- What factors can affect the APR on a loan?

Understanding the Annual Percentage Rate (APR): What It Means and How It Works

When you’re ready to take out a loan, whether it’s for a home mortgage, a car loan, or a credit card, one of the most important factors you need to understand is the Annual Percentage Rate (APR). But what exactly is APR? And how does it work? This article will get you acquainted with APR, dive into how it’s calculated, and shed light on why it’s such a critical element in your financial decisions.

Defining the Annual Percentage Rate (APR)

APR represents the total annual cost of a loan, including interest and fees, expressed as a percentage. It encapsulates all the expenses you’ll incur on your loan over the year, making it slightly higher than the interest rate you’re quoted. It essentially depicts the cost of loaning money and is designed to provide a clearer snapshot of the true cost of borrowing.

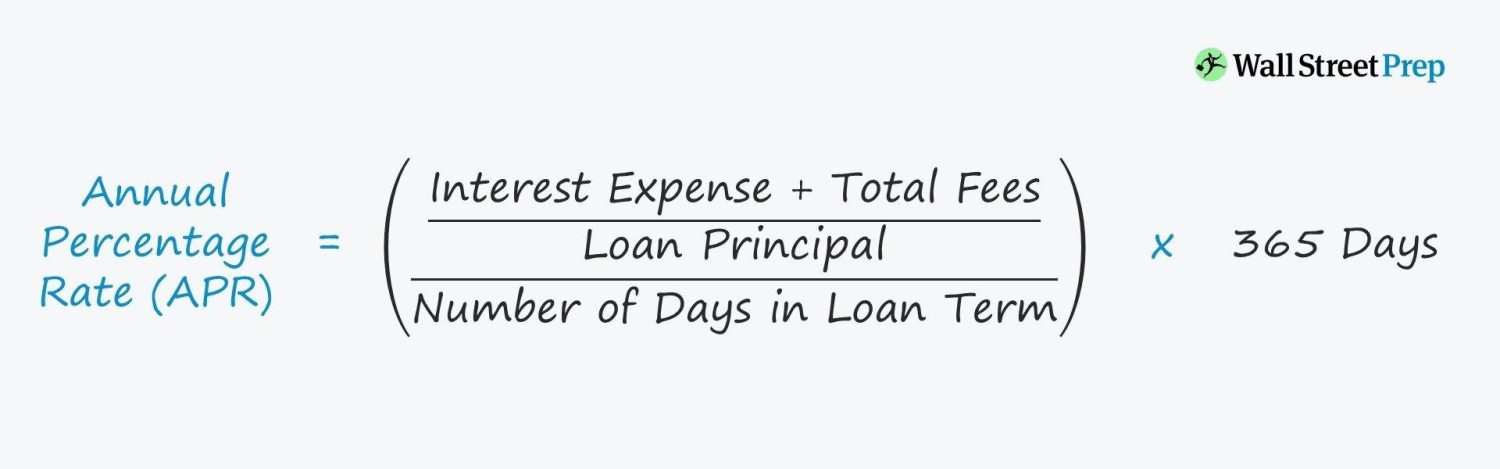

Calculating APR

The APR is calculated by multiplying the periodic interest rate by the number of periods in a year. It includes not only the interest costs, but also any additional fees and charges associated with the loan. However, it’s worth considering that while APR is a useful tool, its calculation method may vary depending on lenders and the type of loan, which could impact on the final figures.

Types of APR

APR isn’t a one-size-fits-all rate. It can come in different forms, each having its unique features. Types of APR include:

- Fixed APR: This is a set rate that does not fluctuate throughout the lifetime of the loan.

- Variable APR: This APR changes according to the index interest rate.

- Introductory APR: Some credit cards may offer an introductory APR, which is a lower rate for a specified period, after which the APR increases.

The Role of APR in Your Loan Decision

APR plays a critical role in making informed decisions about loans. A lower APR means lower costs over the life of the loan, making the loan more affordable. Use APR as a benchmark to compare different loan offers and choices.

The Impact of Loan Duration on APR

Remember, the length of your loan can also impact the APR. Longer-term loans might have lower monthly payments, but they often come with higher APR, resulting in you paying more over the life of the loan.

| Loan Term | Total Interest Paid | APR |

|---|---|---|

| Short-term loan (1-3 years) | Lower | Lower |

| Long-term loan (>3 years) | Higher | Higher |

The Influence of Credit Score on APR

Another key factor in determining your APR is your credit score. Generally, the higher your credit score, the lower your APR.

Final Words

APR is an essential factor to understand when assessing and comparing loan offers. It enables you to perceive the total cost of borrowing – including fees and interest – and make the most value-added decision. As you navigate your financial journey, understanding how APR works can help you make smart choices about borrowing and managing your debts.

Share Your Experience

Have you had a first-hand experience where understanding the APR has greatly influenced your loan decision? Feel free to share your story in the comment section below!

More Tips and Advice

Looking for more resources on financial terms and strategies? Stay tuned to our blog for more insights and practical tips!