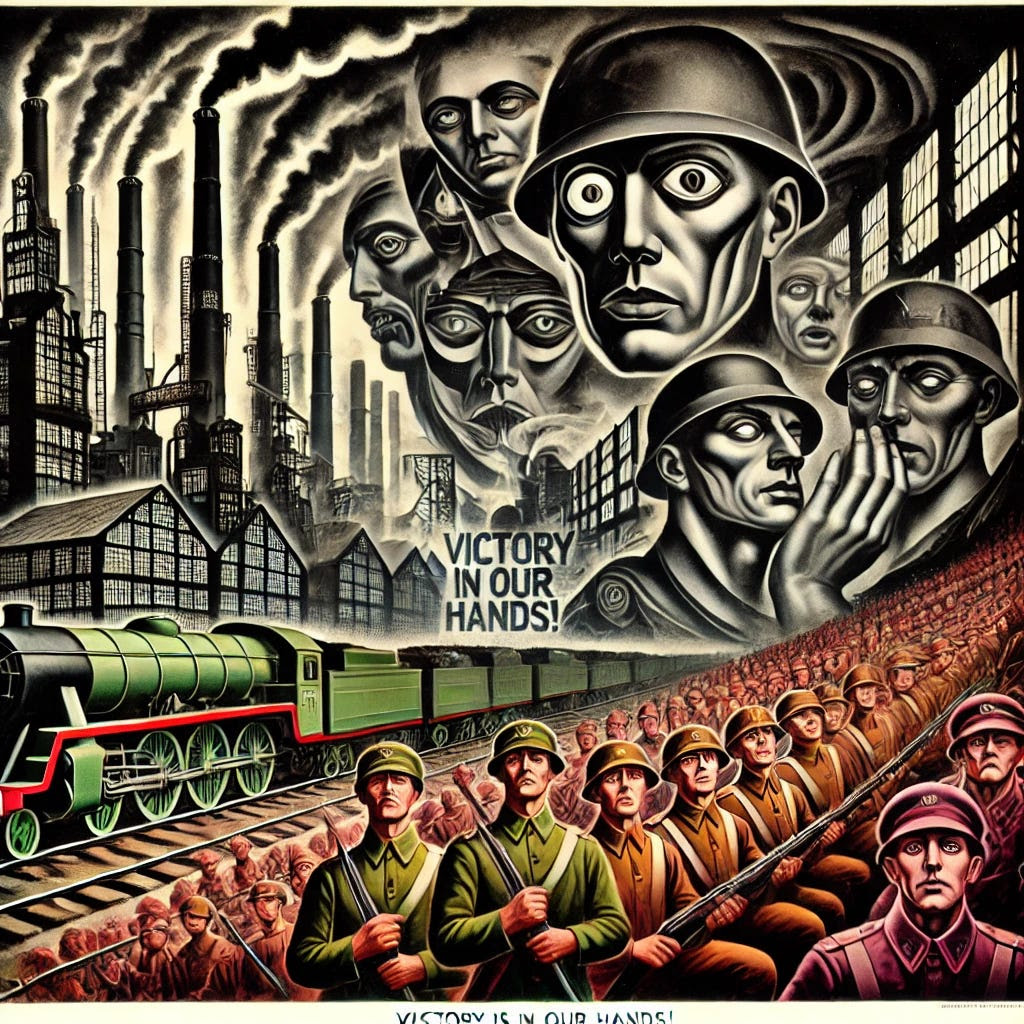

Today, those same tactics used in World War II propaganda campaigns are delivered straight to your social media feeds and inbox.

The infamous black swan warnings, showing ominous images telling you to prepare for a market crash in October. It’s the same old fear-mongering repackaged for a new age.

Once you become fully aware of the psychological tricks and limitations holding you back, you naturally start to break free from them. To see the cage is the first step to actually leaving it. This is how we get away from feeding our bias’s and go towards the idea of profitable trading

Most people would you rather listen to someone “buy this stock now on an 80% discount”.

This sounds compelling, doesn’t it? Headlines that promise quick profits from catching market bottoms or selling at the top always grab attention. But here’s the truth: while this type of hype sells, it’s proven time and again to be the wrong way to trade. The reason most people avoid telling you the real truth about trading isn’t that they’re bad people—it’s simply because it doesn’t sell. Trading strategies that sound exciting, like perfectly timing the market, make for great stories but often lead to losses.

The reality is, the strategies that work—risk management and capturing the middle of a move—don’t sound as glamorous. But here’s the kicker: if you consistently apply these methods, you will make money.

I talk about these strategies because they are proven to work. I’ve never met a successful trader who didn’t understand and use proper risk management. It might not be flashy, but it’s what will lead you to lasting success in the market.

As the election approaches, the key to big profits will be tuning out the noise. The media, politicians, and even well-meaning friends and family may lead you astray, but staying focused on the trend, positioning, and probabilities is the closest thing to creating your own luck. Luck isn’t random; it’s made through preparation and awareness. So, forget chasing headlines and trust the process—you don’t need luck when you know how to make it.

Stay focused, stay disciplined, and let’s keep moving forward.