In the intricate tapestry of financial transactions, a time-honored instrument known as the bank draft has woven its utility and dependability into the fabric of commerce and personal finance. A cornerstone in traditional banking practices, the concept of a bank draft marries the assurance of a cash payment with the security and convenience of a check. This seemingly simple yet profoundly significant financial tool bridges the gap between payer and payee, providing a secure pathway for substantial monetary exchanges. As we delve deeper into the realm of bank drafts, we will explore its definition, decipher how it operates, and walk through a practical example to illuminate its role in today’s financial exchanges. Whether you’re a seasoned investor, a business owner, or just stepping into the world of finance, understanding the mechanics and applications of the bank draft will enhance your financial acumen.

Table of Contents

- Understanding Bank Drafts: An Overview

- The Mechanics Behind Bank Drafts: How They Function

- Comparing Bank Drafts with Other Forms of Payment

- Safety Features of Bank Drafts: A Closer Look

- Step-by-Step Guide to Obtaining a Bank Draft

- Real World Application: Example of Using a Bank Draft

- Potential Pitfalls: When Not to Use a Bank Draft

- Navigating Issues: What to Do If a Bank Draft Goes Wrong

- Future of Bank Drafts: Trends and Predictions

- Choosing Wisely: How to Decide If a Bank Draft Is Right for You

- Q&A

- In Retrospect

Understanding Bank Drafts: An Overview

A bank draft is a payment instrument issued by a bank on behalf of its client, wherein the issuing bank guarantees payment of the specified amount to the beneficiary. Essentially, it works as a more secure form of a standard check as the funds are withdrawn immediately from the payer’s account and held by the bank until the draft is cashed by the recipient. This makes bank drafts a preferred mode of payment in large transactions such as buying a house or a car, where security and certainty regarding payment are paramount.

Here’s how the process typically unfolds:

- Application: The purchaser applies for a bank draft from their bank, providing details about the payee and the amount to be paid.

- Fund Reservation: The bank immediately reserves the funds from the purchaser’s account, ensuring that the draft amount is secured and set aside.

- Issuance and Delivery: The bank creates the draft, which can then be physically delivered to the payee or sent electronically, depending on the bank’s facilities and the preferences of the parties involved.

For illustration, consider the following example:

| Item | Cost | Payment Mode |

| Used Car Purchase | £12,000 | Bank Draft |

| Home Down Payment | £50,000 | Bank Draft |

The above table demonstrates typical scenarios where bank drafts are utilized due to the high amounts involved, providing both the buyer and seller with financial security.

The Mechanics Behind Bank Drafts: How They Function

Understanding the mechanics of bank drafts is quite straightforward. Essentially, a bank issues a draft after confirming that the drawer has sufficient funds in their account or after the drawer has provided the amount in cash. The bank then earmarks these funds for the draft, ensuring that the amount is secure and reserved for the payee. This factor is what gives bank drafts their reputation for reliability and security in transactions.

Here’s what happens step-by-step:

- Application: The customer applies for a bank draft by either visiting the bank in person or using digital platforms, if available.

- Verification: The bank verifies the customer’s account details and the availability of funds. For non-account holders, the amount is paid to the bank upfront.

