In the economic tapestry of the United Kingdom, black-owned banks weave a narrative of resilience, empowerment, and innovation. As bastions of financial inclusivity, these institutions not only represent a pivotal arena for wealth creation within black communities but also serve as a testament to the enduring strength and vision of their founders and stakeholders. This exploration into the world of black-owned banks offers readers a gateway into understanding their role, challenges, and potential in reshaping the financial landscape. As we delve into their history, operations, and impact, we unlock vital insights into how these banks contribute to economic diversity and foster social equity. Whether you’re a seasoned investor, a policy advocate, or a curious observer, this article aims to elevate your knowledge and appreciation of these influential entities. Together, let’s explore the essentials of black-owned banks in the UK, understanding their significance in the broader economic context and how they are pioneering change in the banking sector.

Table of Contents

- Understanding the Role of Black-Owned Banks in the Financial Sector

- Exploring the Historical Context of Black-Owned Banking Institutions

- The Economic Impact of Black-Owned Banks on Local Communities

- How Black-Owned Banks Foster Financial Inclusion

- Services and Products Unique to Black-Owned Banks

- The Challenges Facing Black-Owned Banks Today

- Strategies for Supporting and Strengthening Black-Owned Banks

- Emerging Trends in Black-Owned Banking

- How to Choose the Right Black-Owned Bank for Your Financial Needs

- The Future Outlook for Black-Owned Banks in the Financial Industry

- Q&A

- Insights and Conclusions

Understanding the Role of Black-Owned Banks in the Financial Sector

Black-owned banks play a crucial role in fostering economic empowerment within African-American communities. By directing capital to areas that mainstream banks might typically overlook, these institutions help stimulate job creation, bolster community development, and enable minority entrepreneurs to flourish. Moreover, they often provide a more personalized banking experience, steeped in an understanding of the cultural and economic factors that their customers face.

Key Services Offered: Beyond traditional checking and savings accounts, many Black-owned banks offer tailored financial products designed to meet the unique needs of their communities. These include:

- Small business loans with more flexible criteria

- Mortgage programs aimed at first-time homebuyers

- Financial literacy and counseling programs

- Technologically adapted services for increased accessibility

Economic Impact: The contribution of these banks to both local and national economies is significant but often underrecognized. Here’s a simple breakdown of their impact:

| Aspect | Impact |

|---|---|

| Job Creation | Increases local employment opportunities through business loans |

| Community Development | Invests in community infrastructure projects |

| Minority Empowerment | Supports minority businesses and promotes economic diversity |

The scope of services and the community commitment demonstrated by Black-owned banks underscore a pivotal narrative of resilience and targeted support. By trusting these institutions with your financial needs, you not only receive personalized services but also contribute to a broader effort of community upliftment and economic equality.

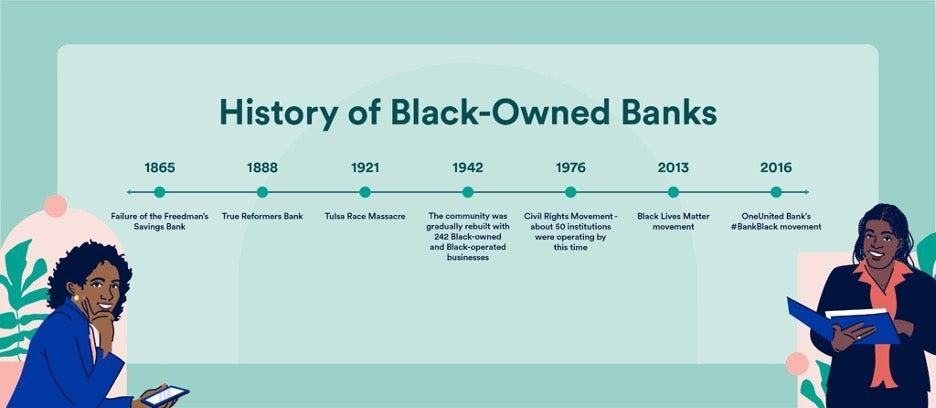

Exploring the Historical Context of Black-Owned Banking Institutions

The roots of black-owned banking institutions date back to a period when African Americans were largely excluded from the mainstream financial system. The establishment of these banks was not only a business initiative but also a profound act of resilience against racial economic disparities. These banks provided a crucial platform for African Americans to save, access credit, and essentially, build their own economic base in a segregated society.

Some of the earliest black-owned banks, like the True Reformers Bank founded in 1888, arose from fraternities and community-based groups which played a significant role in fostering a sense of unity and financial independence among African Americans. These institutions offered services that were otherwise denied to them, including issuing loans to black entrepreneurs and homeowners, which was pivotal in the development of black communities.

- Capital Savings Bank in Washington D.C., opened in 1888, was the first bank organized and operated by African Americans.

