Title: Demystifying Demand Deposits: Understanding Account Types and Requirements

Meta Title: Demand Deposit Definition, Account Types, and Requirements Explained

Meta Description: Learn all about demand deposits, the different types of accounts available, and the requirements needed to open one. Find out how these accounts can benefit you and gain valuable insights into managing your finances effectively.

Introduction:

When it comes to managing your finances, understanding the various types of bank accounts available is essential. Demand deposits are a popular choice for many individuals and businesses due to their flexibility and ease of access. In this comprehensive guide, we will delve into the definition of demand deposits, explore the different account types, and discuss the requirements needed to open one. Whether you’re a seasoned investor or a first-time account holder, this article will provide valuable insights into making informed decisions about your banking needs.

Demand Deposit Definition:

Demand deposits, also known as current accounts or checking accounts, are types of bank accounts that allow holders to withdraw funds at any time without advance notice. Unlike term deposits or savings accounts, which have restrictions on withdrawals, demand deposits provide immediate access to funds, making them highly liquid assets. These accounts are typically used for day-to-day transactions, such as paying bills, transferring funds, or making purchases.

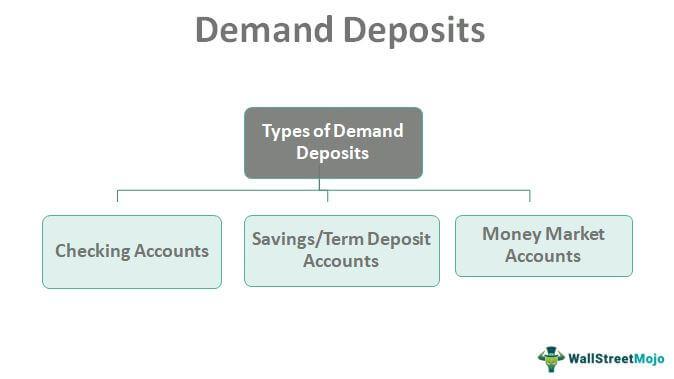

Account Types:

There are several types of demand deposit accounts available, each catering to different needs and preferences. Here are some common account types you may encounter:

- Basic Checking Account:

- Minimal fees and requirements

- Ideal for everyday banking needs

- Limited or no interest on deposits

- Interest-Bearing Checking Account:

- Earns interest on account balances

- Higher minimum balance requirements

- May have additional fees or restrictions

- High-Yield Checking Account:

- Competitive interest rates

- Higher minimum balance requirements

- Additional perks such as ATM fee reimbursements

- Online Checking Account:

- Conduct transactions online or through mobile apps

- Typically lower fees and higher interest rates

- Limited access to physical branches

Requirements:

Opening a demand deposit account is a straightforward process, but certain requirements must be met to ensure eligibility. While specific requirements may vary by bank, here are some common criteria for opening a demand deposit account:

- Proof of identification (driver’s license, passport, or government-issued ID)

- Social Security number or Taxpayer Identification Number (TIN)

- Minimum deposit amount (varies by bank)

- Proof of address (utility bill, lease agreement, or other official documents)

- Age requirement (typically 18 years or older)

- Employment information (for direct deposit setup)

Benefits:

Demand deposit accounts offer numerous benefits, making them a popular choice among consumers. Some advantages of these accounts include:

- Easy access to funds: Withdraw cash or make purchases conveniently

- Flexibility: No restrictions on the number of transactions

- Safety: Funds are typically insured by the FDIC up to a certain limit

- Convenience: Access account information online or through mobile banking apps

- Potential interest earnings: Some accounts offer competitive interest rates

Practical Tips:

To make the most of your demand deposit account, consider the following practical tips:

- Monitor your account regularly to track transactions and detect any unauthorized activity

- Set up direct deposit for quicker access to funds

- Avoid overdrawing your account to prevent fees or penalties

- Take advantage of online banking services for added convenience

Conclusion:

Demand deposit accounts are valuable financial tools that provide easy access to funds and flexibility for everyday transactions. By understanding the different account types available and the requirements for opening one, you can make informed decisions about managing your finances effectively. Whether you’re looking for a basic checking account or a high-yield option, there is a demand deposit account that can meet your needs. Start exploring your options today and take control of your financial future.