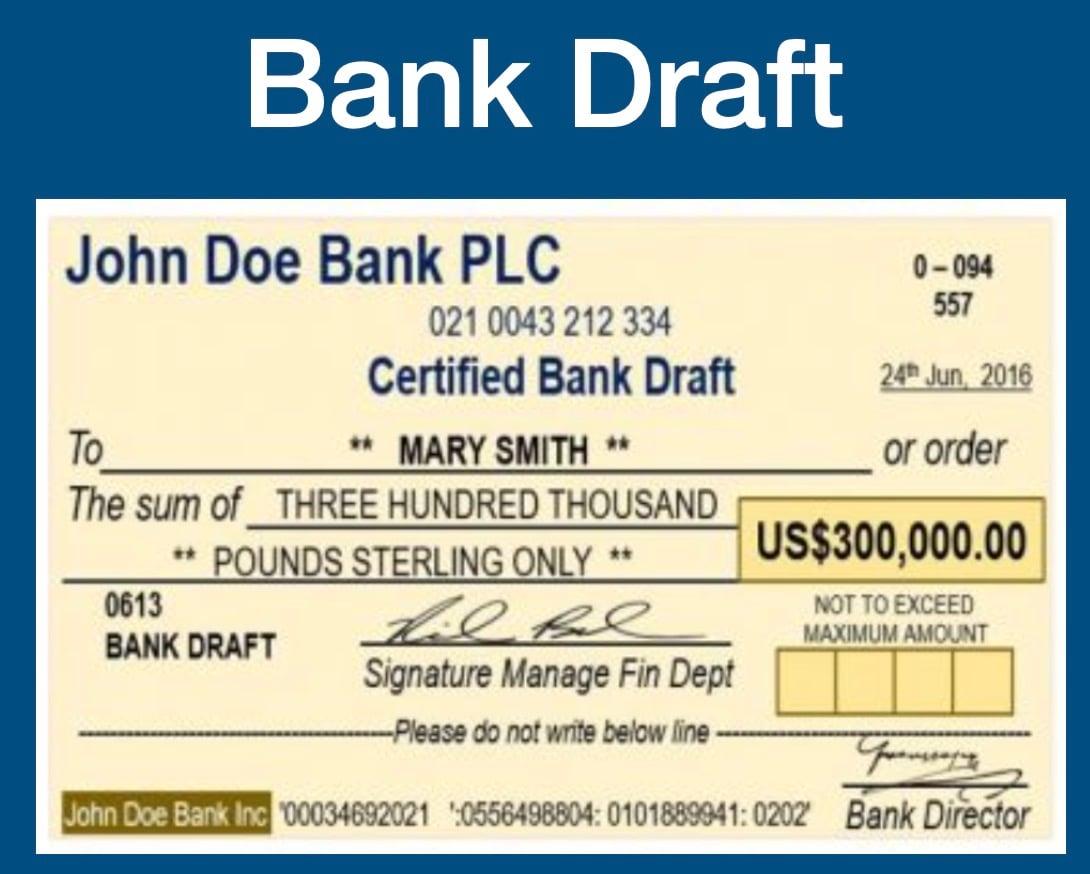

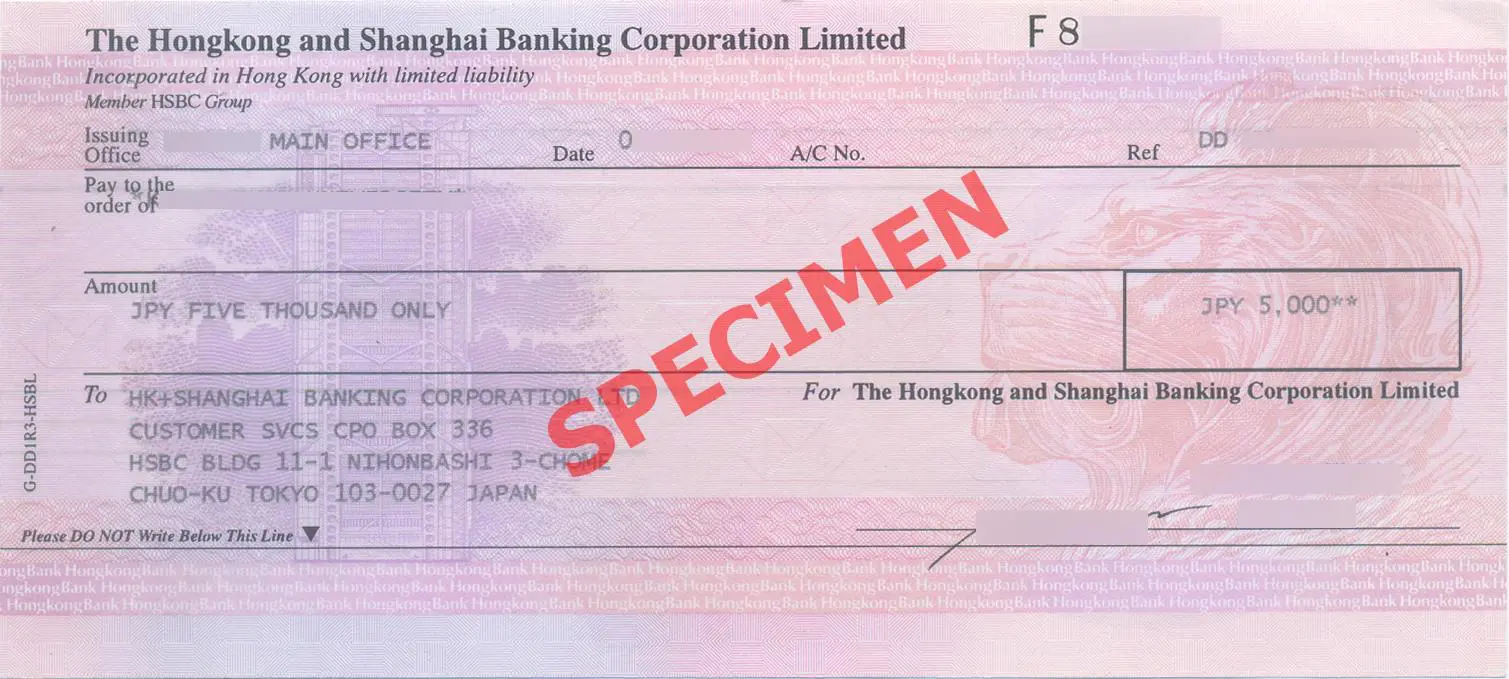

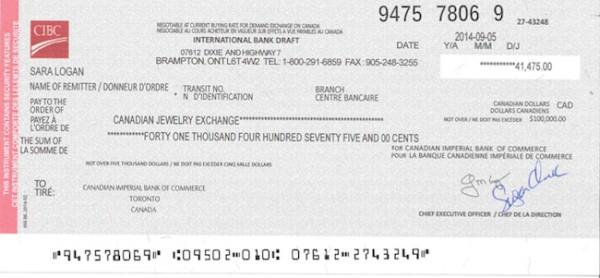

- Issuance: Upon successful verification, the bank issues a draft. This document is similar in form to a cheque but is drawn on and guaranteed by the bank itself.

- Delivery: The draft can then be delivered to the payee or directly to the payee’s bank. It can also be mailed to the beneficiary, especially in cross-border transactions.

To further clarify, here is a simple table showcasing a hypothetical transaction involving a bank draft:

| Step | Participant | Action |

|---|---|---|

| 1 | Customer | Requests bank draft |

| 2 | Bank | Verifies funds and deducts amount |

| 3 | Bank | Issues draft |

| 4 | Payee | Receives and deposits draft |

This sequence ensures that all parties involved are safeguarded, making bank drafts a preferred option for large and secure transactions.

Comparing Bank Drafts with Other Forms of Payment

Bank drafts are considered a secure method of payment, but how do they stack up against other popular payment methods? Here’s a comparative look to help elucidate their respective benefits and drawbacks.

- Credit Cards: Credit cards offer convenience and buyer protection services such as chargebacks, which can be particularly useful in cases of fraud. However, they might encourage higher spending due to revolving credit, and they usually come with higher interest rates on balances. Bank drafts, on the other hand, require upfront funding, which can help in budget management and do not accrue interest.

- Wire Transfers: Wire transfers are fast and can be done globally, making them ideal for international transactions. Unlike bank drafts, which may take a few days to clear, wire transfers typically settle funds within 24 hours. However, they often come with higher fees compared to bank drafts, which could be more economical for large sum transfers.