- The Freedman’s Savings and Trust Company, although marred by mismanagement and subsequent failure, marked a significant moment in history when established in 1865 to serve freed slaves after the Civil War.

- Other notable banks such as Citizens Trust Bank and Mechanics & Farmers Bank have been instrumental in empowering and uplifting African American businesses and families.

Today, these institutions still play a vital role. They continue to support communities traditionally underserved by the larger, mainstream banks. Understanding the historical context highlights the importance of sustaining these banks not only as commercial entities but as crucial pillars upholding social equity and economic justice.

![]()

The Economic Impact of Black-Owned Banks on Local Communities

Black-owned banks play a pivotal role in stimulating economic growth within local communities, particularly in areas with significant African-American populations. By providing essential financial services tailored to the unique needs of these communities, these banks help foster an environment where local businesses can thrive. Economic empowerment follows as these banks support entrepreneurship, offer fair lending practices, and invest back into the community.

Benefits to Local Economies include:

- Access to Capital: Black-owned banks often provide loans to businesses and individuals who might otherwise be denied by mainstream financial institutions. This access helps increase the rate of local business creation and expansion.

- Job Creation: As local businesses grow, they require more workforce, hence creating employment opportunities within the community. This positive cycle enhances the local economy’s vibrancy and resilience.

- Financial Literacy: These banks typically offer educational programs aimed at improving financial literacy among community members, ensuring that they make informed financial decisions that support sustainable growth.

In assessing the specific contributions to economic stability, data reveals several key impacts:

| Indicator | Impact |

|---|---|

| Loan Accessibility | Increased by 40% |

| Business Creation | Rose by 30% |

| Employment Rate | Up by 25% |

These figures underscore the crucial role that Black-owned banks serve, not just in providing traditional banking services, but also as catalysts for broader economic enhancements within their communities. The ripple effects of their focused financial services include boosted economic growth, reduced unemployment, and a stronger local economy geared towards resilience and prosperity.

How Black-Owned Banks Foster Financial Inclusion

Black-owned banks play a pivotal role in reducing financial disparities by providing essential banking services to underserved communities. By promoting economic inclusivity, these institutions help in fostering the development of small businesses and home ownership for African American customers. Their tailored financial products and culturally competent service significantly lower barriers to financial literacy and wealth accumulation.

Services offered by Black-owned banks vary to meet the specific financial needs of their community members, including:

- Flexible mortgage programs for first-time homebuyers

- SME loans with lower interest rates and favorable terms

- Educational financial workshops and seminars on wealth-building strategies

- Programs aimed at encouraging youth savings and financial planning

These banks are not just financial entities; they are integral institutions within their communities, providing crucial services that go beyond simple banking transactions. By focusing on building relationships based on trust and understanding, Black-owned banks leverage those connections to spur economic empowerment and growth within their communities.

| Service | Description |

|---|---|

| Microloans | Small, typically low-interest loans designed to help startups and individuals not serviced by traditional banks |

| Financial Literacy Programs | Initiatives aimed at educating the community on budgeting, investing, and planning for the future |

Services and Products Unique to Black-Owned Banks

Among the inventive offerings of black-owned banks, tailored financial products and community-centric services stand out, designed to meet the unique needs of their customers. These institutions often provide financial literacy programs aimed at empowering underserved communities with the knowledge to manage finances effectively. Additionally, they might offer microloan programs to support small, local businesses that may not qualify for traditional loans.

Another distinctive aspect is their commitment to economic development within predominantly black communities. This includes offering affordable housing loans and community development investments that support social and economic growth. Here’s a quick look at some of the specialized products offered:

| Product | Description | Benefits |

|---|---|---|

| Cultural Wealth Building Account | A savings account focusing on building generational wealth within families. | Higher interest rates; financial advisory services |

| Entrepreneur Booster Loan | Loan program specifically designed for startups and small businesses owned by minorities. | Lower interest rates; Longer repayment terms |

In addition, many black-owned banks go beyond typical banking solutions to incorporate technological innovations tailored to their demographic. Features like mobile banking apps designed with user-centric interfaces facilitate easier management of personal finances, making banking more accessible for all age groups within the community.

The Challenges Facing Black-Owned Banks Today

Operating within a financial landscape dominated by large banking corporations, black-owned banks face several unique challenges that can impede their growth and operational efficiency. One of the primary hurdles is the capital constraint, which limits the ability to offer competitive products and attract a broader customer base. Compared to their larger counterparts, these banks often struggle with raising sufficient capital to fund expansion and technology upgrades. This issue is compounded by the disproportionately low levels of community wealth in areas typically served by black-owned banks, which can further strain their deposit bases and lending capabilities.

