– Are there any fees associated with using prepaid cards?

Are Prepaid Cards Right For You?

Introduction

As we usher in a digital era, prepaid cards are becoming increasingly prominent. However, their suitability can vary depending on individual needs and circumstances. If you have been pondering over the question, “Are prepaid cards right for me?”, you’re in the right place. This comprehensive guide will provide insight into the benefits and downsides of prepaid cards, helping you make an informed decision.

Understanding Prepaid Cards

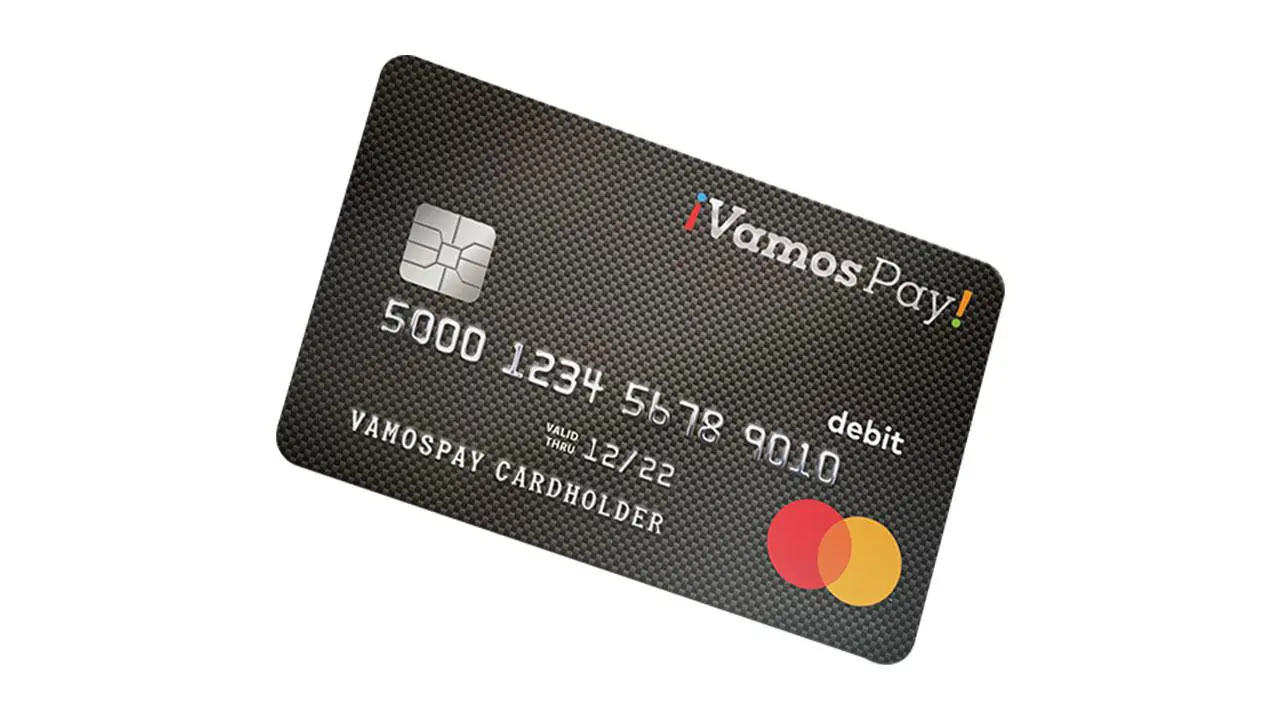

Prepaid cards, also known as pay-as-you-go cards, are a form of electronic money. They differ from debit or credit cards as they must be loaded with money before they can be used. Essentially, you’re spending money you’ve already put on the card rather than borrowing from the bank, as is the case with credit cards.

The Unmatched Benefits of Prepaid Cards

Let’s delve into why prepaid cards might be an excellent choice for you:

1. No Credit Check Required

With prepaid cards, you don’t need to worry about a stringent credit check or a banking history. They’re accessible to almost anyone, making them perfect for those unable to get a conventional credit card.

2. Controlling Spending

Prepaid cards can help suppress reckless spending. You can’t spend more money than what’s loaded on the card, which can be beneficial if you’re trying to budget or curb impulsive shopping.

3. Safety

If your prepaid card is stolen or lost, you only risk losing what’s on the card, rather the than a direct hit to your bank account.

Considerations before Choosing Prepaid Cards

Despite their numerous advantages, prepaid cards may not be the best solution for everyone. Here are some limitations to bear in mind:

1. Fees

Prepaid cards often come with fees, including loading, withdrawal, and transaction fees. Make sure you’re aware of all potential charges before choosing this payment method.

2. No Credit Building

Using prepaid cards does not contribute to credit building or repairing as they do not involve borrowing money.

3. Limited Protection

Prepaid cards do not offer the same level of protection as traditional credit or debit cards. For instance, if the card provider goes bust, you could potentially lose all the money loaded on your card.

Is a Prepaid Card a Perfect Match for You?

Considering a prepaid card might be advantageous for you if:

- You struggle with maintaining a budget and want to control spending.

- You’re seeking an alternative to cash in terms of convenience and safety.

- You don’t have a bank account or can’t qualify for a conventional credit card.

Conclusion

The answer to “Are prepaid cards right for you?” largely depends on your individual requirements and circumstances. Weigh the benefits and disadvantages to determine if this type of card is the best fit for your financial situation. Prepaid cards offer a unique way to manage spending, but like any financial product, they’re not a one-size-fits-all solution. It’s important to always compare alternatives to figure out what will serve you best in the long run.

When used wisely, prepaid cards can be a fantastic tool for managing your finances, ensuring that you stay within your means. Whichever card you choose, educated and mindful usage will always yield the best benefits.