- Cashier’s Checks: Like bank drafts, cashier’s checks are issued by a bank and backed by its funds, but they’re generally available only to the bank’s clients. Bank drafts are more accessible as they can be drawn by any individual with sufficient funds in their account or through a loan arrangement with the draft-issuing bank.

| Payment Method | Security | Cost | Transaction Speed |

|---|---|---|---|

| Bank Draft | High | Low to medium | Medium |

| Credit Card | Medium | Medium to high | High |

| Wire Transfer | High | High | High |

| Cashier’s Check | High | Low to medium | Medium |

The choice of payment method can significantly impact both sender and receiver concerning security, cost, and convenience. While bank drafts stand out for their security and cost-effectiveness in handling large transactions, assessing the transaction’s urgency and cross-border needs is crucial when selecting the optimal payment approach.

Safety Features of Bank Drafts: A Closer Look

One of the standout features of using a bank draft is the enhanced level of security it offers both parties involved in a transaction. A bank draft is guaranteed by the issuing bank, making it a safer option than personal checks, which can bounce if insufficient funds are available. This pre-verification of funds not only secures the transaction but also fast-tracks the credibility of the payer.

Here are the key safety features of bank drafts that make them a reliable choice:

- Pre-verification of Funds: Before issuing a bank draft, the bank confirms and sets aside the funds from the payer’s account, ensuring the amount is available and reserved for the transaction.

- Signature Verification: To further fortify security, banks implement stringent signature verification processes. This makes it difficult for fraudulent activities to occur, providing an additional layer of trust and security.

- Difficult to Forge: Bank drafts are printed on special paper, similar to checks, making them difficult to alter or counterfeit. The integration of specific security features such as watermarks and chemical alterations indicators also deters fraud.

To illustrate these safety features more vividly, consider the example of a real estate transaction. When a buyer opts to use a bank draft, the assurance from the bank that funds are secured and available for disbursal adds a level of trust that personal checks cannot match, streamlining the closing process and providing peace of mind to both the buyer and the seller.

Step-by-Step Guide to Obtaining a Bank Draft

Obtaining a bank draft is a simple yet formal process that ensures the security of large transactions. Here’s a straightforward guide to help you acquire a bank draft from your bank:

- Verify funds: Before issuing a draft, banks require confirmation that you have sufficient funds in your account. Visit your bank or check online to ensure your account balance meets or exceeds the amount you need for the draft.

- Visit your bank: While some banks may offer online services, most require you to apply for a bank draft in person. Speak with a bank representative about your need for a draft. This is a good time to verify any fees associated with issuing the draft.

- Complete an application: Fill out a bank draft application form. You’ll need to provide the exact amount of the draft, the payee’s name, and other relevant details. Accuracy is crucial to avoid delays.

- Pay fees and receive your draft: Once you submit the application and your account is debited the draft amount plus applicable fees, the bank will create the draft. This might take some time depending on the bank’s process.

Below is a simple table of typical bank draft fees which may vary depending on the institution:

| Bank | Fees |

|---|---|

| Bank A | £15 |

| Bank B | £20 |

| Bank C | £10 |

Once obtained, keep your bank draft in a secure place until it’s time to deliver it to the payee. Remember, a bank draft, once issued, is as good as cash and should be treated with the same level of care and security.