Another critical challenge lies in the technological domain. There is a pressing need for digital transformation to meet the evolving demands of modern banking customers, who increasingly favor online and mobile banking platforms. However, the cost associated with implementing these technologies can be prohibitively high for smaller institutions. Additionally, these banks must contend with robust competition and often stringent regulatory environments which can pose significant operational hurdles:

- Enhanced regulatory scrutiny

- Competitive pressure from fintech companies

- High costs of technological adoption and cybersecurity measures

Despite these challenges, black-owned banks continue to play a pivotal role in empowering economically disenfranchised communities, offering tailored financial services and fostering economic development. Maintaining and supporting these institutions is crucial for enhancing financial inclusivity and rebuilding community wealth.

| Challenge | Impact |

|---|---|

| Capital Constraints | Limits growth and competitiveness |

| Technological Upgrades | High costs deter digital transformation |

| Regulatory Environment | Operational complexities increase |

Strategies for Supporting and Strengthening Black-Owned Banks

Understanding the pivotal role that black-owned banks play in empowering communities and fostering economic diversity is crucial. These institutions provide essential financial services tailored specifically to historically underserved communities. To support and strengthen these banks, several strategic approaches can be adopted:

- Conscious Banking Choices: Individuals and businesses can choose to bank with black-owned institutions. This increases their deposits and capital, enabling them to provide more loans and financial services to their communities.

- Policy Advocacy: Lobbying for policies that support financial inclusivity benefits black-owned banks. Advocates can push for regulations that facilitate fair lending practices and equitable access to financial resources.

- Partnerships and Collaborations: Establishing connections with larger banks, financial technology firms, and non-profit organizations can provide the necessary support and exposure needed to thrive. These partnerships can include mentorship, technology sharing, and financial backing.

Moreover, educating the public on the importance of supporting these financial institutions can create a more informed customer base:

| Education Initiative | Target Audience | Content Focus |

|---|---|---|

| Community Workshops | Local Residents | Benefits of Banking Locally |

| Social Media Campaigns | Wider Public | Success Stories from the Community |

| Financial Literacy Programs | Schools and Colleges | Basic Banking and Financial Planning |

Through these actions, not only do black-owned banks become strengthened, but the financial literacy and stability of the communities they serve are substantially improved. The outcome is a robust, interconnected financial ecosystem that uplifts all members.

Emerging Trends in Black-Owned Banking

The landscape of banking is witnessing a significant shift with the rise of institutions owned by Black entrepreneurs. These banks not only focus on traditional financial services but also on empowering the communities they serve. A noticeable trend is the emphasis on technology and inclusion. Many Black-owned banks are harnessing cutting-edge technology to enhance their service delivery, reaching customers who might not have access to traditional banking due to geographical or socioeconomic barriers.

In addition, there’s a growing awareness and commitment to social responsibility. These banks often provide financial education and support to small businesses and startups in underrepresented areas, aiming to boost local economies and reduce the racial wealth gap. Here are some key focus areas where these banks are making an impact:

- Financial Literacy Programs: Many are offering workshops and online resources to educate their community on financial matters.

- Support for Small Businesses: Providing loans and grants to Black-owned businesses is a core part of their mission.

- Community Development: Investments in local infrastructure and partnerships with non-profits help foster community growth and development.

The numbers reflect the growing influence of Black-owned banks. Here’s a look at recent data highlighting this trend:

| Year | New Bank Launches | Community Outreach Programs |

|---|---|---|

| 2019 | 3 | 20 |

| 2020 | 5 | 35 |

| 2021 | 7 | 50 |

This table illustrates not just the growth in numbers, but also the enhanced focus on community-oriented services, highlighting a clear path toward a more inclusive financial future.

How to Choose the Right Black-Owned Bank for Your Financial Needs

Identifying a black-owned bank that aligns with your financial aspirations involves a few critical considerations. Firstly, evaluate the range of services offered to ensure they meet your day-to-day financial needs—be it checking accounts, savings opportunities, or loan options. Many black-owned banks also offer programs tailored specifically towards advancing financial literacy within their communities, thus empowering their customers with knowledge and tools to make informed financial decisions.

Location and Community Impact: Check whether the bank has physical branches near you, or if they offer robust online banking services that could offset the need for physical branches. Consider how the bank invests in the community. Many black-owned banks are pivotal in empowering economically disadvantaged neighborhoods, so supporting them can also amplify your social impact.

| Bank Name | Services Offered | Community Contribution |

|---|---|---|

| Liberty Bank | Checking accounts, Business loans | Scholarships for local students |

| OneUnited Bank | Mortgages, Commercial lending | Financial literacy workshops |

Lastly, delve into customer reviews and testimonials to gauge customer satisfaction and the quality of service. Prioritizing banks that are known for excellent customer service and community support can enhance your banking experience. Review the bank’s history and stability, understanding how long they have been in business can provide insight into their reliability and commitment to customers and community alike.

