– Can you use a personal loan for business expenses?

Business Loan vs. Personal Loan: What’s the Difference?

In the financial world, the dynamics of personal and business loans play an enormous role in the establishment of startups, expansion of established businesses, and managing personal finances. Choosing between a business loan and a personal loan can be challenging when you don’t completely understand the distinctions. This article aims to shed light on the topic and help you make decisions with clarity.

| Aspect | Personal Loan | Business Loan |

|---|---|---|

| Purpose | Personal use | Business use |

| Interest Rates | Usually higher | Varies, can be lower |

| Paperwork | Less | More |

Decoding Business Loans and Personal Loans

What Is a Personal Loan?

A personal loan is often unsecured, meaning you don’t need to provide any collateral to obtain the loan. You can use it for any personal purpose – from home renovation to paying for a wedding ceremony.

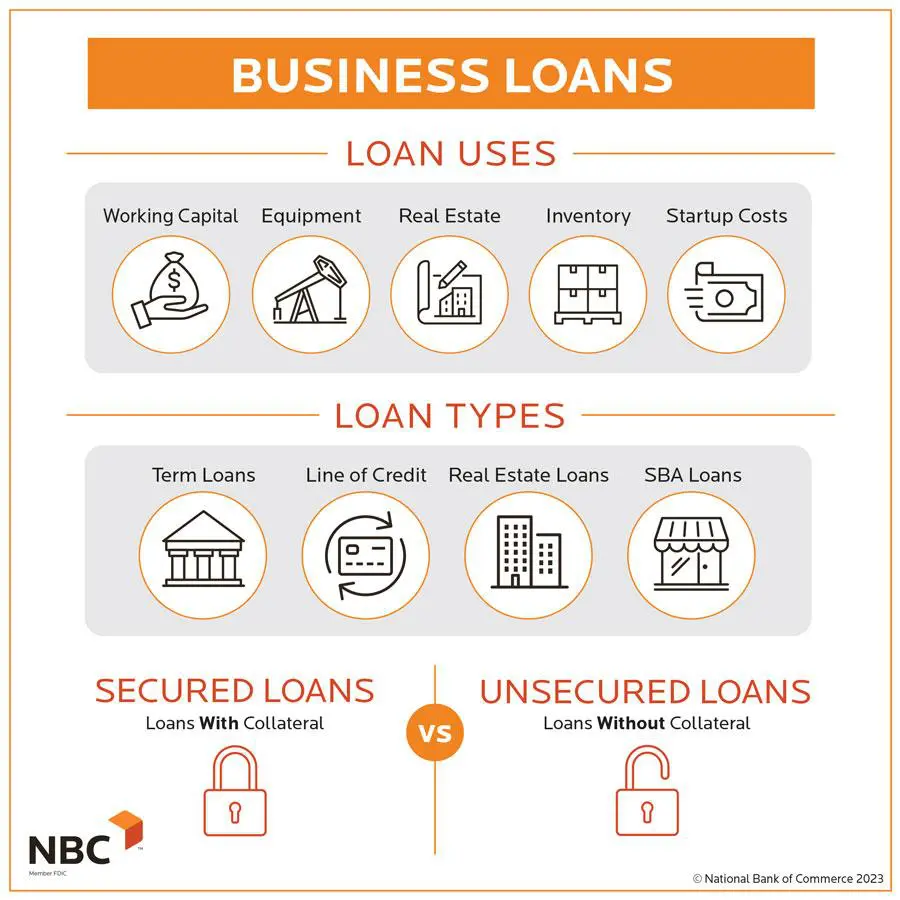

What Is a Business Loan?

Business loans are specially designed to cater to business-related expenses. These include costs related to expansion, inventory purchase, marketing, and even paying employee salaries.

Key Differences Between Business Loans and Personal Loans

Intention of Use

As the names imply, personal loans are used for personal needs, while business loans are used for business purposes. Misusing the funding can lead to a breach of contract with your loan providers.

Borrowing Limit

As a rule of thumb, business loans usually offer a larger pool of funds compared to personal loans. That’s because business expenses usually dwarf personal requirements.

Interest Rate

Interest rates can generally be higher for personal loans. However, the specific rate depends on factors such as your credit score and the loan term.

Documentation

Applying for a business loan usually requires more documentation than a personal loan. Lenders often request to see business plans, financial statements, and tax returns to assess your repayment capacity.

A Peek into their Benefits

Advantages of Personal Loans

– No need for collateral.

- Simpler application process.

– Flexibility in usage.

Advantages of Business Loans

– Higher borrowing limits.

– Can optimise business taxes.

– Can help build a strong business credit profile for future borrowing.

Choosing Right: Business Loan or Personal Loan?

Choosing between a personal loan and a business loan comes down to your specific needs and circumstances. Each has its merits and demerits. Business loans can be the right choice if you are a business owner in need of a large loan amount. Personal loans could be a better fit if you need quick funds for a personal expense and don’t want to go through a ton of paperwork.

Conclusion

Understanding the differences between business and personal loans is crucial for effective financial planning. Carefully consider your specific funding needs, your ability to repay the loan, the paperwork involved, and the purpose of the loan before making your decision. With this knowledge, you can make more informed loan decisions that suit your financial needs best. And remember, whatever you choose, ensure that it aids in meticulously managing your financial future.