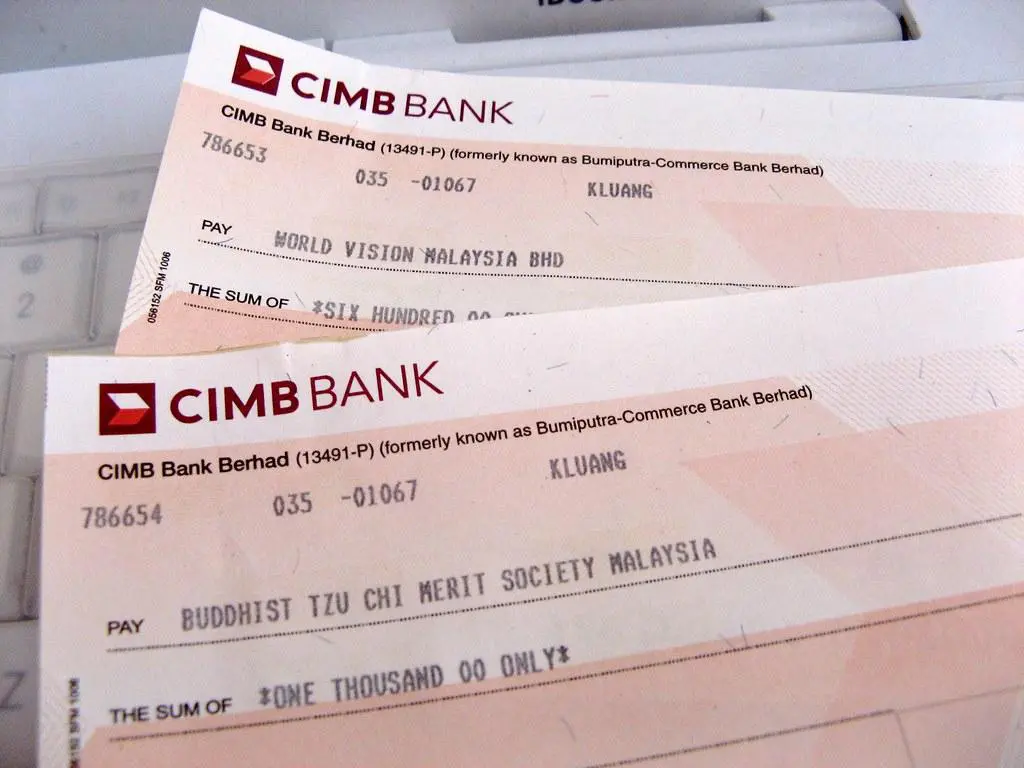

Real World Application: Example of Using a Bank Draft

To illustrate how a bank draft can be particularly beneficial, consider the scenario of purchasing a high-value item, such as a car. The buyer, Jessica, wants to ensure the payment is secure and the seller requires guaranteed funds.

In this case, Jessica opts to get a bank draft from her bank. Here’s why and how she proceeded:

- Security: A bank draft ensures that the funds are available, as they are drawn against the bank’s account after verifying Jessica’s capabilities to cover the amount. This reassures the seller, who can be confident that the payment will not be returned due to insufficient funds.

- Convenience: Once issued, Jessica hand-delivers the bank draft to the car seller, providing immediate confirmation that the funds are secured and dedicated to this transaction.

Let’s take a look at the basic steps Jessica followed to obtain the bank draft:

- She visited her local bank branch and requested a bank draft in the amount required by the seller.

- The bank checked her account to ensure she had sufficient funds and then debited the amount from her account.

- The bank issued a bank draft, which is a physical document, similar to a check, stating that the bank guarantees the amount of money.

When using a bank draft, it is important to keep the document safe until it is handed over, as it is as good as cash in many respects. This example shows how bank drafts can be used to facilitate significant transactions in a safe and efficient manner while offering peace of mind for all parties involved.

Potential Pitfalls: When Not to Use a Bank Draft

While bank drafts are considered a secure form of payment, they come with their own set of limitations and risks. The instrument is not foolproof, and understanding these potential drawbacks is vital before deciding to use one.

High Costs: One major disadvantage is the cost associated with obtaining a bank draft. Many banks charge a significant fee for issuing these drafts, which can be prohibitive if you’re dealing regularly in transactions that could be settled with less costly methods like electronic transfers.

- Delay in Funds Clearing: Despite their reputation for safety, bank drafts can still require several days or even weeks to clear. This delay can be cumbersome when timing is critical, especially in business transactions where prompt payment is crucial.

- Irrevocability: Once issued, a bank draft cannot be easily cancelled or stopped. If you change your mind or if there’s a dispute regarding the transaction, recovering the funds paid through a bank draft can be difficult, if not impossible.