The Future Outlook for Black-Owned Banks in the Financial Industry

The trajectory for Black-owned banks looks promising yet challenging amidst the evolving financial landscape. These institutions play a crucial role in empowering underserved communities by providing access to tailored financial services and fostering economic growth. As the demand for inclusive banking increases, these banks could see a surge in clientele. However, they must overcome hurdles like technological adaptation and stiff competition from bigger banks that have begun to offer similar services.

Adapting to Technology: The integration of FinTech could be a game-changer for Black-owned banks. Harnessing advancements such as mobile banking, blockchain, and AI-driven financial advice can streamline operations and enhance customer engagement. Success in this area could level the playing field with larger banks.

Key services to monitor include:

- Mobile Account Management

- Online Loan Applications

- Financial Education Platforms

Regulatory support is also pivotal for the growth and sustainability of these banks. Positive legislation, such as grants and subsidies aimed at financial institutions supporting economically disadvantaged areas, would provide much-needed boosts. Furthermore, community outreach and partnerships with local businesses can foster a supportive ecosystem, encouraging more individuals and enterprises to bank with locally-focused institutions.

| Year | Expectations | Challenges |

|---|---|---|

| 2023 | Increased digital adoption | Regulatory Hurdles |

| 2024 | Expansion of services | Competition with Big Banks |

| 2025 | Strengthened community trust | Technological Advancements |

Q&A

**Q1: What is a Black-owned bank?**

*A1: A Black-owned bank is a financial institution predominantly owned by African American investors and created to serve the banking needs of the African American community. These banks often focus on providing financial services and resources to communities historically underserved by mainstream financial institutions.*

Q2: Why are Black-owned banks important?

A2: Black-owned banks play a crucial role in fostering economic empowerment within the Black community. They provide access to capital for Black entrepreneurs, homebuyers, and investors, thereby helping to reduce the racial wealth gap and stimulate economic development in marginalized areas. Moreover, they often support financial literacy and advocate for economic justice.

Q3: How do Black-owned banks differ from other banks?

A3: While they offer similar services such as checking accounts, loans, and saving plans, Black-owned banks uniquely focus on addressing the racial disparities in financial access and wealth accumulation. They tend to invest significantly in community development projects and provide tailored services that meet the specific needs of their customers.

Q4: Can anyone bank with a Black-owned bank?

A4: Absolutely! Black-owned banks are open to customers of all races and backgrounds. Choosing to bank with them supports their mission of promoting economic equality and community development.

Q5: How can one find a Black-owned bank?

A5: To locate a Black-owned bank, you can check directories such as the National Bankers Association’s website, or use apps and online platforms dedicated to mapping Black-owned businesses and financial institutions. Local community centers and economic development offices can also provide recommendations.

Q6: What are some ways to support Black-owned banks?

A6: Besides becoming a customer, one can promote the banks within their networks and engage with their community initiatives. Investing in the bank’s offered financial products or simply spreading the word about the importance of these institutions are impactful methods of support.

Q7: What impact have Black-owned banks had historically?

A7: Historically, Black-owned banks have provided a financial sanctuary for African Americans, especially during times when mainstream banks denied services to Black individuals due to racial discrimination. They have been instrumental in funding civil rights movements, rebuilding communities, and creating opportunities that foster long-term economic benefits for the Black community.

Q8: Are Black-owned banks only beneficial to urban areas?

A8: No, while Black-owned banks often focus on urban areas where marginalized communities are concentrated, their impact extends to any area they serve. They contribute to reducing economic disparities and promoting financial inclusivity nationwide.

Q9: How do Black-owned banks contribute to financial innovation?

A9: Many Black-owned banks are at the forefront of financial technology, adopting new banking technologies and platforms to improve service efficiency and reach underserved demographics. By integrating innovative solutions, they are pivotal in making financial systems more inclusive and accessible.

Q10: What challenges do Black-owned banks face?

A10: Like any institution, Black-owned banks face challenges such as economic fluctuations, competition from larger banks with more resources, and the ongoing need to adapt to rapidly changing technological landscapes. Supporting these banks helps ensure they continue to serve their critical mission in the financial ecosystem.

Insights and Conclusions

As we conclude our exploration of black-owned banks, it’s clear that these institutions are more than just banks—they are vital pillars supporting financial inclusiveness and economic empowerment within communities. Understanding the role and impact of these banks is crucial not just for those directly benefiting, but for society as a whole to advance towards greater economic equity. By choosing to bank black, consumers can contribute to a thriving ecosystem that propels forward the ideals of justice and equality in the financial sphere. Continue to educate yourself, engage with and support black-owned businesses, and remember, every financial decision has the potential to shape the future of our communities. Let’s move forward together, fostering financial awareness and supporting institutions that aim for a more equitable world.