Furthermore, while rare, there is a possibility of encountering fraudulent bank drafts. In these instances, the security features touted by bank drafts provide little consolation if the document was forged or the issuing bank doesn’t honor it due to discrepancies.

| Risk Factor | Details |

| Cost | Variable fees depending on bank |

| Clearing Time | Up to several weeks |

| Irrevocability | Non-cancellable post-issuance |

| Fraud Potential | Risks of forged documents |

Navigating Issues: What to Do If a Bank Draft Goes Wrong

When dealing with a bank draft, its reliability is usually a given, however, complications can arise. If you encounter an issue where the bank draft is lost, stolen, or not honored, immediate action is important to mitigate potential losses. The first step would be to contact the issuing bank to report the issue. Depending on the situation, different approaches may be applicable:

- Contact the recipient: If the draft has been lost in transit to the beneficiary, inform them about the situation to avoid confusion or fraud.

- Stop payment: Request a stop payment on the bank draft. This can prevent funds from being drawn against it in case it was stolen.

- Reissue the draft: Once the bank has verified that the draft was not cashed, they can cancel the original draft and reissue a new one.

Most banks provide specific guidelines on the timeline in which these actions should be taken once a problem is identified. Be mindful of any charges that could apply for reissuing or stopping payments on bank drafts. For a clearer idea, here is a simplified table summarizing potential fees associated with these services:

| Action | Typical Fee |

|---|---|

| Stop Payment | £10 – £30 |

| Draft Reissuance | £15 – £50 |

Always keep a record of all communications and transactions related to the bank draft issue. Adequate documentation can expedite resolutions and is especially useful if legal steps become necessary. For more complex situations, seeking professional legal advice might be required.

Future of Bank Drafts: Trends and Predictions

As we chart the evolving landscape of financial transactions, the future of bank drafts seems intertwined with increasingly digital solutions. One major trend is the gradual integration of blockchain technology, which offers enhanced security and transparency. This could potentially lead to a new form of bank drafts called ‘crypto drafts’ that would operate on decentralized ledger systems, reducing the risk of fraud and errors.

Digital Adaptations: The rise of digital banking platforms has led to predictions that traditional bank drafts may morph into more streamlined, digital formats. Some anticipated features include:

- Instant Processing: Unlike traditional drafts which can take days to clear, digital drafts may offer instant clearing and settlement.

- Enhanced Security Features: Use of biometrics and multi-factor authentication to ensure the security of transactions.

- Integrated International Support: Easier international transactions with automatically adjusted currency values based on current exchange rates.

Another prediction that stands out is the potential decline in the use of traditional drafts in favor of electronic payments and wire transfers. With fintech innovations, consumers and businesses are looking for instantaneous solutions, driving the demand for faster and more efficient banking processes. A summary of how market preferences may shift can be demonstrated in the table below:

| Payment Method | Current Use | Predicted Use |

|---|---|---|

| Bank Drafts | Medium | Decreasing |

| Electronic Payments | High | Increasing |

| Wire Transfers | High | Stable/Increasing |

Overall, the trend toward digitalization and the demand for immediacy are expected to shape how bank drafts evolve, potentially impacting their relevance in future financial transactions.

Choosing Wisely: How to Decide If a Bank Draft Is Right for You

When considering whether a bank draft is the appropriate choice for your transactions, several factors need to be carefully weighed. Bank drafts are generally perceived as a safer form of payment compared to personal checks, because the funds are drawn directly against the bank’s account after verifying that the drawer has enough balance to cover the amount. This makes a bank draft a preferred option in large transactions or when dealing with unknown parties.

Advantages of using a bank draft include:

- Security: Since the funds are drawn from a bank’s own reserves, the risk of non-payment due to insufficient funds is practically eliminated.

- Widely accepted: Bank drafts are accepted domestically and internationally due to the perceived security behind the payment form.

- Record-keeping: Both parties have a documented trace of the transaction, which can be helpful for financial record keeping and resolving potential disputes.

However, while considering a bank draft, be aware of the downsides:

- Cost: Obtaining a bank draft often involves a fee, which can be substantial depending on the bank.

- Inflexibility: Once a bank draft is issued, stopping the payment can be difficult unless there is a clear case of fraud or a clerical error.

- Time-consuming: The process of issuing a bank draft can be slower compared to other forms of payment, such as electronic transfers.

Here is a simple comparative table that might help in decision making:

| Payment Method | Security Level | Speed | Cost |

| Bank Draft | High | Medium | Medium to High |

| Personal Check | Medium | Fast | Low |

| Electronic Transfer | High | Very Fast | Low to Medium |

Considering these factors will help you make an informed decision, aligning your payment method with your financial security needs and convenience preferences.

Q&A

### Q&A Section: Understanding Bank Drafts

Q1: What exactly is a bank draft?

A1: A bank draft is a payment method issued by a bank on behalf of the payer, which allows the payer to transfer money securely. It’s a type of check where the bank guarantees the availability of the funds, and the amount is withdrawn directly from the payer’s account when the draft is issued.

Q2: How does a bank draft work?

A2: To obtain a bank draft, the buyer needs to provide the funds to their bank, either by transferring from an existing account or by depositing cash. The bank will then issue a draft that guarantees these funds to the payee. The bank draft can then be deposited or cashed by the recipient in a similar way to a regular check.

Q3: Can you provide a simple example of how a bank draft might be used?

A3: Sure! Imagine you’re purchasing a used car from someone who lives several towns over. To ensure that the payment is secure and that the funds are guaranteed, you opt for a bank draft. You go to your bank, request a draft for the agreed amount, and the bank issues you the draft after securing the funds from your account. You then mail or deliver the bank draft to the car seller as payment.

Q4: What are the main benefits of using a bank draft?

A4: Bank drafts are particularly valued for their security and reliability. Since the funds are drawn directly against the bank’s account, the recipient can be confident that the funds will be available. Additionally, bank drafts are useful for large transactions and are accepted internationally.

Q5: Are there any risks or disadvantages associated with bank drafts?

A5: While bank drafts are generally secure, they are not entirely risk-free. It’s important for the payer to keep the bank draft safe, as it can be cashed by anyone if lost or stolen before it is delivered to the intended recipient. Additionally, there may be fees associated with obtaining a bank draft and it may take a few days for the recipient to access the funds upon depositing the draft.

Q6: How does a bank draft differ from a cashier’s check?

A6: Both bank drafts and cashier’s checks are prepaid checks and offer similar levels of security. The key difference often lies in their availability; bank drafts are often used in international transactions, while cashier’s checks are typically used within the same country. Also, bank drafts are drawn from the bank’s funds after taking the money from the payer’s account, while cashier’s checks are drawn directly against the bank’s funds and given in exchange for the equivalent cash from the payer.

Q7: What should one consider before choosing to use a bank draft?

A7: Before opting for a bank draft, consider the nature of the transaction, the associated fees, and the convenience factors. For large, international transactions where security is a priority, a bank draft may be ideal. However, for smaller or more immediate transactions, other forms of payment like electronic transfers might be more convenient and cost-effective. Always check with your bank about the most suitable payment method for your needs.

In Retrospect

In conclusion, a bank draft represents a secure method of payment that transcends ordinary checks by offering an added layer of financial stability. Whether you’re making significant transactions like purchasing a home or settling cross-border business agreements, understanding how a bank draft works can enhance your financial navigation. As we’ve explored its workings, benefits, and practical examples, remember that each financial instrument, including bank drafts, should be chosen with careful consideration of your specific needs and circumstances. For further assistance on using bank drafts or any other financial queries, feel free to reach out to your banking institution who can provide tailored advice. Let this knowledge empower your future financial decisions, ensuring that each transaction you make not only serves its purpose but does so with utmost security and efficiency.